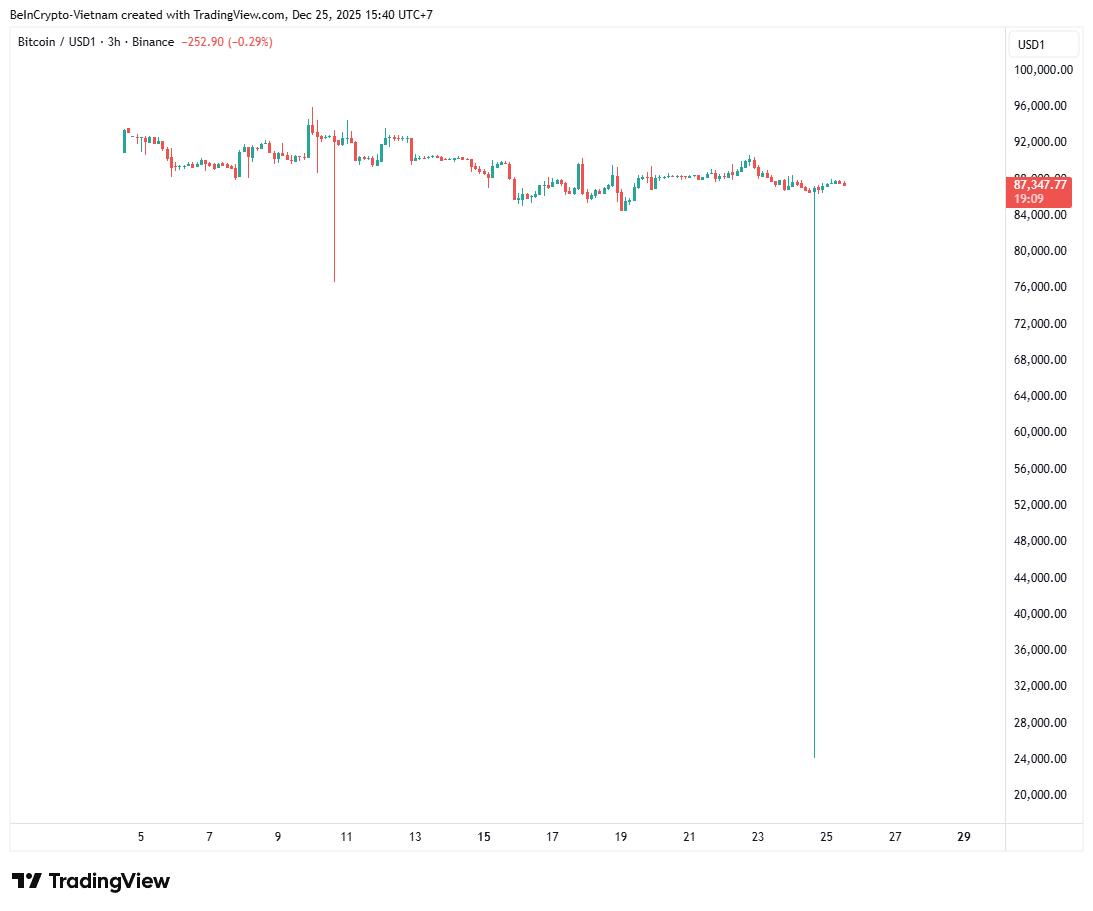

The BTC/USD1 trading pair on Binance experienced a sudden and brief flash crash, with Bitcoin’s price plummeting to $24,000 before swiftly rebounding.

This unusual event did not impact Bitcoin prices on more established pairs like BTC/USDT but brought attention to the liquidity vulnerabilities present in newly introduced trading pairs.

Flash Crash of BTC/USD1 Highlights Risks of Low Liquidity

Binance market data reveals that the flash crash lasted only seconds, after which the BTC/USD1 price recovered and stabilized above $87,000.

The USD1 stablecoin is a recent issuance by World Liberty Financial and is reportedly supported by relatives of former US President Donald Trump.

Binance’s charts displayed a sharp wick during this incident; however, no liquidation cascades were triggered as a result.

BTC/USD1 price performance. Source: TradingView

The timing coincided with the Christmas holiday season when trading volumes typically decline sharply. Some analysts speculated that this might have been an intentional liquidity stress test for the new pair.

Joao Wedson, founder of Alphractal, noted that such volatility due to low liquidity tends to be more frequent during bearish market phases when capital inflows diminish significantly.

“Low liquidity across various exchanges often results in sudden volatility spikes causing temporary distortions in pricing and arbitrage inefficiencies lasting minutes. This phenomenon becomes especially prevalent during bear markets,” Wedson explained.

A deeper analysis from investor circles linked this event to Binance’s promotional campaign for USD1 stablecoin offering 20% APY incentives up to $50,000 per user recently launched on their platform.

