Bitcoin (BTC) has recently surged past the $90,000 mark, marking a 15% increase from its low near $80,000 on November 21. This upward movement is supported by three key cost basis indicators: the 2024 annual volume-weighted cost basis, the True Market Mean, and the average cost basis of U.S. spot exchange-traded funds (ETFs).

These indicators are crucial for pinpointing where investors are most likely to hold their ground during price declines. The support zone they form is significant because it closely matches the average purchase prices across various investor groups.

The first indicator, known as the True Market Mean, represents the average on-chain purchase price of bitcoins held by active traders. It excludes coins that have remained dormant for extended periods and thus reflects the cost basis of investors who frequently engage in trading.

During this recent correction, the True Market Mean hovered around $81,000 and served as a strong support level. Bitcoin initially surpassed this threshold in October 2023 and has not fallen below it since then—highlighting its role as a critical marker within this bullish market phase.

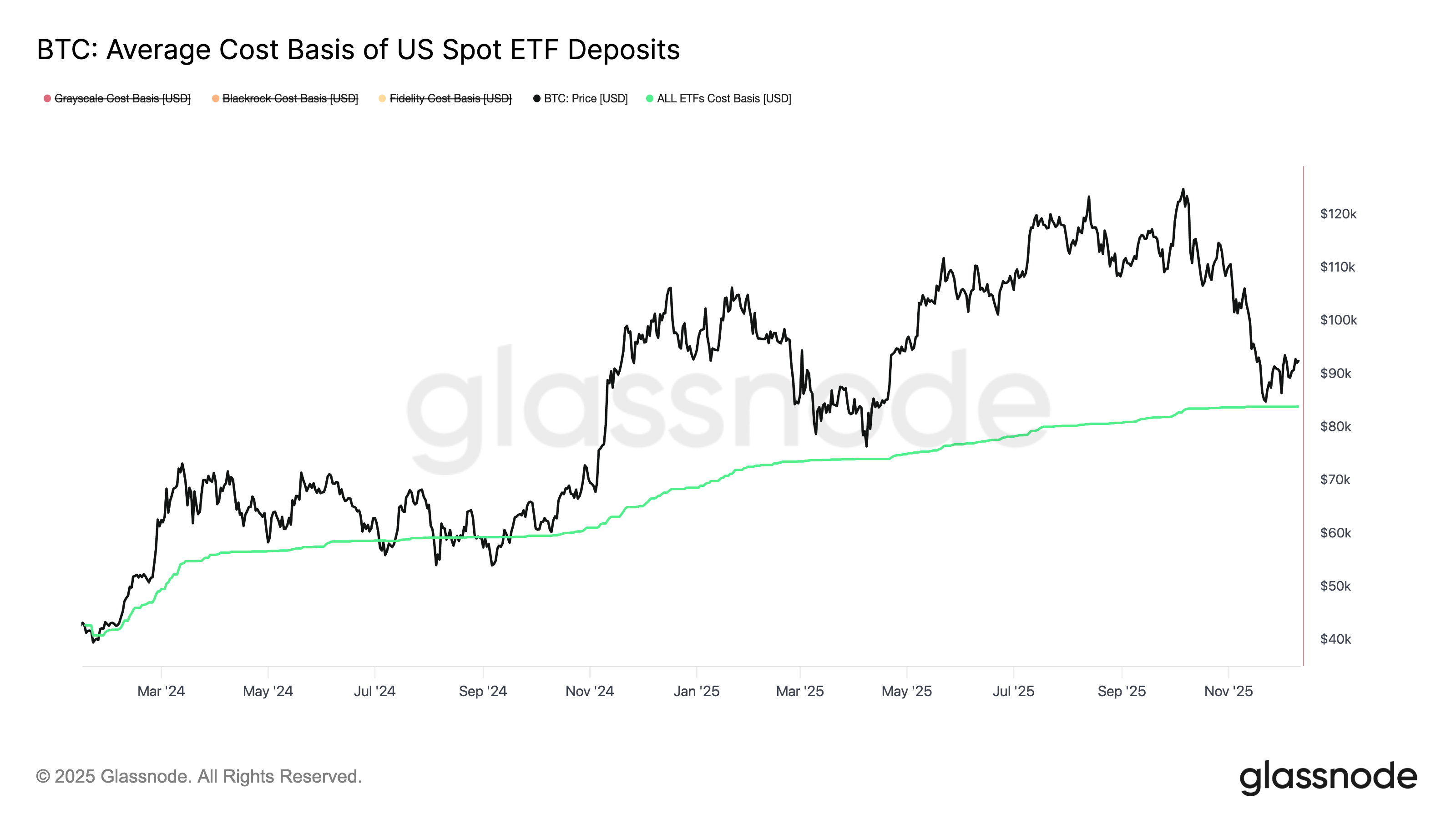

The second metric pertains to U.S.-listed spot ETFs’ weighted average entry price for bitcoin inflows. Glassnode calculates this figure by combining daily ETF inflow data with prevailing market prices.

