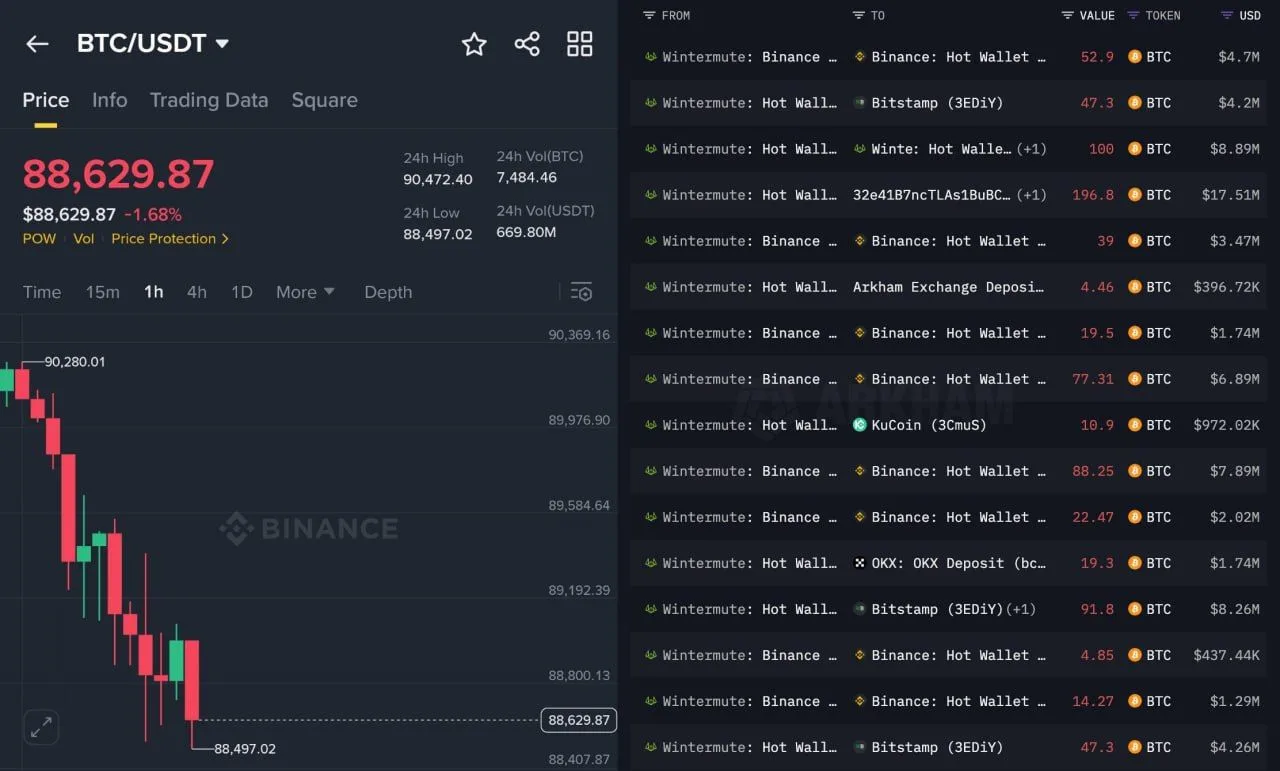

On December 15, Bitcoin was trading between $88,600 and $89,800 as social media discussions highlighted transfers linked to Wintermute, a nearly filled CME gap, and a daily support test that some traders believe could influence the upcoming price direction.

The price of BTC showed a decline of approximately 1.68%, hovering around $88,629 in the BTC USDT pair. Meanwhile, CME futures were priced near $89,780 after an initial gap had narrowed. The daily chart remained just above an ascending support line that analysts cautioned could lead to a drop towards $80,000 if it fails.

Attention on Wintermute-Related Bitcoin Transfers as Prices Hover Around $88,630

Rumors circulated on X regarding Wintermute “dumping” Bitcoin after an account claimed that the market maker had sold off $1.5 billion worth of BTC and continued to sell at intervals. However, this post lacked independently verifiable proof for such claims.

BTC USDT one-hour price chart. Source: Binance / x

The trading session indicated that Bitcoin was valued at approximately $88,629 against the USDT pair—a decrease of about 1.68% during this update period. According to Binance data from the last 24 hours; prices peaked at around $90,472 while dipping down to about $88,497.

Additively analyzing on-chain data revealed several BTC transactions associated with wallets tagged under Wintermute moving towards exchange-related addresses like those designated for Binance and Bitstamp among others per Arkham’s findings. Nevertheless these movements do not necessarily indicate market sales since market makers often transfer coins for inventory management or liquidity purposes.

CME Gap Narrows Following Initial Session Movement—Analyst Insights

A fresh gap appeared in Bitcoin’s CME futures which “most has been closed straight away,” according to trader Daan Crypto Trades’ post on X dated December 15th.

CME Futures fifteen-minute chart showing gaps in pricing.Source: Daan Crypto Trades via X

The fifteen-minute CME futures graph indicated that BTC traded close to$89 ,780 following an opening around$89 ,990 . The session recorded highs near$90 ,035 while hitting lows close$89 ,775 . Overall there was roughly a180 dollar dip noted translating into about0 .20 percent movement based upon displayed labels

The remaining gap area identified by charts spans from approximately$90 ,200to90 ,400with analysts suggesting what remains is“pretty negligible”and indicating it likely won’t be significant focus throughout this week

Bitcoin Tests Ascending Support Near $89 Thousand While Chart Indicates Potential Retest Risk At $80 Thousand

At present time bitcoin trades closely aligned with values nearing about 88000 -935in accordance with daily btc usdt charts showcasing prices pressing against established upward sloping trendlines sustained since late November rebound according graphic shared by analyst Ted known online as @TedPillows through platform X

BTC USDT one-day overview displaying historical trends over time Source : TradingView Ted viaX

The graph illustrates how bitcoin fell from levels between120k-to124k back during October transitioning into broader downtrend before tightening ranges commenced late November forming higher lows along upward trajectory whilst repeated rallies encountered resistance within flat band zones approximating95 k thus creating wedge-like formations across daily timeframe structure.

Ted emphasized importance surrounding current zone noting breaking below rising trend supports opens pathways toward potential movements reaching lower levels estimated between80 k-and84 k where prior swing low areas exist just above indicating next visible demand zones should supports fail whereas92 k-and95 k remain closer reclaimable targets should rebounds occur.