This week, Bitcoin’s value has been fluctuating as traders anticipate the Bank of Japan’s upcoming interest rate announcement set for December 19.

Overview

The price of Bitcoin has seen a decline this week while investors await the BoJ’s decision on interest rates. The likelihood of a rate cut according to Polymarket has surged to an impressive 99%. Additionally, Bitcoin is currently exhibiting a bearish flag pattern on its daily chart.

As of now, Bitcoin (BTC) is trading at $87,700. This figure represents a decrease of approximately 7.47% from its peak earlier this month and is about 30% lower than its all-time high.

Increasing Likelihood of BoJ Rate Hike

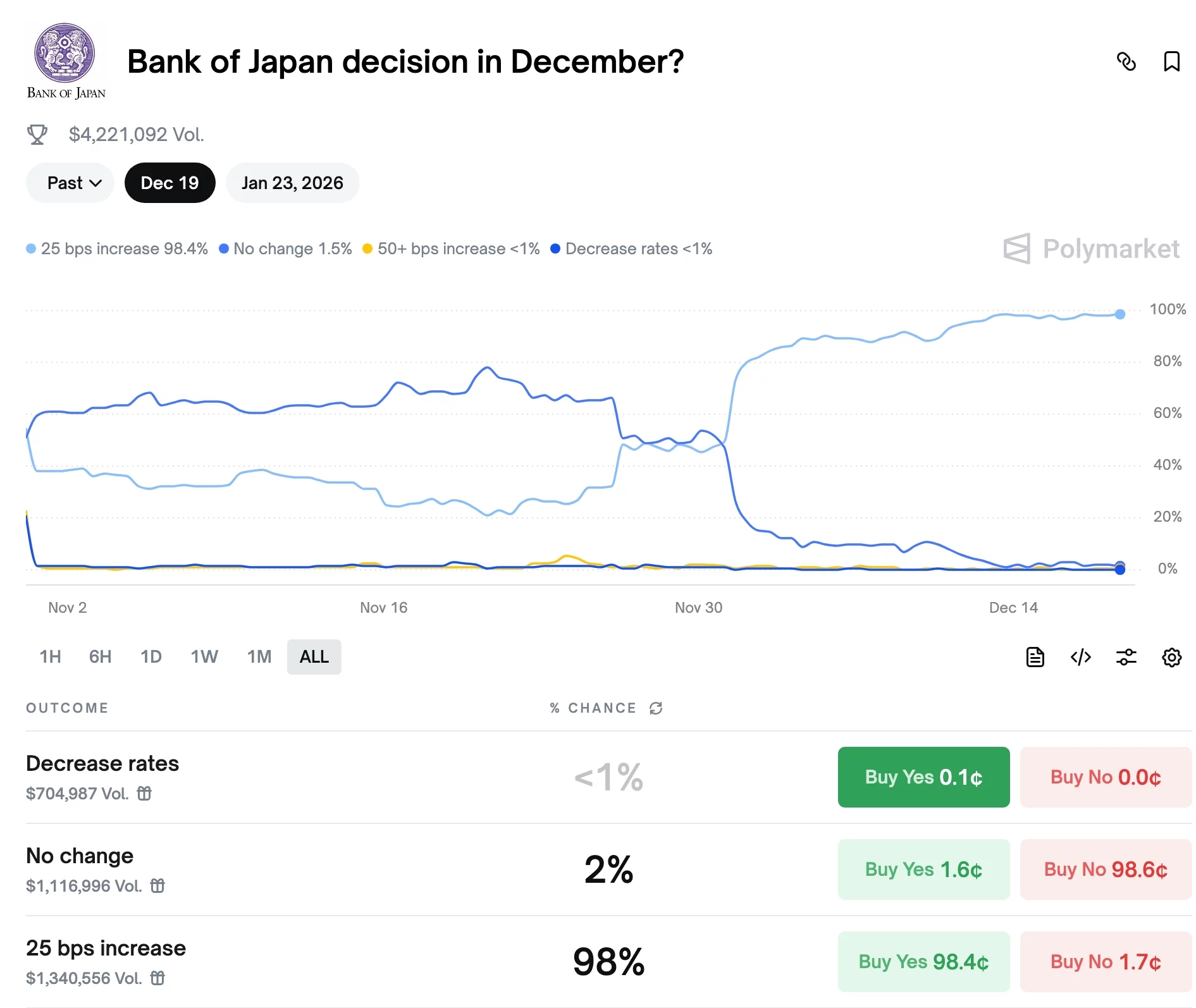

In recent days, both Bitcoin and altcoins along with stock markets have experienced pullbacks as expectations for an increase in BoJ rates have risen significantly. Polymarket currently assigns a staggering 98% chance to such an increase.

Odds of BoJ interest rate hike | Source: Polymarket

A potential rate hike by the Bank of Japan carries substantial weight due to its position as one of the largest central banks worldwide, managing assets exceeding $4.48 trillion and being the foremost holder of U.S. government bonds.

You may also find interesting: Bitwise predicts that Bitcoin, Ethereum, and Solana are poised for new highs driven by ETF demand surging by 2026.

The risk associated with a possible BoJ hike during a period when the Federal Reserve is reducing rates could compel investors to unwind their carry trades—where they borrow in low-interest-rate countries to invest in higher-yielding assets.

