Bitcoin has largely overlooked macroeconomic indicators that should have bolstered its price. In December, the US Consumer Price Index (CPI) dropped to 2.7%, fueling expectations for interest rate cuts, yet Bitcoin’s value remained stagnant. Instead of drawing new investments, its price plateaued as funds shifted elsewhere.

This divergence has reignited conversations about a potential bear market in Bitcoin.

Jurrien Timmer, Fidelity’s Director of Global Macro, recently cautioned that Bitcoin might have already concluded its latest four-year cycle back in October—both in terms of price action and timing. Subsequent on-chain metrics and market data increasingly validate this perspective.

Indicators Point Toward Bitcoin Entering a Bear Market

A variety of independent signals now converge on one conclusion: capital is withdrawing from Bitcoin; long-term holders are offloading their positions; and the cryptocurrency is bearing risk without genuine demand backing it.

Stablecoin Deposits Have Plummeted Since Cycle Peak

Stablecoin inflows typically serve as the fuel for crypto rallies—but this source has dried up significantly.

The total inflow of ERC-20 stablecoins into exchanges peaked at approximately $10.2 billion on August 14 but plunged to nearly $1.06 billion by December 24—a staggering decline close to 90%.

If you want more insights like these, consider subscribing to Editor Harsh Notariya’s Daily Crypto Newsletter.

This peak in stablecoin deposits preceded Bitcoin’s October surge above $125,000—the same timeframe Timmer identified as the probable cycle apex.

Although I remain bullish on Bitcoin over the long term, I worry that it may have completed another four-year halving cycle both in terms of pricing and duration by October. Aligning all previous bull markets visually shows that the October high near $125k after 145 months fits perfectly… pic.twitter.com/Uxg9DTccnt

— Jurrien Timmer (@TimmerFidelity) December 18, 2025

No significant new capital influx has occurred since then, reinforcing the notion that accumulation gave way to distribution post-peak.

