In the past couple of months, the wider bitcoin market has experienced a significant downturn, pushing prices to unexpectedly low levels and stirring widespread apprehension among investors. However, Michael Saylor of Strategy remained unfazed by this volatility and continued to accumulate more bitcoin with determination.

Within just the last two weeks alone, Strategy invested close to $2 billion in acquiring additional Bitcoin assets.

Over time, Strategy has consistently grown its Bitcoin reserves and currently holds an impressive 671,268 BTC. This amount represents approximately 3.2% of all bitcoins projected to ever exist according to company data.

The firm’s average cost per bitcoin stands near $75,000, with total expenditures reaching around $50 billion. Meanwhile, the current net asset value of their Bitcoin holdings is estimated at about $60 billion.

Strategy has been purchasing Bitcoin every quarter since Q3 2020 without interruption—completing a total of 90 separate transactions during this period.

According to Bitcointreasuries.net statistics, Strategy’s stash dwarfs that of any other publicly traded entity by a wide margin; it owns twelve times more BTC than MARA Holdings—the second largest holder on the list.

While most top ten companies hold between roughly 13,000 and 53,000 bitcoins each, Strategy’s massive accumulation clearly sets it apart as an unparalleled leader in terms of scale within institutional BTC ownership.

This month also saw Strategy establish a substantial cash reserve worth $1.44 billion aimed at securing future dividend payments and interest obligations. This move was designed specifically to reassure shareholders that there would be no need for selling any part of their nearly $56 billion bitcoin portfolio despite ongoing market weakness.

The reserve was funded through recent sales of Class A shares and initially covers payment commitments for twenty-one months—with plans underway to extend coverage up to twenty-four months. CEO Phong Le emphasized that this financial buffer greatly diminishes concerns about forced liquidation related risks raised previously by investors or analysts alike.

BREAKING: Michael Saylor’s company now controls over three percent (3.2%) of all existing Bitcoins 😲

pic.twitter.com/R907KnHsee

— Bitcoin Magazine (@BitcoinMagazine) December 16, 2025

Aiming Higher: ‘We’re Going To Acquire It All’

