MicroStrategy’s Bold Bitcoin Strategy: A Double-Edged Sword

MicroStrategy has shifted its identity from a conventional software firm to essentially a Bitcoin investment vehicle. Over recent years, the company has aggressively accumulated Bitcoin, frequently leveraging debt instruments, convertible notes, and equity sales to fund these purchases.

This approach has resulted in Bitcoin becoming the predominant asset on MicroStrategy’s balance sheet. With ownership of hundreds of thousands of BTC tokens, the company’s valuation is now tightly linked to fluctuations in Bitcoin prices. While this tactic yields significant gains during bullish markets, it also exposes MicroStrategy to considerable risk when markets turn bearish for extended periods.

At this stage, MicroStrategy isn’t merely exposed to Bitcoin price swings—it is financially intertwined with them.

The Future Outlook for Bitcoin Prices: Volatility Prevails

The trajectory of MicroStrategy hinges largely on how Bitcoin performs moving forward.

Examining the weekly chart for $BTC reveals:

- Bitcoin recently lost upward momentum after failing to break through key resistance levels;

- The current trading price is hovering near an important support area;

- Momentum indicators remain subdued, implying potential further downside risks.

BTC/USD Weekly Chart – TradingView

Historically, while Bitcoin tends to rebound following severe bear markets, such recoveries often come only after prolonged phases of stagnation or sideways movement lasting one or two years before resuming upward trends.

A scenario where BTC experiences sharp declines or remains suppressed at low levels over multiple years cannot be dismissed outright.

