Bitcoin finds itself in a tight spot today, lingering just below the significant $90,000 threshold as if hesitating to make a decisive move. The 24-hour price fluctuation remains minimal, resembling the discipline of a New Year’s resolution diet, while its market capitalization rivals that of entire countries. Trading volume stands at $18.29 billion, indicating either trader uncertainty or fatigue following recent turbulent swings.

Technical Overview of Bitcoin

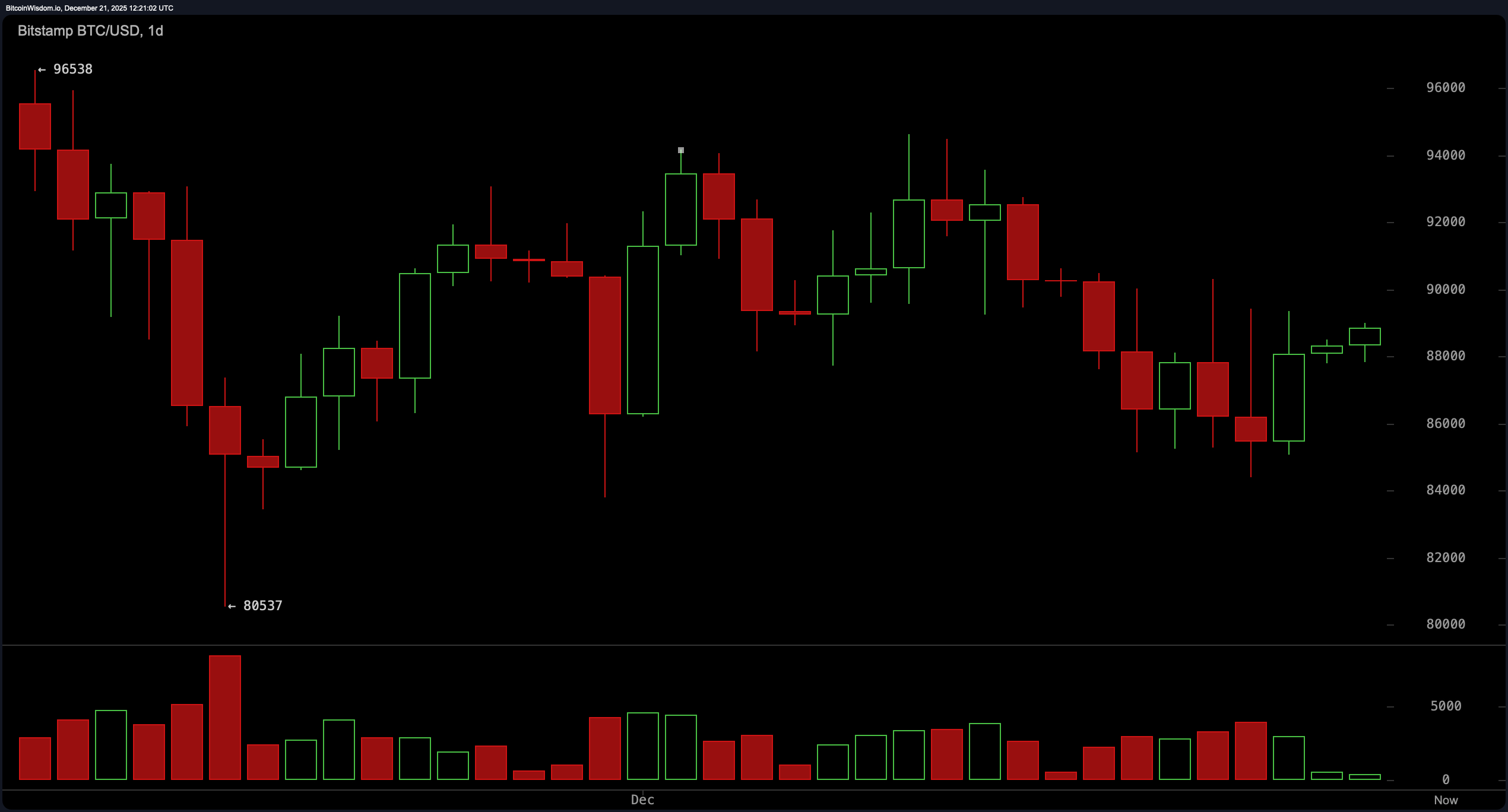

The daily chart reveals Bitcoin attempting to regain composure after a dramatic drop from roughly $96,538 down to about $80,537. It has since been forming progressively higher lows in an effort to stabilize and is currently oscillating between $86,000 and $90,000.