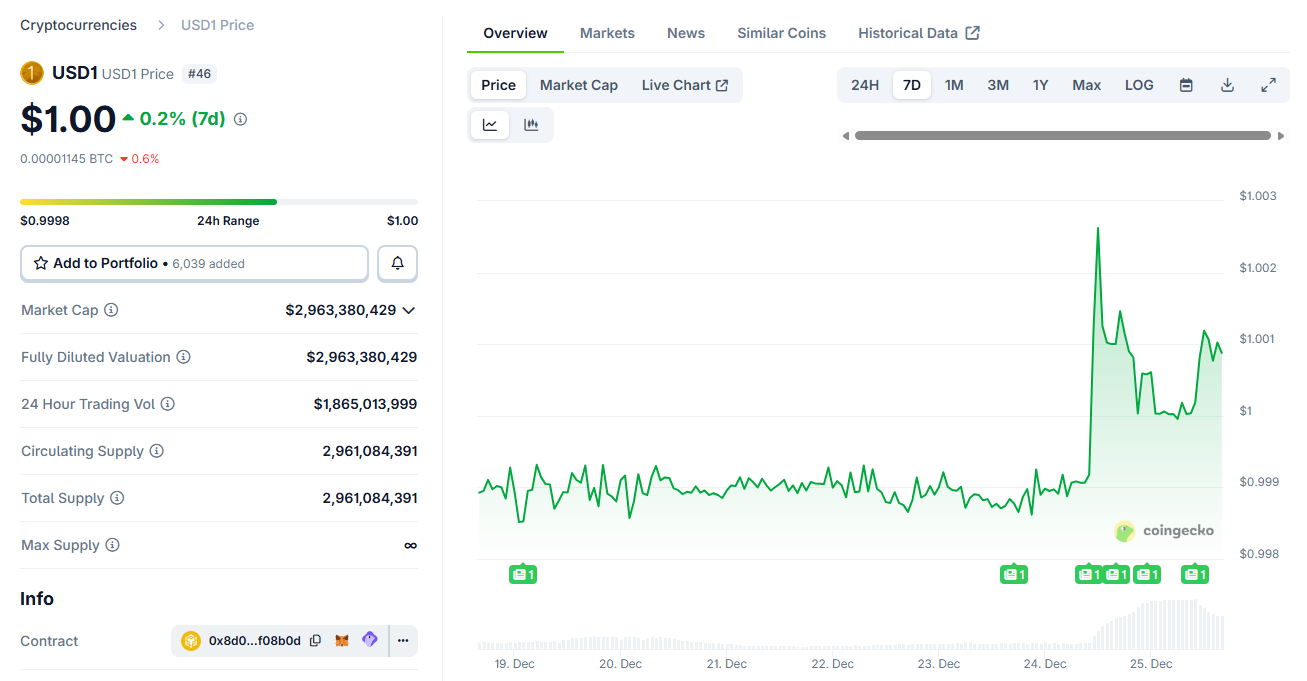

According to WuBlockchain—a well-regarded crypto analytics account—the supply of USD1 surged dramatically post-launch by over 45.6 million tokens within hours pushing its total market cap beyond $2.79 billion.

This influx caused USD1’s value to increase slightly by approximately 0.2% amid heightened demand driven by promotional activities.

USD1 Price Performance. Source: CoinGecko

An X (formerly Twitter) user named Punk described how many investors engaged in arbitrage strategies—borrowing USD1 tokens then gradually selling them into spot markets where participants were attracted by Binance’s promotion offers.

Meanwhile, some traders opted for selling through the thinly traded BTC/USD1 pair where limited liquidity caused prices to collapse abruptly leading to the observed flash crash scenario described earlier.

“''''''' This minor fluctuation reflects typical behavior seen within bearish trends—there is no cause for alarm as similar short-lived swings are expected going forward,” Punk reassured.

Could Such an Event Occur With More Liquid Pairs Like BTC/USDT?

A broader concern arises regarding whether comparable crashes could happen on high-liquidity pairs such as BTC/USDT which dominate market volume globally—and where sharp drops would lead to significant liquidation losses among traders.

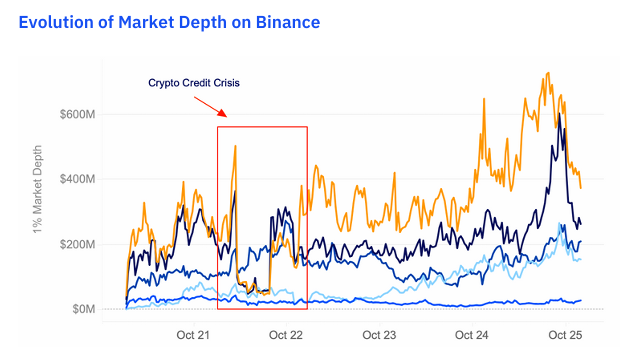

Analyst Maartunn referenced Kaiko data highlighting notable growth in Bitcoin's 1% market depth over recent years.

“Market depth has not only recovered but expanded considerably,” Maartunn stated. “By October 2025 highs,

Binance’s one percent depth surpassed $600 million — exceeding levels seen before the major downturns experienced pre-2022.”

Bitcoin Market Depth on Binance. Source: Kaiko

He further emphasized that despite nearly three months of declining prices (down roughly 21&period77%) from about &dollar110&comma291 to &dollar86&comma089), BTC/&t UST’s daily average spot volume remained robust at around &$19&period8 billion,&rdquo totaling approximately &$613&period5 billion throughout this period.

With enhanced market depth combined with substantial trade volumes , similar abrupt events occurring within highly liquid pairs like BTC / USDT appear improbable .

<p& ;gt ;Nevertheless ,this episode underscores crucial lessons about choosing trading pairs wisely .Pairs lacking sufficient liquidity can expose traders risk severe slippage alongside unexpected financial setbacks .

<p& ;gt ;The original article titled " ;Bitcoin’s Trading Pair Flashes Down To $,24000 On Binance : Why You Need To Be Careful" was first published at BeInCrypto .