On December 12, renewed rumors surfaced claiming that the Wall Street trading firm Jane Street orchestrates a daily Bitcoin sell-off at 10 a.m., following a sharp intraday decline in BTC prices.

Social media chatter once again implicated institutional traders and ETF market makers as the culprits. However, an in-depth examination of the data reveals a more complex reality.

The Origin of the “Jane Street 10 a.m.” Theory

This theory posits that Bitcoin frequently experiences price drops between 9:30 and 10:00 a.m. Eastern Time, coinciding with the opening of U.S. equity markets. Jane Street is often singled out due to its role as a prominent market maker and authorized participant for U.S.-based spot Bitcoin ETFs.

The accusation suggests these entities deliberately push prices down to trigger liquidations before repurchasing assets at lower levels. Nevertheless, no regulatory body, exchange operator, or verified data source has ever substantiated claims of such coordinated manipulation.

BREAKING: The 10am manipulation is back.

Bitcoin dropped $2,000 in just 35 minutes wiping out $40 billion from its market capitalization.

$132 million worth of long positions were liquidated within the last hour.

This situation is becoming absurd. https://t.co/0DRTFfL08r pic.twitter.com/RByT4CWF65

— Bull Theory (@BullTheoryio) December 12, 2025

Bitcoin Futures Data Does Not Support Aggressive Dumping Claims

Throughout today’s U.S. market open session, Bitcoin traded sideways within a narrow range near $92,000 to $93,000 without any abrupt or unusual sell-offs precisely at 10:00 a.m. ET.

The notable price drop occurred later during mid-day hours when BTC briefly dipped below $90,000 before recovering somewhat—indicating delayed selling pressure rather than one triggered by market open events.

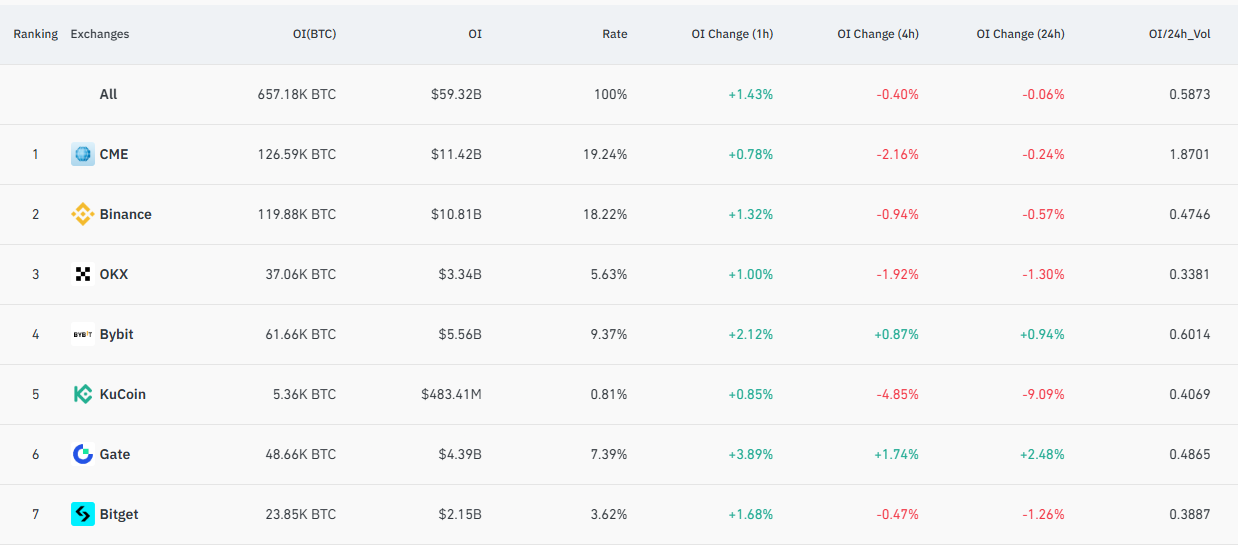

Total open interest on major futures exchanges remained largely unchanged throughout the day with no significant surge in new short positions detected.

CME Group—the primary venue for institutional derivatives trading—actually saw modest declines in open interest consistent with risk reduction strategies or hedging activities instead of aggressive directional selling pressures.

Total BTC Futures Open Interest Source: CoinGlass

If an influential proprietary trading firm was orchestrating coordinated dumps daily at this time frame one would expect noticeable spikes or collapses in futures open interest metrics—but none appeared here.