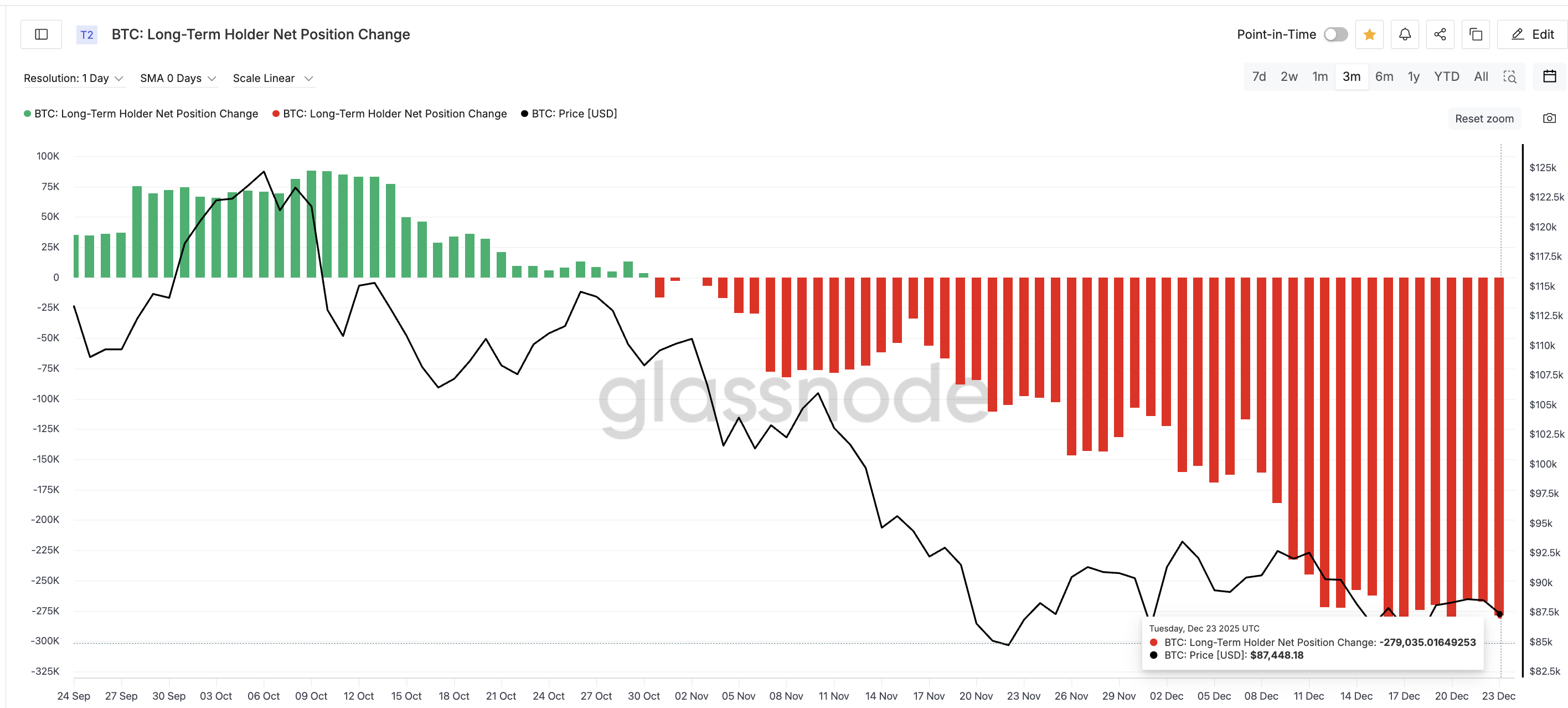

Long-Term Holders Are Increasingly Selling Off

The behavior among dedicated holders shifted dramatically after October’s peak.

The net position change for long-term holders turned negative shortly following this high point. Daily selling surged from around 16,500 BTC at late October up to roughly 279,000 BTC recently—a rise exceeding 1,500% in daily sell pressure.

This trend aligns closely with Timmer’s thesis regarding an ended halving phase last fall: seasoned investors appear less inclined to defend prices and instead reduce their exposure aggressively.

