For the first time since July, holders of Bitcoin who retain their assets long-term have shifted from selling to buying, sparking speculation about a potential price rebound.

After reaching an all-time high near $126,000 in early October, Bitcoin experienced a steep decline that pushed its value below $90,000. Currently trading around $87,932, BTC has fallen over 30% from its October peak amid significant sell-offs by long-term investors.

Long-Term Bitcoin Holders Resume Accumulation

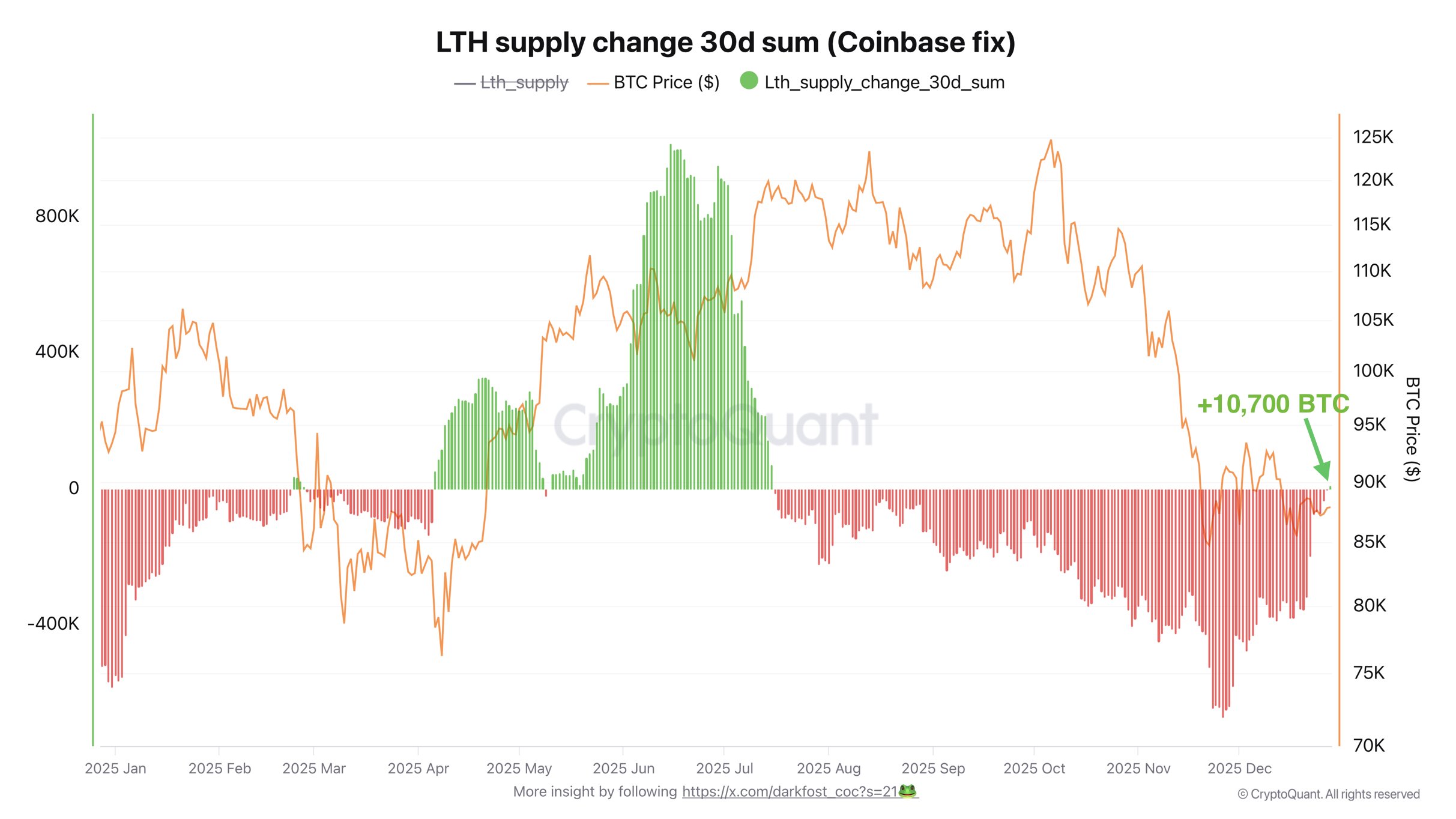

Recent blockchain analytics indicate that the intense selling phase may be subsiding. CryptoQuant analyst Darkfost revealed that investors holding Bitcoin for more than six months have begun accumulating again for the first time since mid-summer.

This behavioral shift is often crucial in forecasting Bitcoin’s upcoming market direction. Darkfost highlighted discrepancies between popular narratives of ongoing heavy sales and adjusted on-chain data.

By excluding nearly 800,000 BTC transfers originating from Coinbase—which had skewed previous figures—Darkfost’s analysis uncovered a notable change in supply dynamics.

The 30-day cumulative supply change among long-term holders remained negative starting July 16th as they consistently reduced their holdings during this distribution period. However, this trend has reversed recently with approximately 10,700 BTC returning to long-term holder status.

Although modest in scale, this accumulation matters significantly. According to Darkfost, the slowdown in selling by these holders allowed their total supply share to increase once again while short-term traders maintained steady positions. Historically across market cycles such shifts precede phases of consolidation or initial recovery depending on broader conditions.

The Behavioral Patterns of Long-Term Holders

The accompanying CryptoQuant chart corroborates these findings by illustrating monthly changes in long-term holder supplies between April and July 2025 mostly remaining positive—indicating steady accumulation during those months.

This accumulation peaked near 400K BTC around mid-April before tapering off slightly but maintaining an overall upward trajectory. By mid-May it resumed growth and surpassed 800K BTC through June before weakening into negative territory come July.

The downward trend persisted for several months reaching below -400K BTC by November—a timeframe coinciding with Bitcoin’s poor price performance throughout Q4 of 2025—before finally flipping back positive recently.

An Attempted Price Recovery

This renewed buying coincided with a brief uptick in prices; however the rally was short-lived as values soon corrected downward again. Darkfost noted that within hours Bitcoin surged roughly $3K mainly driven by derivatives activity rather than spot purchases alone during which open interest expanded about $2 billion dollars concurrently.

Caution was advised since rallies fueled primarily through leverage tend not to sustain strong recoveries and often fade quickly afterward.

$BTC surged toward critical resistance at approximately $90,600.

The move bypassed lower levels I preferred testing first.

In trading, it&aposs better missing out on some trades than entering bad ones.

Weekly open at ~$87,800 looks weak so breaking below seems likely soon.

If liquidity above is swept…”

— Lennaert Snyder (@LennaertSnyder) December 29, 2025

Snyder pointed out weakness around the weekly opening price near $87, 800 which might be tested shortly ahead.

He explained if liquidity above $90, 600 gets cleared, a break within shorter timeframes would signal possible short opportunities targeting weaker lows.

Conversely, if $90, 600 is reclaimed over four hours he would anticipate continuation longs aiming toward resistance near $93, 500.& nbsp ;Liquidity dips under $87, 490 could also present chances for longs following sweeps and reversals.& nbsp ;

Losing support at $86 ,900 across higher intervals opens paths toward shorts targeting lows close to $85 ,000 . & nbsp ; Snyder concluded noting subdued volume alongside erratic holiday trading led him reduce exposure until clearer trends emerge .