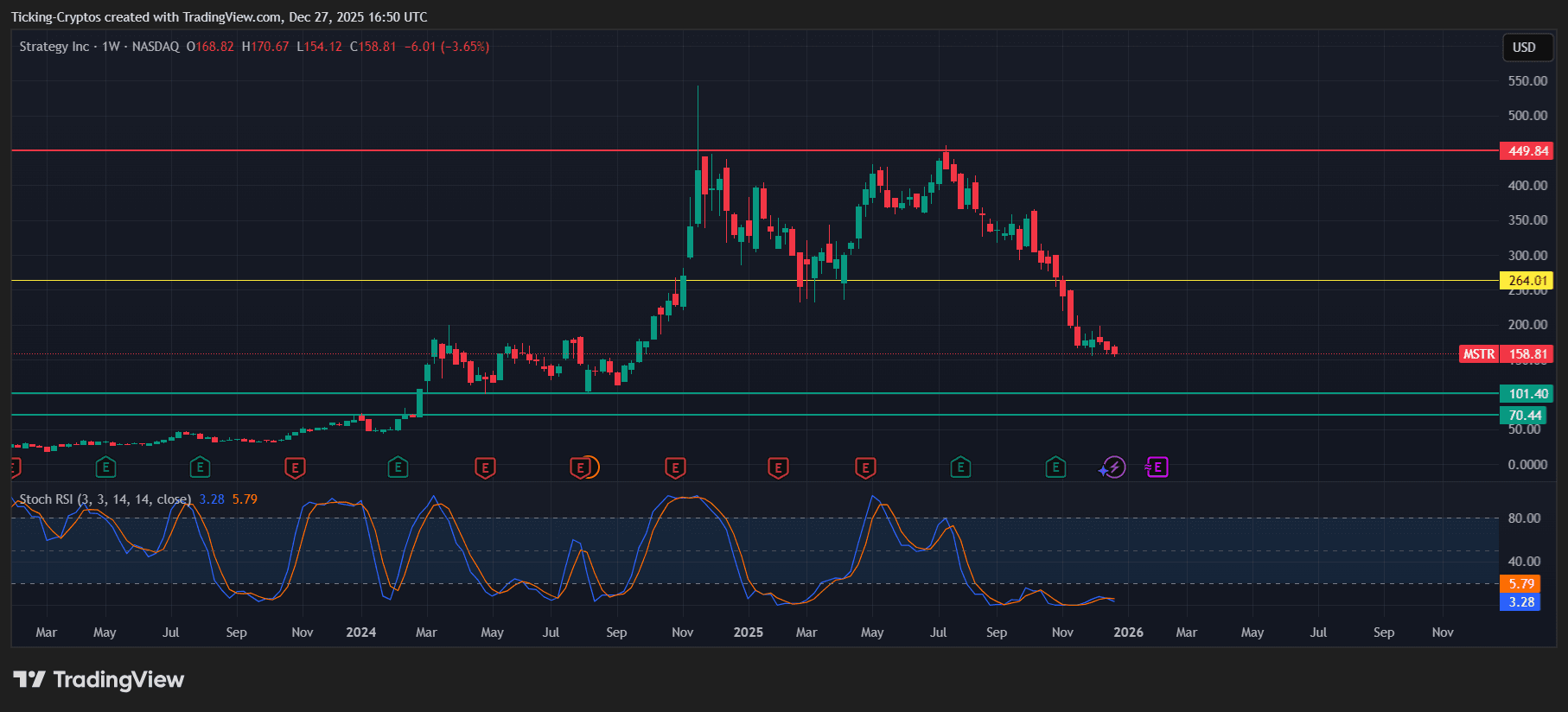

An Analysis of MicroStrategy Stock: The Risks Amplified by Leverage

- MSTR stock reached peaks near major resistance points but has since entered a pronounced downtrend;

- Certain critical support thresholds have already been breached;

- The share price currently trades significantly below previous highs reflecting similar weakness seen in BTC prices.

MSTR Weekly Chart – TradingView

Although MSTR does not mirror every tick movement in bitcoin prices perfectly, their correlation intensifies sharply during periods of market turmoil. When bitcoin undergoes steep sell-offs, MSTR tends to underperform due mainly to its leveraged position and investor apprehension related to its debt load and financial structure.

This means that while MSTR can outperform bitcoin during bullish runs thanks partly to leverage effects—during downturns it usually suffers greater losses than bitcoin itself.

Are MicroStrategy and Bitcoin Fully Synced?

Not entirely—but their fates are closely linked enough that changes in one heavily influence the other.

Bitcoin impacts:

- The valuation assigned by investors based on reserves held;

- Market confidence regarding corporate strategy;

- Ability for raising capital at favorable terms.

Meanwhile,

MicroStrategy must manage:

Operating expenses,

Payroll commitments,

Debt repayments,

And other business costs unrelated directly to crypto valuations.

Time Is The Structural Challenge For Companies Like This

Unlike bitcoin—which can afford long dormant periods without operational costs—companies like MicroStrategy face ongoing financial obligations regardless of market conditions.

If bitcoin were:

– To stay depressed over several years

– Cause large unrealized losses impacting balance sheets

– Restrict access needed capital funding

Then sustained survival becomes challenging despite optimism about long-term recovery prospects.

This concern transcends belief about cryptocurrency value—it centers around corporate viability amid prolonged adversity.

A Potential Crash In 2026? What Lies Ahead For Microstrategy

No collapse is certain but risks are tangible given dependencies involved.

Critical factors shaping outcomes include:

- The ability for btc retain long-term worth;

- Avoidance from multi-year deep drawdowns;

- Sustained access into capital markets at reasonable cost.

If btc rebounds swiftly then microstrategy stands poised for substantial gains.

However if crypto endures an extended bear phase microstrategy faces amplified hazards beyond those confronting btc holders alone.

Simply put:

&&;nbsp;&;nbspЯкий-то, что- u0411;u0438u0442u043au043eu0438u043d u043cu43eeu436f u432 u0441у0447у0456тн у04; у042fка.nn's core risk investors must grasp entering 2026.

<p&gt;nn&#39;s asymmetry represents fundamental danger all stakeholders should recognize as they evaluate future positions.”