The price of XRP has risen by approximately 2.3% in the last 24 hours; however, the overall trend remains weak. Over the past month, XRP has declined by nearly 14%, and it is down about 8.5% in the previous seven days.

This decline is notable because it occurs despite six consecutive weeks of inflows into spot ETFs, which would typically signal bullish momentum. Yet, a closer examination reveals why XRP’s price growth has stalled.

Six Consecutive Weeks of ETF Inflows with Waning Momentum

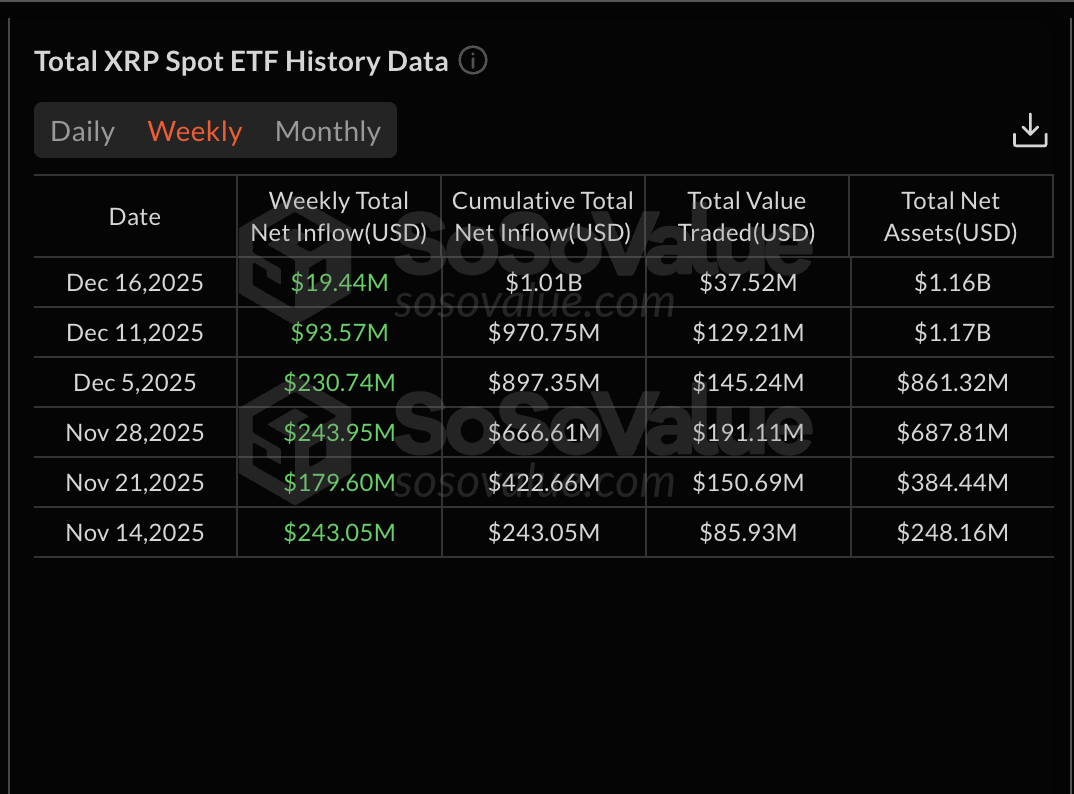

Spot ETFs for XRP have experienced inflows for six straight weeks starting from mid-November, accumulating net inflows exceeding $1.01 billion.

The initial weeks showed strong demand: during the week of November 14, net inflows reached $243.05 million; this was followed by $179.60 million on November 21 and $243.95 million on November 28. Early December saw another peak with $230.74 million added during the week ending December 5.

If you want to receive more insights like these on tokens, consider subscribing to Editor Harsh Notariya’s Daily Crypto Newsletter.

However, since then there has been a significant slowdown: net inflows dropped to $93.57 million during the week ending December 11 and further decreased to just $19.44 million in the most recent week concluding December 16.

Although ETF flows remain positive over these six weeks, their pace is decelerating considerably—this cooling demand helps explain why XRP’s price hasn’t surged alongside earlier strong inflow figures.

Diverging On-Chain Data Among Holder Groups

If declining ETF interest were offset by active buying from on-chain holders, prices might stabilize—but that scenario hasn’t fully materialized yet.

A worrying indicator is that coins inactive for over a year now represent an increased share of total supply—from 48.75% on December 2 up to around 51% recently—the highest level seen in about one month.

When long-dormant coins start moving again without panic selling involved, it often signals that previously locked-up supply could be entering circulation as potential sell pressure.

Conversely, another group holding XRP long-term (wallets holding over five months) shows signs of easing selling pressure.

Net outflows peaked at roughly 216.86 million tokens around December 11 but dropped approximately 29% down to about 154.57 million tokens by December 16—indicating reduced liquidation among this cohort recently.

This mixed data paints an ambiguous picture: some older holdings are becoming active—which tends bearish—but others are scaling back sales somewhat.

This dynamic may have prevented a sharper drop so far; however,

it’s possible those movements reflect holders preparing to sell when prices bounce upward rather than outright accumulation.

Until we see this metric turn positive (net buying), any rallies might lack strength or sustainability.

XRP Price Levels Will Determine If Current Pause Leads To Decline

The current trading pattern shows XRP stuck within a descending wedge formation near its mid-range levels.

For bullish traders,

the key resistance lies at around $2.28;<nbsp;a daily close above this point could break out from downward pressure, potentially driving gains near 19% from present prices and shifting momentum toward buyers. n