Japan has historically been pivotal for carry trades due to its long-standing low-interest environment; thus any narrowing yield spread between U.S. and Japanese bonds might prompt investors to divest from riskier assets acquired previously.

Nonetheless, it’s important to note that even if there’s an uptick in rates from the BoJ, it may not necessarily push down Bitcoin prices further since market participants seem prepared for such news given that expectations are already at 99%. Consequently, we could see buyers entering back into positions once news breaks—embracing what seems like ‘the new normal.’

Technical Analysis on Bitcoin Pricing

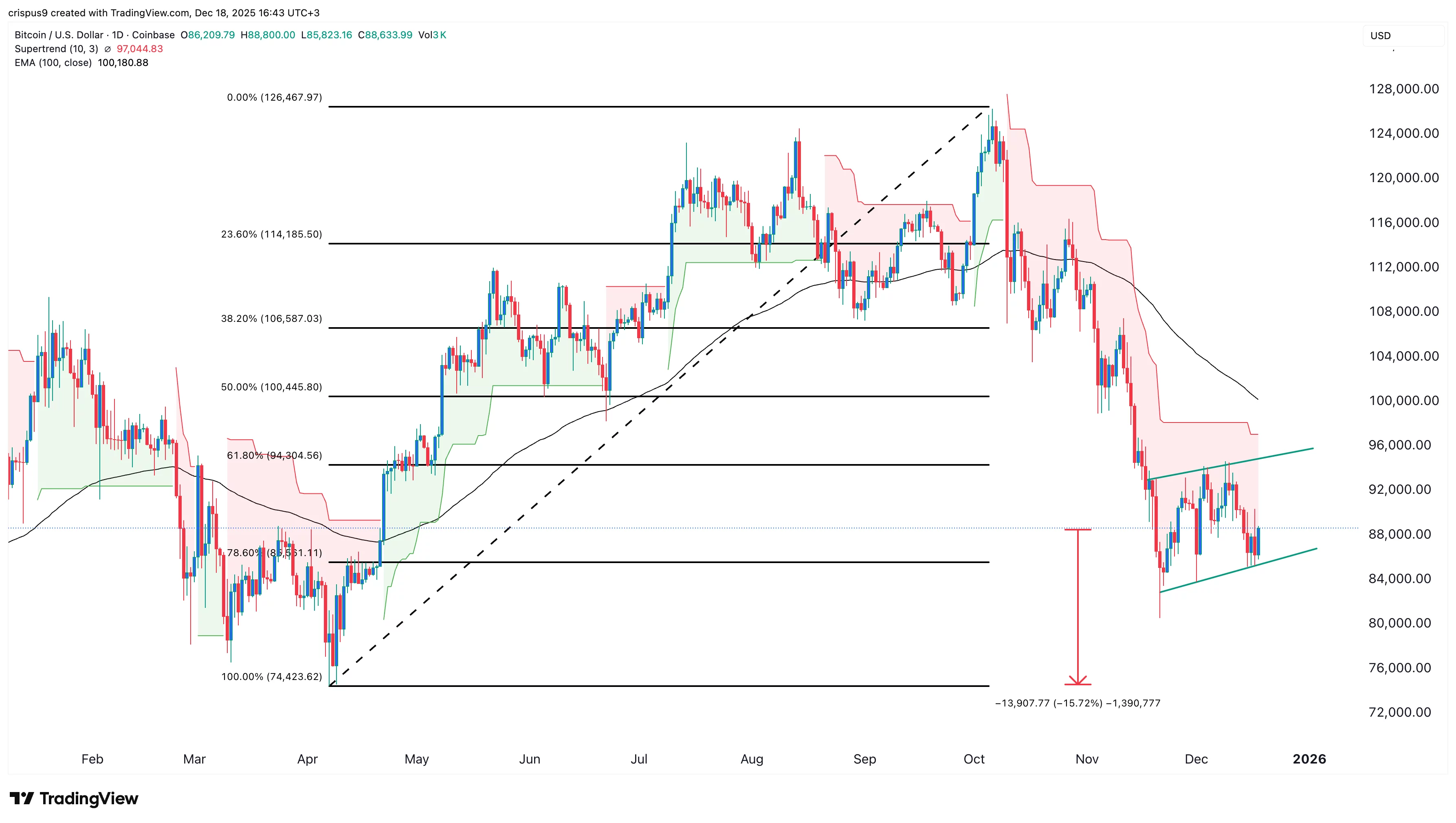

BTC price chart | Source: crypto.news

An analysis based on daily charts indicates that short-term trends suggest bearish resistance for Bitcoin prices ahead. Currently forming what appears like a bearish flag pattern—it seems we’ve completed constructing an inverted flagpole phase and are now within the flag section itself.

The current price remains beneath both Supertrend indicators alongside the crucial 100-day Exponential Moving Average while approaching near levels indicated by Fibonacci Retracement at around 78.6% mark.

This sets up potential risks where we might witness declines leading towards retesting year-to-date lows around $74,423—a drop roughly amounting close towards another additional fall off about15%.

Despite prevailing bearish sentiments surrounding BTC outlooks presently; there’s still room left open whereby possible rebounds could occur pushing us back upwards toward upper limits located around $94k before ultimately reverting back into downward trends thereafter!

You can read more:

Dogecoin shows signs indicating bullish reversals amid whale purchases coinciding with diminishing exchange balances.