The Relative Strength Index (RSI) hovers around 46 — signaling indecision rather than bullish momentum — whereas the Moving Average Convergence Divergence (MACD) reads −1,561 and hints at slight optimism amid otherwise neutral indicators. Short-term averages like the 10-period EMA and SMA provide support near current prices; however, longer-term moving averages (20-, 30-, 50-, 100-, and 200-period) remain positioned above price levels acting as formidable resistance barriers reminiscent of ancient Spartan defenses.

Examining the four-hour timeframe uncovers a narrative of gradual recovery shadowed by unresolved setbacks. Following a sharp liquidation event on December 18 that pushed prices from approximately $90,317 down to near $84,398 USD, Bitcoin has been clawing back with higher highs and lows but lacks robust trading volume supporting this ascent—suggesting tentative enthusiasm among traders.

The stochastic oscillator sits modestly at around 39 while the Commodity Channel Index (CCI) registers −47—both whispering caution rather than shouting conviction—leaving room for varied interpretations akin to abstract art appreciation.

On an hourly scale, Bitcoin sits snugly within a narrow consolidation range between roughly $88,000 and $89,000.

The Awesome Oscillator reads −1&comma590 with momentum at −3&comma804&comma painting a slightly weary picture—as if Bitcoin is catching its breath or simply fatigued.

Low trading volumes dominate this timeframe too, making any breakout beyond ~$89&comma500 contingent upon increased market participation.

This micro-range action may feel tedious but it reflects necessary calm before potential volatility returns.

Structurally speaking,&nbspthe framework for bullish momentum exists thanks to ascending lows supported firmly around á$86\,000&. However,ás we approach \,90000&.the resistance acts like an exclusive velvet rope barring entry into further gains unless backed by strong volume—the proverbial bouncer refusing passage.

Should volume surge alongside price breaching this ceiling decisively,át could ignite sustained upward movement.

Until then though,

patience outweighs impulsiveness when navigating these waters.

In summary,

on December twenty-first,

bitcoin balances delicately amid mixed technical signals

from oscillators

and moving averages alike.

Price consolidation urges caution:

this isn’t time for rash bets but rather observation—

monitor ranges closely especially near ninety thousand dollars which might unlock new chapters should it break convincingly.

Bullish Perspective:

If bitcoin closes firmly above ninety thousand dollars accompanied by solid trading volumes,

the case for continued upward trajectory strengthens significantly.

Higher lows across multiple timeframes combined with short-term moving average support hint toward preparation for another rally leg pending breakout confirmation backed by active participation .

Bearish Perspective:

Conversely , failure maintaining levels above ninety thousand coupled with slipping below eighty-five thousand on increasing sell pressure could signal recent rebounds were mere temporary spikes .

Persistent resistance along long term averages plus weakening momentum suggest bulls face challenges ahead .

Dropping under eighty-four thousand would negate recovery hopes opening door wider corrections .

Frequently Asked Questions 🧠

What is bitcoin’s current value?

<span>Bitcoins trade around eighty-eight thousand seven hundred eighty-seven US dollars as per data dated December twenty-first , two zero two five .</span>

Will bitcoin surpass ninety-thousand-dollar mark soon?

<span>Breakout beyond this level depends heavily on strong volume validation .</span>

Where are key support/resistance zones located?

<spanSupport clusters close ~86k USD ; resistance concentrated near ~90k USD .</span

Is now advisable moment enter trades ? & lt ; br / & gt ;

<spanCurrent technical setup recommends awaiting clearer directional cues before committing capital.