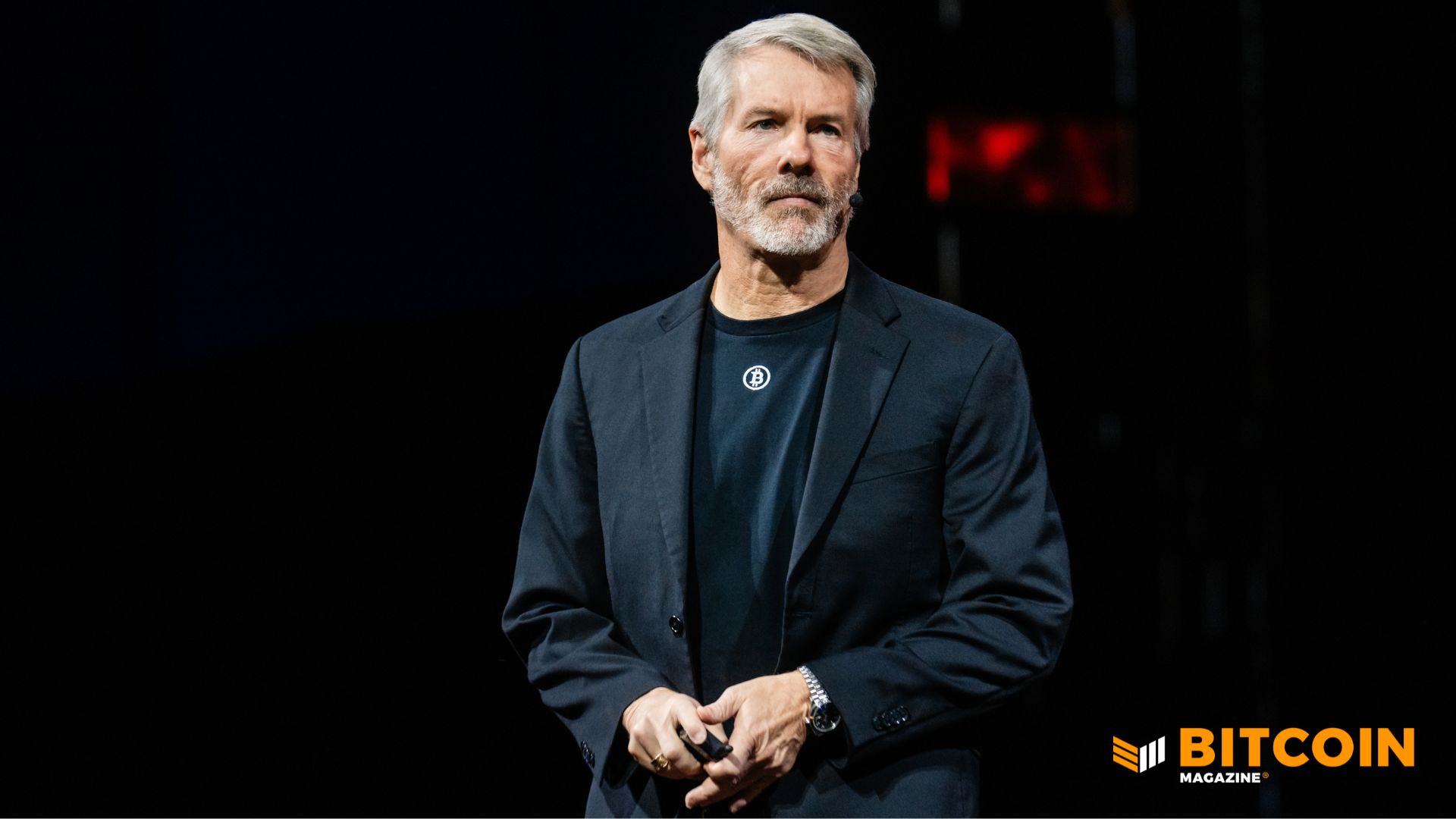

During his address at the Bitcoin MENA conference,Saylor elaborated on his vision regarding bitcoin’s role as foundational digital capital ushering in new credit paradigms worldwide. He spoke directly toward sovereign wealth funds,banks,and investment groups framing bitcoin not merely as an alternative asset but rather as “a core pillar” providing stability akin yet superior compared with traditional stores like gold or real estate.”

Saylor highlighted how institutional acceptance continues expanding rapidly—pointing out major American banks such as Bank Of America,Wells Fargo,JPMorgan Chase,and Citi now offer custody services along with lending facilities secured against cryptocurrency holdings including BTC itself. the growing bipartisan support from regulatory bodies including Treasury Department,the SEC,and CFTC further legitimizes these developments.”

A central element behind Strategy’s approach involves transforming volatile bitcoins into predictable income streams via over-collateralized financial products like STRK—which pays an eight percent dividend—and STRF,a perpetual bond yielding ten percent returns.These instruments enable steady cash flow generation while simultaneously increasing long-term exposure across their entire portfolio.”

Saylor asserted these innovative structures allow doubling btc per share approximately every seven years,&am p ; nbsp ; effectively creating liquidity channels aligned perfectly between corporate growth ambitions alongside investor return expectations.He drew parallels comparing these models favorably against historic gold-backed monetary systems,envisioning global adoption where digital gold underpins credit markets integrated seamlessly within conventional banking frameworks .

Recent announcements confirmed that despite annual changes removing six firms while adding three,newly reaffirmed inclusion ensures strategy remains part Nasdaq100 index .

Michael Saylor delivering remarks at Bitcoin Amsterdam event .

This article titled & quot ; Michael Saylor ’ s Approach To Building A Massive Bitcoin Treasury Now Represents Over Three Percent Of Total Supply & quot ; originally appeared on Bit coin Magazine authored by Micah Zimmerman .