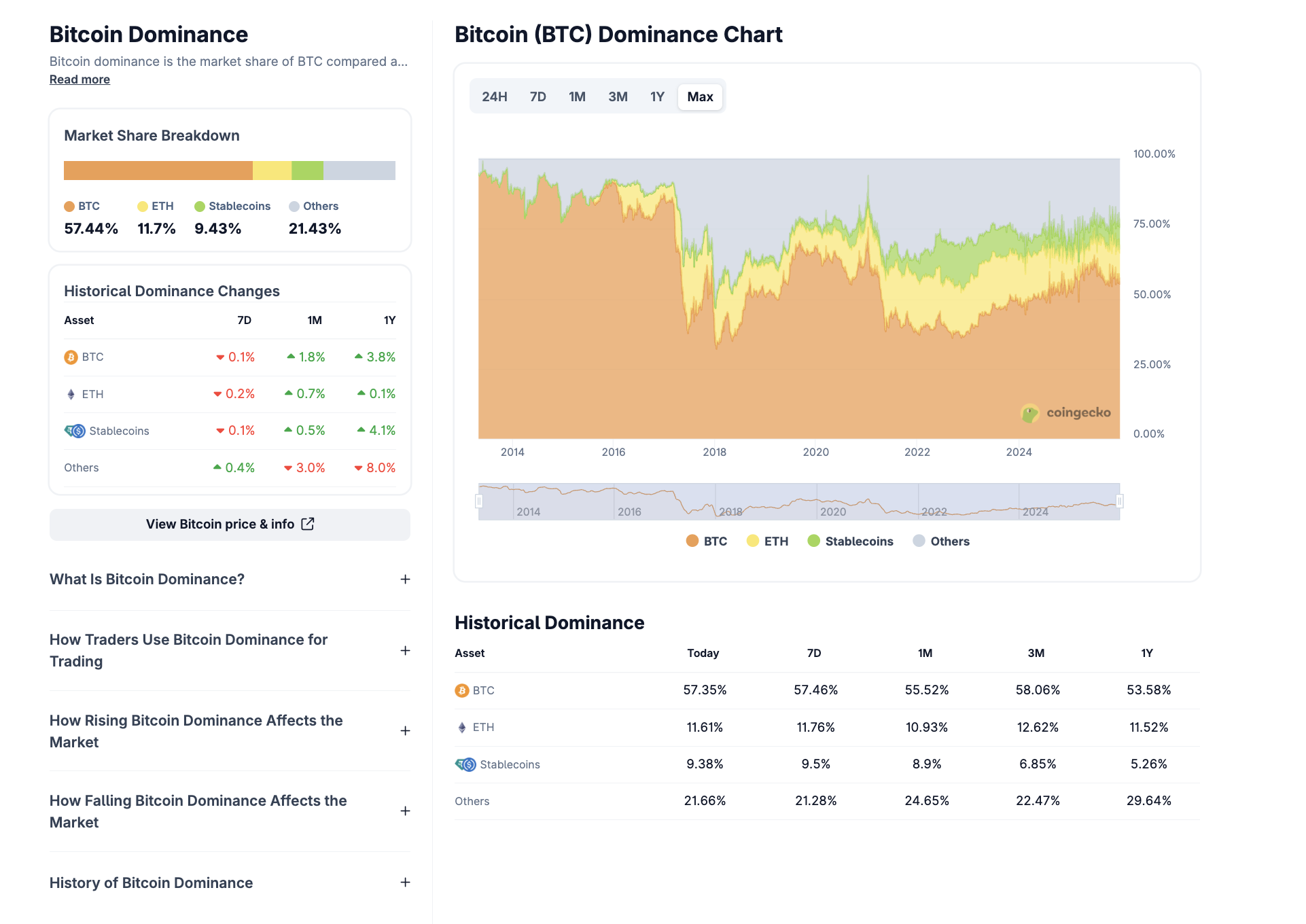

Bitcoin Dominance Is Increasing But Not Due To Bullish Sentiment

The dominance metric for Bitcoin climbed back toward a range between roughly 57%–59%. However, this uptick does not signal increased risk appetite among investors.

After softer CPI data was released, rather than rotating into cryptocurrencies like BTC, money flowed into traditional safe havens such as silver—which soared over +120% year-to-date—and gold with gains near +65%. Meanwhile, broad crypto assets lagged considerably.

if you had invested $10k across various assets at January start:

silver → $23k

<br>gold →$16.5k<br><br>nvidia →$13.45k<br>nasdaq →$12k<br>s&p500→$11 .6 k & lt ; br & gt ; btc→$9 .4 k & lt ; br & gt ; eth→$8 .8 k & lt ; br & gt ; altcoins→$5 .8 k— Dirk 💎 (@DirksDegen) December

This movement suggests bitcoin’s rising dominance stems more from capital seeking refuge within crypto rather than fresh investment enthusiasm.

Ray Youssef , CEO and founder of NoOnes , shared exclusive commentary with BeInCrypto emphasizing why gold outperformed during a debasement trade throughout 2025 while bitcoin stayed range-bound:

“<span style="font-weight: normal;">While gold clearly leads performance-wise amid debasement concerns this year, a deeper look reveals defensive positioning by investors who crave certainty amid fiscal excesses,& geopolitical tensions plus policy uncertainty.& Central bank buying alongside a weaker dollar supports gold’s role as top defensive asset,””

“Conversely , bitcoin hasn’t lived up fully to digital-gold hedge expectations so far due mainly due its sensitivity towards macroeconomic variables rather than just monetary inflation alone.

Its upside now depends heavily upon liquidity growth , clear sovereign policies , plus positive risk sentiment,” he added.Mega Whale Wallets Are Quietly Shrinking Their Holdings

Larger stakeholders are also retreating quietly.

The count of addresses holding more than ten thousand bitcoins decreased from ninety-two early December down to eighty-eight — coinciding with falling prices rather than accumulation activity.

Mega whale wallets often represent institutional players or entities managing vast sums.Their reduction adds further evidence smart money isn’t aggressively betting upward here.

Beneath A Key Long-Term Moving Average Level

​bitcoin remains below its critical one-year moving average hovering near one hundred two thousand dollars — last decisively lost when bear markets began early twenty twenty two.