Liquidation Activity Explains Price Movements Better

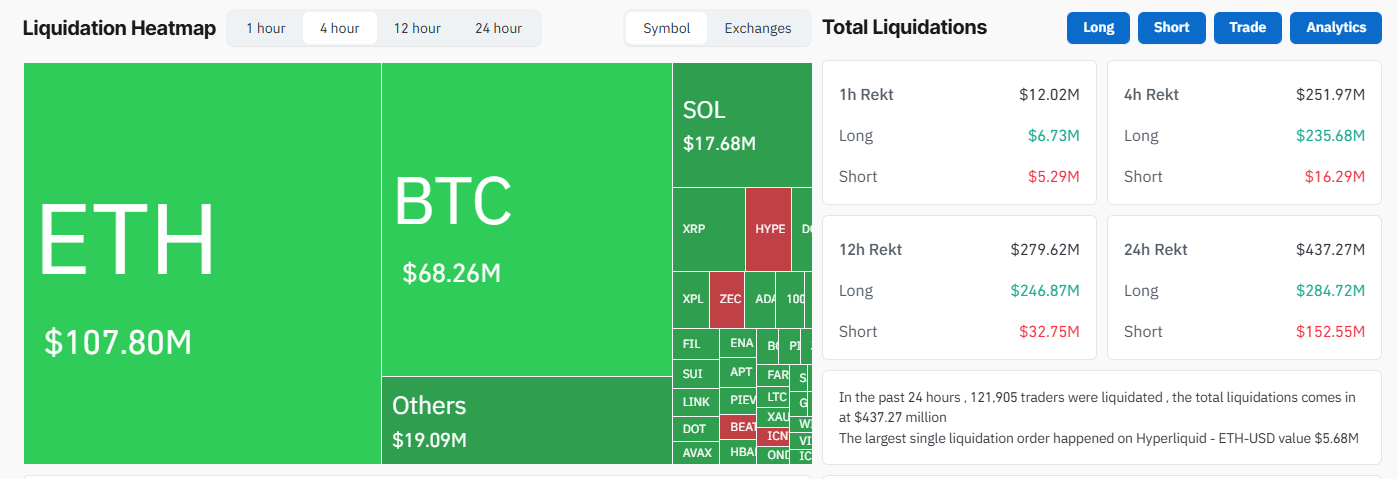

A clearer explanation emerges from liquidation statistics showing over $430 million worth of crypto liquidations across all markets during past twenty-four hours—with longs making up most losses.

Specifically for Bitcoin alone there were more than $68 million liquidated while Ethereum experienced even higher liquidation volumes—pointing toward widespread deleveraging rather than isolated BTC manipulation events specifically targeting it alone.

Crypto Liquidations on December 12 Source: CoinGlass

Drops below critical support levels often trigger forced margin calls causing cascading liquidations which accelerate downward moves without requiring any single dominant seller’s intervention.

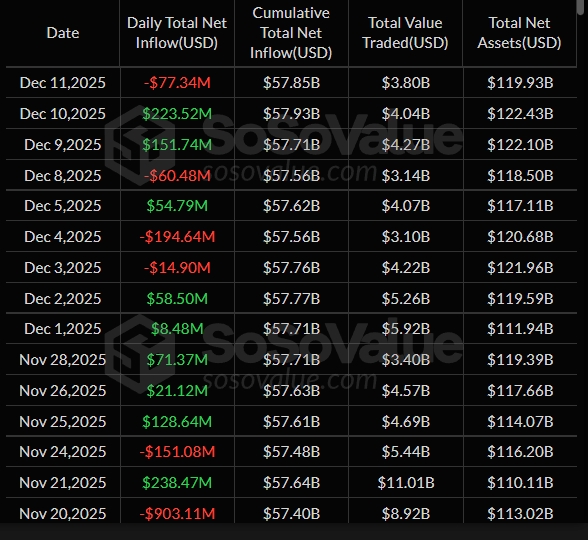

Most notably, U.S.-based spot Bitcoin ETFs recorded net outflows totaling approximately $77 millionu00A0on Decemberu00A011, reversing two days prior inflows — reflecting much of today’s brief price shock.

US Bitcoin ETFs Daily Inflow Source: SosoValue

No Single Exchange Was Responsible For The Sell-Off

The decline was spread broadly across multiple platforms including Binance,CME ,OKX,and Bybit.There was no indication that selling pressure concentrated exclusively on one venue or instrument.

This distribution matters because genuine manipulative schemes typically leave identifiable traces.This event demonstrated widespread participation consistent with automated risk unwinding processes.

Reasons Behind Recurring Jane Street Rumors

Volatility around US stock market hours tends to cluster due to factors like ETF-related trades ,macroeconomic announcements,and portfolio rebalancing by institutions.These structural dynamics can create recurring patterns mistaken for deliberate interventions.

Jane Street Bots already entered Polymarket xD

While many traders chase stories,a Polymarket account converted fifteen-minute crypto prediction windows into mechanical profits .

Because Jane Street plays visible roles as an ETF liquidity provider,it becomes an easy scapegoat for speculative narratives.But actual market making involves balancing inventory risks through hedging—not manipulating prices directionally.

Today’s episode fits typical crypto behavior where leverage accumulates until minor slips cause cascading liquidations followed by rumor-driven explanations .

The article titled “Did Jane Street Cause Another Daily Ten AM Bitcoin Dump?”& nbsp ;was originally published by BeInCrypto .