Currently estimated at approximately $83,844 according to Glassnode’s data, bitcoin rebounded off this level once again—similar to its behavior during April’s tariff-induced selloff.

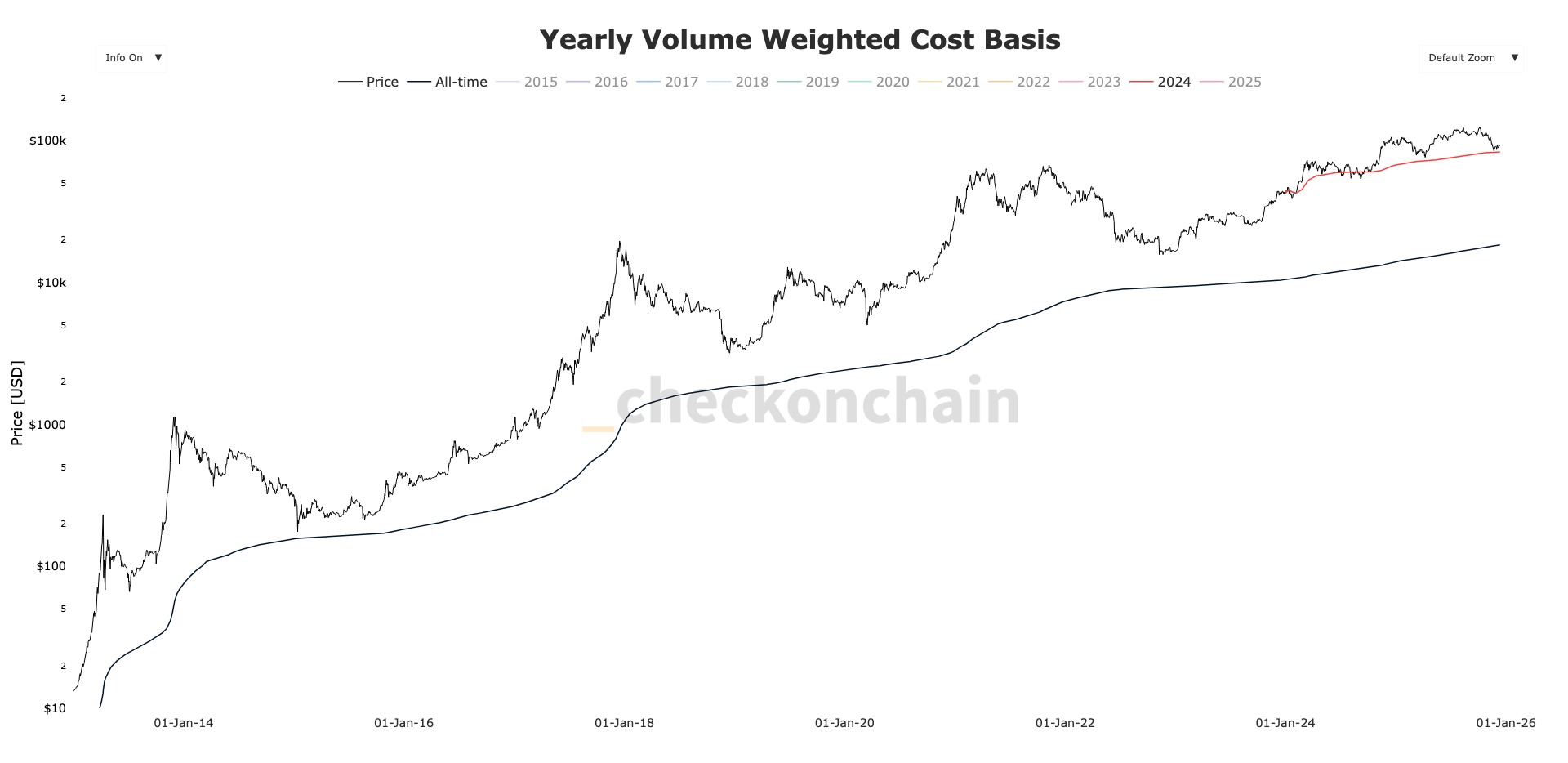

The third important measure is the 2024 yearly volume-weighted cost basis which tracks average withdrawal prices of coins acquired throughout 2024 from exchanges. Research from CoinDesk indicates that such yearly cohort averages often act as support zones during bull markets.

This year’s cohort-based cost basis stands near $83,000 according to Checkonchain data and provided further evidence of demand strength—it also acted as a reliable support point during April’s market correction.

Together these metrics illustrate robust buying interest supporting bitcoin around the $80K region—a key area where multiple investor segments converge in defense against downward pressure.