This moving average acts both technically and psychologically.As failure reclaim implies regime shift away from trend continuation.Historical patterns indicate if price stays below then downside targets emerge closer toward seventy two thousand dollars realized trader cost basis band.

“'''bitCoin Is Below Its Three Hundred Sixty Five Day Moving Average ($102K), A Key Technical And Psychological Support Level Last Broken At The Start Of The Two Thousand Twenty Two Bear Market.

If Price Fails To Reclaim It Data Suggest The Next Support Lies Near Seventy Two K The Traders Minimum Realized Price Band.Pic.Twitter.Com/VysVce5Ny9”

— CryptoQuant.Com (@cryptoquant_com) November Five Twenty Twenty Five

Taken collectively these indicators support Timmer’s cautionary view suggesting bitcoin may already be entrenched within or approaching bear territory despite lackluster immediate price reflection.Capital inflows faded conviction sellers dominate dominance rises defensively while macro relief goes ignored.

Nontheless some key longer term cyclical supports remain intact.These countervailing signs along exact thresholds will determine whether we face full blown bears or extended sideways transition next.In depth discussion follows below:

Bearing In Mind Why Bear Market Case Isn’t Fully Confirmed Yet

Evidences pointing toward bearishness coexist alongside two important long term cycle markers arguing against definitive structural breakdown.

Also investor interpretation around CPI deceleration plays crucial role.Cooling inflation normally aids risky assets however current reaction indicates preference towards safety/liquidity over growth prospects.This doesn’t invalidate CPI signal but possibly means delayed response historically typical for bitcoin relative traditional hedges once liquidity expectations translate fully into flows.

These nuances do not dismiss bearish signals previously discussed but explain why ongoing phase might evolve either way – prolonged transition versus outright bear market.

No Pi Cycle Top Signal Yet

One renowned indicator known as Pi Cycle Top compares short-term (111-day MA) against double weighted longer MA (350-day x two).Crossovers historically mark major peaks/bull market ends.

Currently no crossover exists implying absence overheated euphoric conditions even post-October highs.

This observation contradicts Fidelity’s Jurrien Timmer assertion linking Oct high near $125K fitting prior cycles timing.

Historically confirmed bears followed clear Pi Cross confirmation which remains missing today.

TWO YEAR SMA Remains Critical Threshold

Structurally another key factor lies nearby – bitcoin trades close above its pivotal two year simple moving average (~82 800 USD).

This level consistently separates bull vs bear phases.Monthly closes above signify survival whereas sustained closes beneath herald deep downturns.

To date monthly closing under SMA hasn’t happened making upcoming Dec close crucial.If btc holds above ~$82 800 through end-of-year likely represents late-cycle pause instead confirmed downturn.

🚨 Critical Zone On Btc’S TWO Year Sma Multiplier

The TWO Year Sma Multiplier stands among most respected cyclical charts demanding attention.Currently btc trades very close @~82 800

History matters:

Whenever…

Pic.Twitter.Com/Jmiw9Rssgg

—

Alphractal(@Alphractal)

December Sixteen Twenty Twenty Five

Holding levels opens door possibility where next year sees delayed rally rather prolonged drop.But decisive monthly breach below would lend credence towards lower targets circa sixty five–seventy five K referenced earlier.

Tl Dr – Essential Levels For Monitoring Now

Bear case invalidates if btc reclaims yearly ma (~102K), aligning w Tom Lee’s optimistic forecast marking renewed strength starting point(also was break start ’22 bear).

Summary:

Above ~82 800 @Dec Close : Transition Phase Likely Maintained

Below ~82 800 Monthly Close : Heightened Bear Risk

Back Above ~102 000 : Bullish Structure Rebuild Begins

Currently btc caught between conviction-driven selling pressure vs sturdy multi-year support.Not confirming strength yet nor breaking decisively.December closure expected decide prevailing narrative heading into ‘26.

The article titled “Is Bitcoin Already In A Bear Market? Fidelity Chief Raises Concerns” originally appeared on BeInCrypto.