As the year 2025 comes to an end, key figures in the cryptocurrency sector, including Ripple’s CEO Brad Garlinghouse, have voiced their expectations for Bitcoin’s price movement in 2026.

Recent insights from the well-known crypto news outlet Wu Blockchain reveal a widening skepticism regarding Bitcoin price predictions.

The report highlights that institutional forecasts for 2025 largely missed the mark on how Bitcoin’s market behaved throughout the year. Analysts failed to accurately predict not only the magnitude of price fluctuations but also their timing, volatility levels, and depth of downturns. This shortfall has contributed to diminishing trust in fixed target-price projections within the market.

Interestingly, investors are now viewing these forecasts more as hypothetical scenarios rather than guaranteed outcomes. Instead of focusing on a single predicted figure, market participants prefer examining underlying assumptions along with macroeconomic factors and structural influences shaping Bitcoin’s future.

Bitcoin Price Outlook for 2026

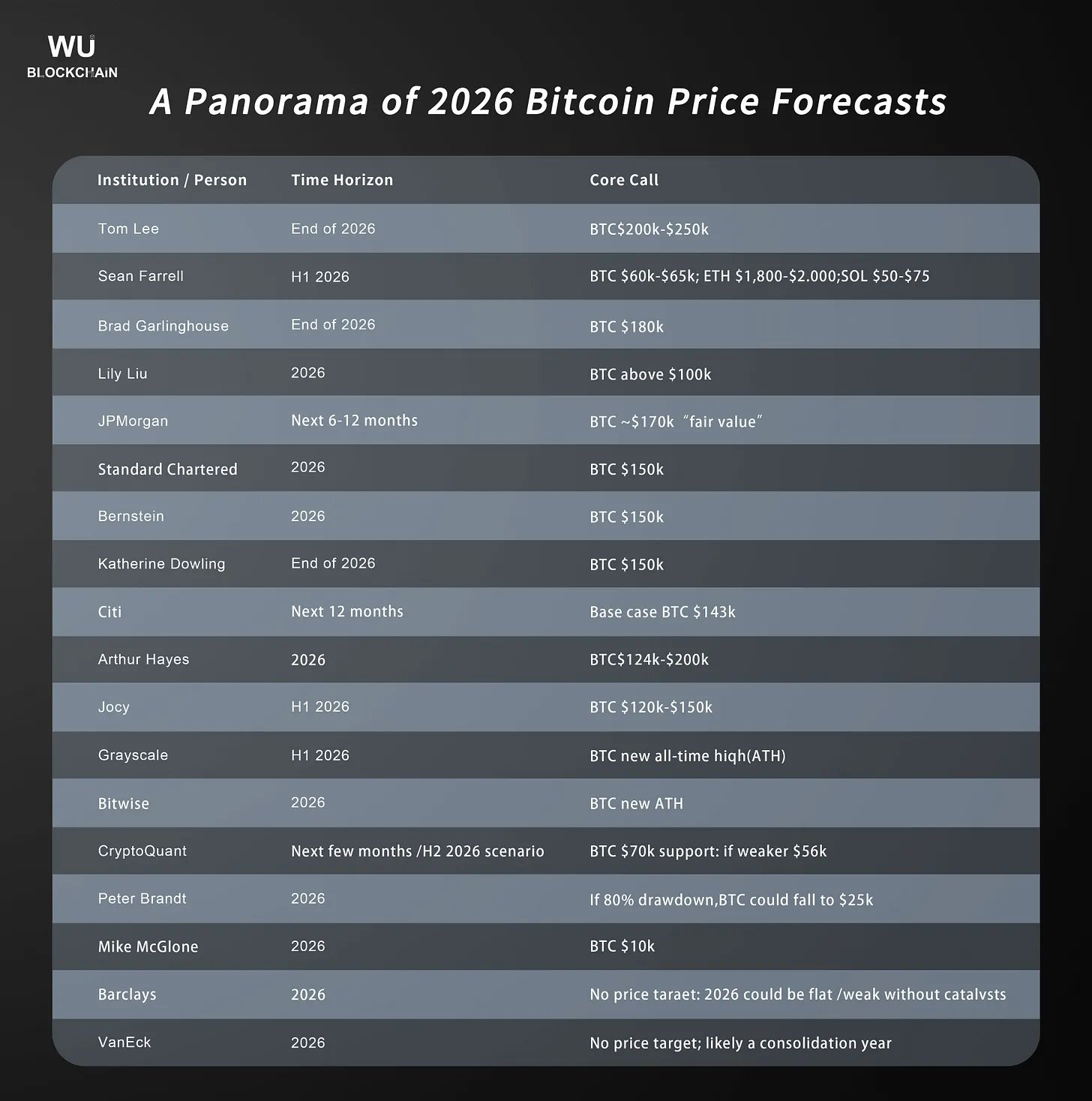

Despite waning confidence in pinpointing exact prices for Bitcoin next year, prominent industry experts and major financial institutions continue to present structured perspectives on BTC’s potential trajectory. Broadly speaking, these views fall into two categories: optimistic (bullish) and pessimistic (bearish).

Bullish Expectations

The optimistic camp generally anticipates Bitcoin reaching between $150,000 and $250,000 by 2026—representing an increase ranging from approximately 72% up to nearly 186% over its current value near $87,279.

This bullish sentiment is championed by notable personalities such as Ripple CEO Brad Garlinghouse who projects around $180K; Fundstrat founder Tom Lee forecasting between $200K and $250K; BitMEX co-founder Arthur Hayes estimating about $200K; plus BSTR President Katherine Dowling suggesting a target near $150K.

Larger financial entities like Standard Chartered Bank ($150K), Bernstein ($150K), and JPMorgan Chase ($170K) also share similarly positive outlooks for next year’s BTC performance.

Meanwhile asset management firms Grayscale Investments and Bitwise Asset Management refrain from specifying exact targets but remain confident that Bitcoin will achieve new all-time highs during this period.

A number of common factors underpin these upbeat predictions: enhanced regulatory clarity worldwide; growing allocations by institutional investors; expanded adoption of spot-based Bitcoin ETFs; alongside potential shifts toward more accommodative monetary policies—all viewed as catalysts likely driving further upward momentum in BTC prices.

Bitcoin Price Forecasts for 2026

Bearish Perspectives

The opposing viewpoint warns that significant downward pressure could hit Bitcoin throughout 2026 with values possibly dropping below six figures substantially.

An example comes from CryptoQuant which suggests that BTC might already be entering a bearish phase. Their analysis identifies roughly $70,000 as critical support level while warning about possible deeper declines toward approximately $56,000 if demand weakens further.

Veteran trader Peter Brandt echoes concerns based on historical trends indicating that exponential growth phases may be ending—raising chances of sharp corrections down towards around twenty-five thousand dollars ($25k).

Taking an even more cautious stance is Bloomberg Intelligence strategist Mike McGlone who cautions that deflationary pressures following inflation could trigger severe mean reversion cycles potentially pushing bitcoin prices down close to ten thousand dollars ($10k).

Certain institutions like VanEck Capital Management along with Barclays bank choose not to provide explicit numeric targets at all but warn instead that next year might represent a consolidation or transitional phase rather than one marked by rapid gains or losses in bitcoin valuation.