As of 8:30 a.m. on December 15, 2025, Bitcoin is priced at $89,698, resulting in a market capitalization of approximately $1.79 trillion. The trading volume over the past 24 hours reached $33.33 billion. Throughout the day, Bitcoin’s price has fluctuated within a tight range between $87,892 and $89,935, indicating a market caught between cautious recovery efforts and persistent resistance from above. This dynamic is evident across hourly to daily charts where technical indicators suggest uncertainty and lack of strong conviction.

Bitcoin Market Analysis

Examining the daily chart reveals that Bitcoin remains significantly below key trend lines established since its decline from six-figure levels. Although it currently trades near the upper boundary of its recent range, it faces resistance beneath several long-term moving averages such as the 50-period exponential moving average (EMA) and the 100-period simple moving average (SMA).

The candlestick patterns on this timeframe display diminishing body sizes accompanied by frequent wicks—classic signs of indecision rather than clear directional momentum. Volume trends reinforce this interpretation by tapering off after previous rebound attempts without signaling any definitive shift in control.

Looking closer at the four-hour chart shows continued formation of lower highs and lower lows despite attempts to stabilize above mid-$87,000 levels. Multiple rallies toward $90,000 have failed to sustain gains leaving behind rejection shadows that indicate selling pressure overhead remains intact.

The Average Directional Index (ADX) reading around 26 suggests an existing but moderate trend strength while Commodity Channel Index (CCI) at -77 points toward stretched conditions without extreme oversold status—together illustrating controlled downward pressure rather than panic selling or bullish breakout energy.

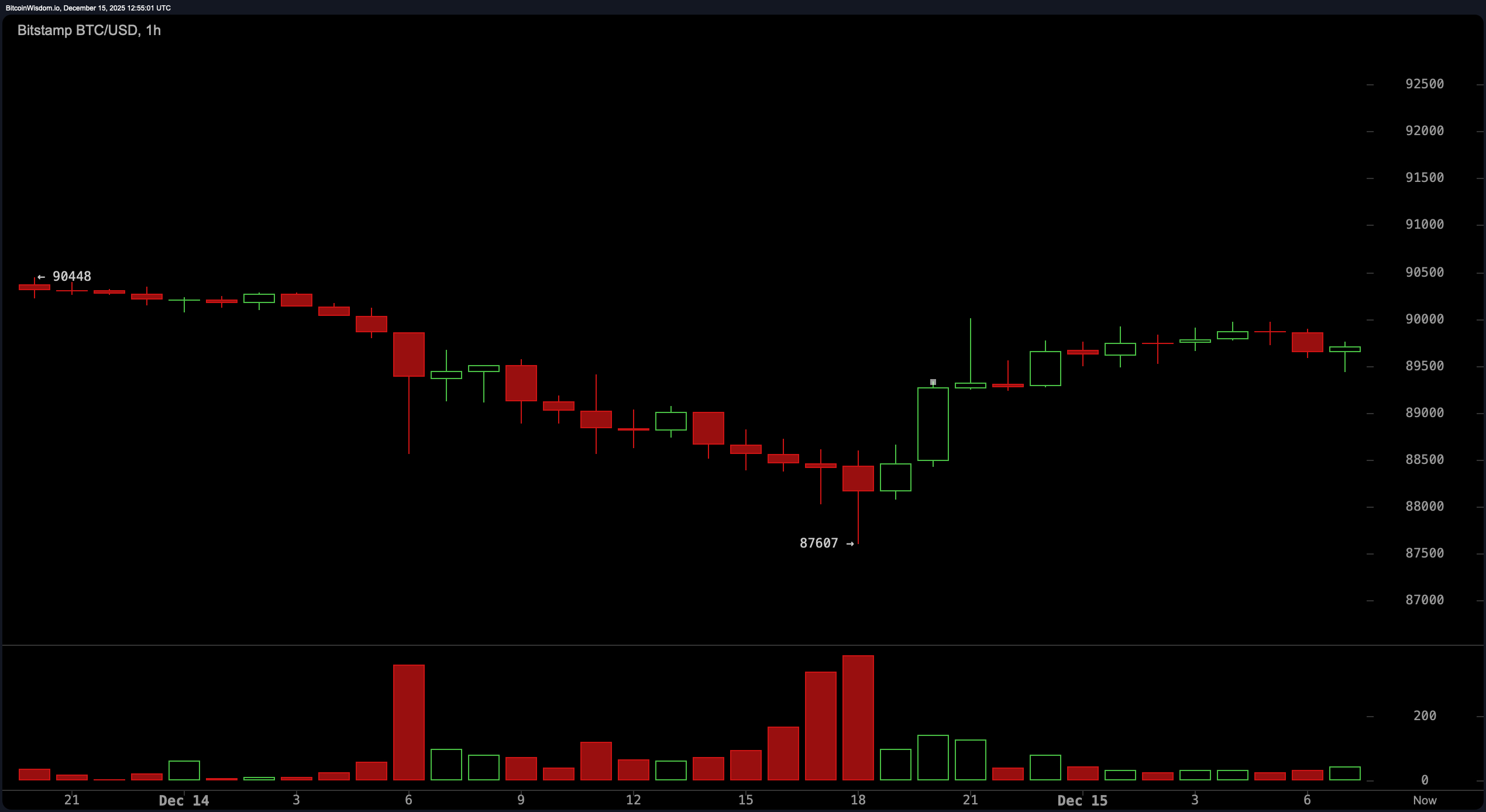

The one-hour chart presents a more detailed view where Bitcoin has managed a slight bounce from recent lows followed by sideways consolidation on lighter volume—indicating selective buying interest instead of broad enthusiasm.

Price action near $89,500 appears choppy with narrow candles clustered tightly together—a pattern often preceding volatility expansion but not necessarily predictive regarding direction alone. Traders focusing here are mostly interpreting minor price structures amid fading momentum that emerges briefly before dissipating again.

Oscillator readings further emphasize this mixed scenario—the Relative Strength Index (RSI) stands neutral around 44 away from oversold or overbought extremes while Stochastic oscillator at roughly midpoint confirms balance in momentum shifts.

The Awesome Oscillator remains negative reflecting ongoing bearish undertones despite some short-term stabilization attempts seen through improving Momentum and Moving Average Convergence Divergence (MACD). However, these positive signals face strong headwinds as nearly all tracked EMAs and SMAs—from short-term ten-day averages up to long-term two-hundred-day ones—remain positioned above current prices.

This alignment highlights how much ground must be regained technically before sentiment can truly pivot upward across broader timeframes.

Taken collectively, Bitcoin’s technical setup early Monday leans towards caution rather than confidence. While shorter timeframes hint at potential base formation, longer periods remind traders relief rallies may falter quickly unless sustained moves break through stacked resistance zones — a prerequisite for shifting prevailing bearish narratives into bullish ones.

Bullish Perspective:

If Bitcoin maintains support just above upper-$87K levels alongside strengthening short-term indicators like MACD momentum improvements—even amid subdued volumes—it could signal an emerging foundation for future stability.

Should prices respect recent lows while gradually challenging nearby resistances,

there exists room for optimism about developing broader consolidation phases prior to any meaningful uptrend continuation.

nnnn

Bearish Perspective:

nn <