Bitcoin’s recent surge toward the $90,000 threshold has provided a brief boost to the cryptocurrency market, yet most experts remain skeptical about this rally marking a significant turnaround after one of the weakest second halves in recent memory.

Over the last 24 hours, leading cryptocurrencies have mostly traded within tight ranges. XRP, Ether, Solana’s SOL, Cardano’s ADA, and Dogecoin saw modest increases of up to 2%. Meanwhile, Aave’s token AAVE continued its decline amid ongoing governance disputes, making it the worst performer with a 7% drop.

The total market capitalization for cryptocurrencies has once again surpassed $3 trillion—a psychologically critical level that has acted as a battleground between buyers and sellers throughout the past month. Despite daily gains in prices, analysts warn that this rebound is more indicative of exhaustion than genuine renewed confidence.

Alex Kuptsikevich, chief market analyst at FxPro, explained that recent gains are primarily technical corrections stemming from an oversold base following weeks of selling pressure.

“The crypto sector is attempting another push upward; however, this should not be mistaken for a full recovery,” Kuptsikevich remarked. He noted only slight improvements in market sentiment. The fear and greed index currently stands at 25—signaling traders are moving away from extreme pessimism but remain cautious about taking on risk.

During Asian trading hours on Tuesday morning, Bitcoin hovered near $88,000—testing the upper boundary of its range established since early last week. Kuptsikevich cautioned that short-term momentum might be deceptive given broader trends: Bitcoin remains approximately 30% below its peak levels projected for 2025 and trades lower than where it started this year.

“Efforts to recover year-to-date losses offer little solace,” he added via email. “Disappointment has largely replaced earlier optimism seen earlier this year.”

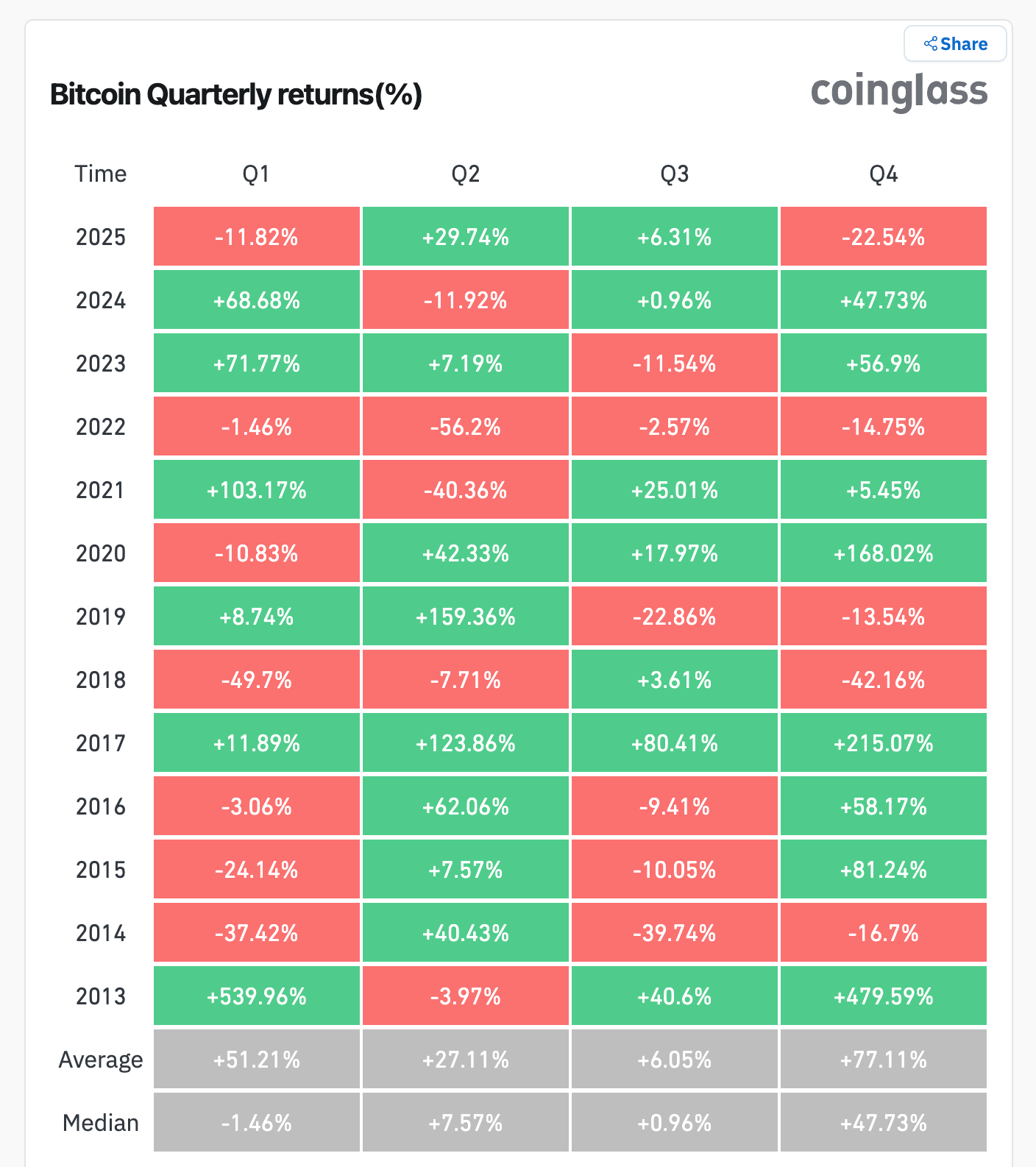

Seasonal trends further support prudence. Data from CoinGlass reveals Bitcoin is down over 22% so far during Q4 — positioning 2025 as one of Bitcoin’s weakest year-end performances outside major bear markets.

Although historically Q4 often brings some of Bitcoin’s strongest rallies, if macroeconomic uncertainty and tightening liquidity dominate—as they have recently—it can also trigger steep declines instead.

(picture source: CoinGlass)

The crypto market remains susceptible to sudden reversals—especially during U.S. trading sessions—as price advances made during Asian and European hours frequently dissipate once North American markets open.