In the last 24 hours, Bitcoin has experienced a nearly 2% increase, maintaining its position above $92,200. While the daily chart appears to be sluggish, the 4-hour chart indicates that early signs of strength are emerging.

As short-term charts are more responsive to changes in market conditions, the upcoming sessions could determine whether Bitcoin will finally approach the critical $95,000 mark—an important threshold for BTC’s price growth according to experts.

Emerging Short-Term Strength Comes with Risks

The potential for a bullish EMA crossover is forming on the 4-hour chart for Bitcoin. The Exponential Moving Average (EMA) gives greater significance to recent prices and is utilized by traders to identify early trend reversals. A bullish crossover occurs when a faster EMA surpasses a slower one, signaling an uptick in buying momentum. Currently, there’s anticipation that the 50-EMA may soon cross above the 100-EMA.

The distance between these two EMAs has significantly narrowed. If this crossover materializes successfully, it could pave a clearer route towards $95,700—a crucial resistance level. However, indicators like Bull Bear Power—which reflect market control over each candle—have shown signs of weakening. Should this trend continue downward again before completion of the crossover occurs, it poses significant short-term risks.

If you’re interested in receiving more insights about tokens like this one? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

This perspective aligns with external analyses as well; analysts from B2BINPAY—a comprehensive crypto ecosystem for businesses—shared similar thoughts exclusively with BeInCrypto:

“Bitcoin currently trades within the range of $92k–$93k; however all attempts at breaking through $95k have been unsuccessful due to lack of strong drivers.”

“Should that change occur,” they added further insightfully “we might witness Bitcoin aiming for $96k next and if consolidation happens above this zone we could see movements toward reaching $100k.”

This reinforces that breaking through $95K represents a significant barrier and emphasizes that sustaining short-term strength is essential for achieving long-term gains—even those exceeding beyond $100K must hold firm.

A Rise in Dormancy Could Serve as Catalyst

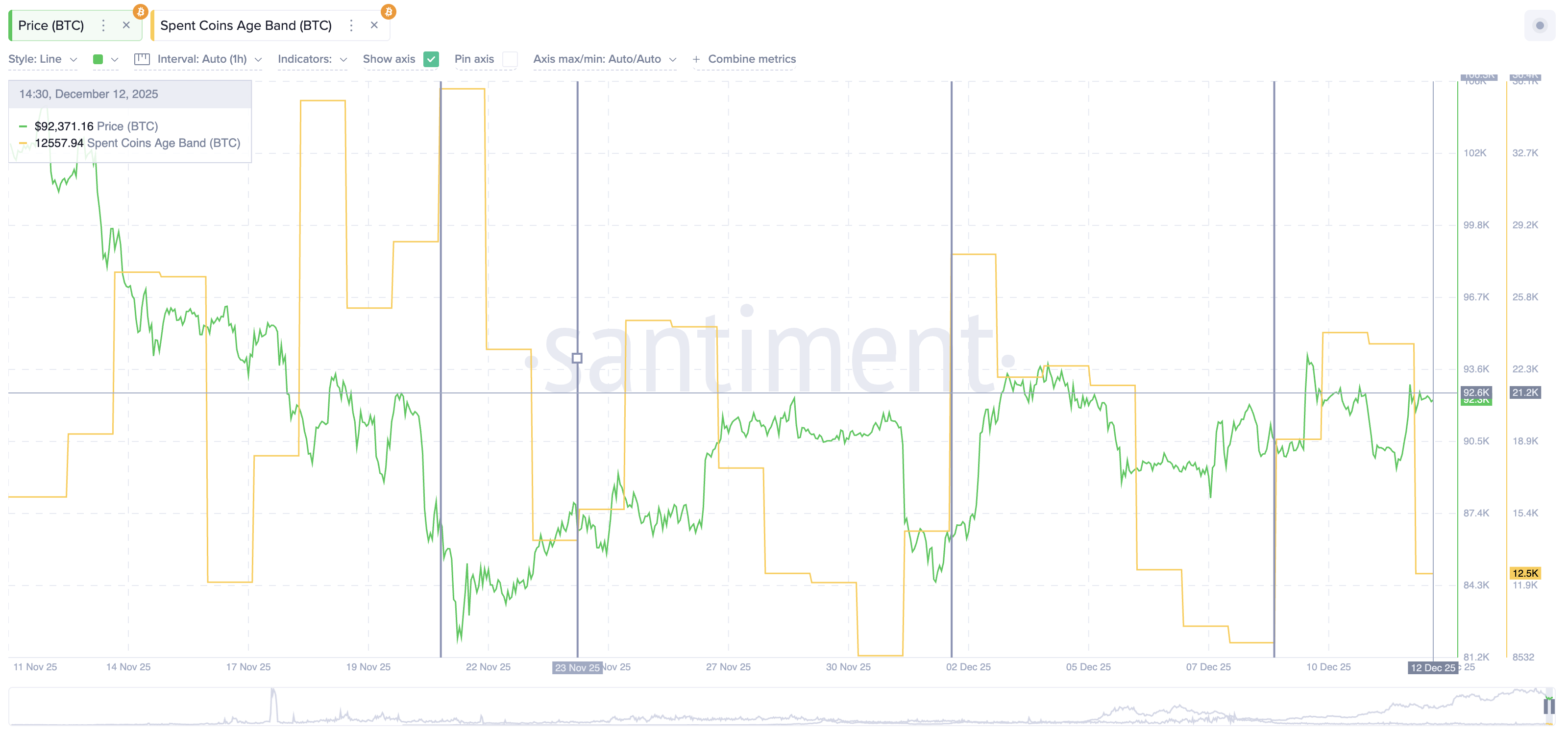

The Spent Coins Age Band tracks how many coins transition among holders; when this number declines it indicates older coins remain inactive (increased dormancy). This scenario reduces selling pressure which often coincides with price rebounds.

This metric has plummeted from approximately 24,100 on December 10 down to just around 12,500 today—a nearly fifty percent decrease reminiscent of previous rallies triggered by similar drops.

A notable example occurred between December second and ninth where spent coins fell from about twenty-seven thousand eight hundred downwards towards nine thousand two hundred leading up an approximate five percent climb thereafter by Bitcoin itself!

An additional instance saw spent coin counts decline between November twenty-first through twenty-fourth resulting into an upward surge taking Bitcoin from eighty-five thousand five hundred up until ninety-two thousand three hundred representing an eight percent gain over subsequent days!

The current reduction might not be as pronounced but follows suit within established patterns observed previously! Increased dormancy (declining spent coin activity) alongside efforts at forming crossovers can yield noteworthy implications particularly reflected upon shorter timeframe charts!

Critical Short-Term Price Levels For Bitcoin To Monitor This Week

$93K stands out as initial resistance point within shorter timeframes since no four-hour candles have closed above since December ninth thus establishing clear movement past opens pathway towards levels near94K .

If successful completion regarding EMA crossovers combined alongside sustained momentum transpires then targets shift closer towards$95 ,700 marking decisive line determining capability enabling bitcoin aspirations directed towards analyst indicated zones .

$90 ,800 serves functionally supportive base beneath current positioning whereas any dips below revert attention back onto$89 ,300 potentially stalling attempts geared toward hitting target areas surrounding$95 K .

Pivotal factors coalesce presently aligning three distinct elements : prospective ema crossings declining spent coin activities & pricing nearing resistances ! Should buyers maintain support while metrics sustain trends we may finally witness chance arising allowing testing against pivotal mark set forth namely ($97 K precisely).

This article titled “Bitcoin Builds Short-Term Strength — Now The Level That Matters Is At$95000” originally appeared first via BeInCrypto .