The Federal Reserve appears increasingly divided, and according to its own internal surveys, 2026 might witness just a single interest rate reduction.

Bitcoin Decline Attributed to Fed’s Hawkish Stance for 2026

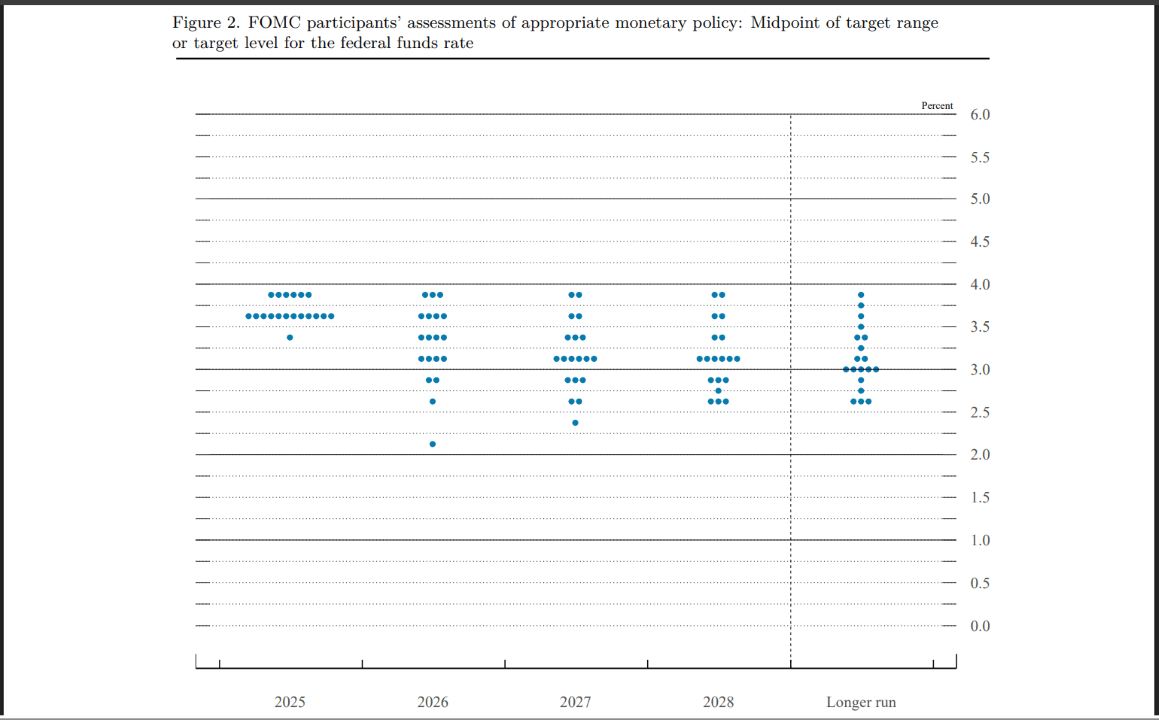

For the first time in over six years, three members of the Federal Open Market Committee (FOMC) officially opposed Wednesday’s decision to lower interest rates, revealing growing discord within this influential group. The Fed’s “dot plot,” a chart summarizing rate expectations from top officials, indicates that only one rate cut may occur in 2026. This outlook unsettled bearish investors and pushed bitcoin below $90,000 on Thursday morning.

The central bank maintained steady rates throughout most of the year despite pressure from the Trump administration for aggressive cuts. However, weaker-than-expected employment figures led to three policy rate reductions in 2025—the latest being Wednesday’s move. Not all members agreed with this third cut: Austan Goolsbee and Jeffrey Schmid—presidents of the Chicago and Kansas City Fed branches—voted against lowering rates while Stephen Miran favored a larger half-point decrease.

“There are people with strong opinions,” stated Fed Chair Jerome Powell during Wednesday’s press briefing. “Nine out of twelve supported it, so there was broad backing; however, it wasn’t unanimous as usual.”

The “strong opinions” Powell mentioned are reflected clearly in the dot plot—a quarterly visualization showing individual interest rate forecasts by twelve FOMC members plus seven Federal Reserve Bank presidents. The median forecast suggests an interest range between 3.25% and 3.50%, which Powell confirmed as approximately 3.4%. This implies that many officials anticipate only one quarter-point cut next year—a scenario unfavorable for risk-sensitive assets like bitcoin since current rates stand at 3.50%-3.75% following Wednesday’s adjustment.

“In our economic projections summary,” Powell explained, “participants provided their personal assessments indicating that by end-2026 an appropriate federal funds target would be around 3.4%.”

Market Snapshot

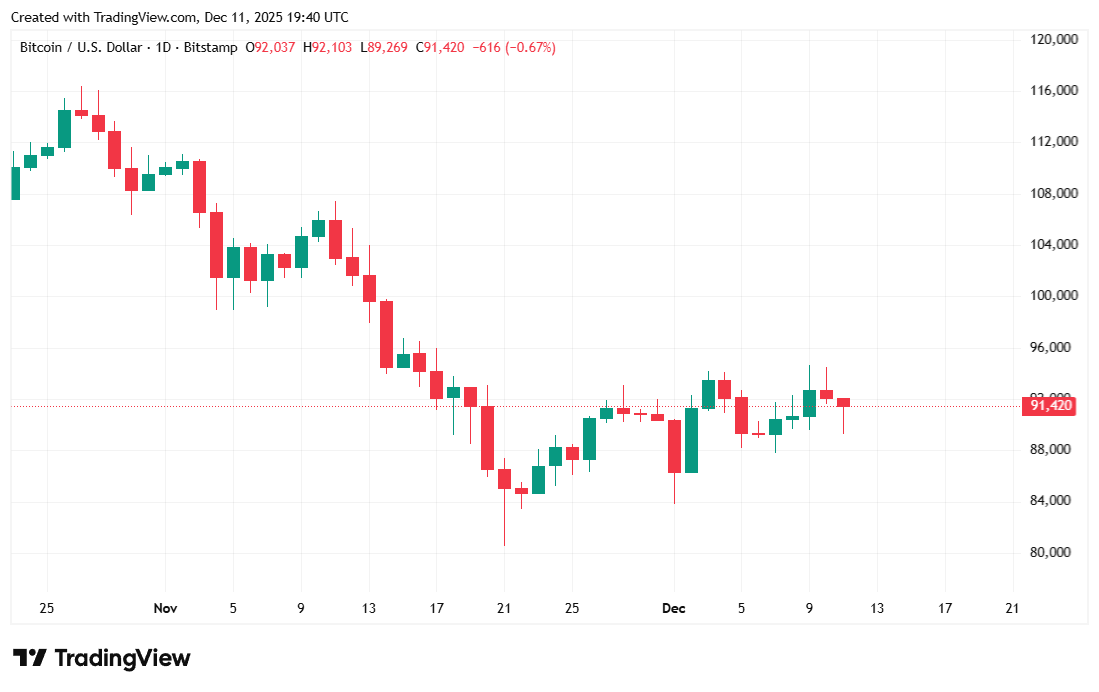

At reporting time, bitcoin traded near $91,346—down about 1.82% over twenty-four hours and slightly off by roughly 0.43% across the week per Coinmarketcap data points.

The cryptocurrency dipped as low as $89,335 on Thursday but also climbed up toward $94,477 during intraday trading sessions.

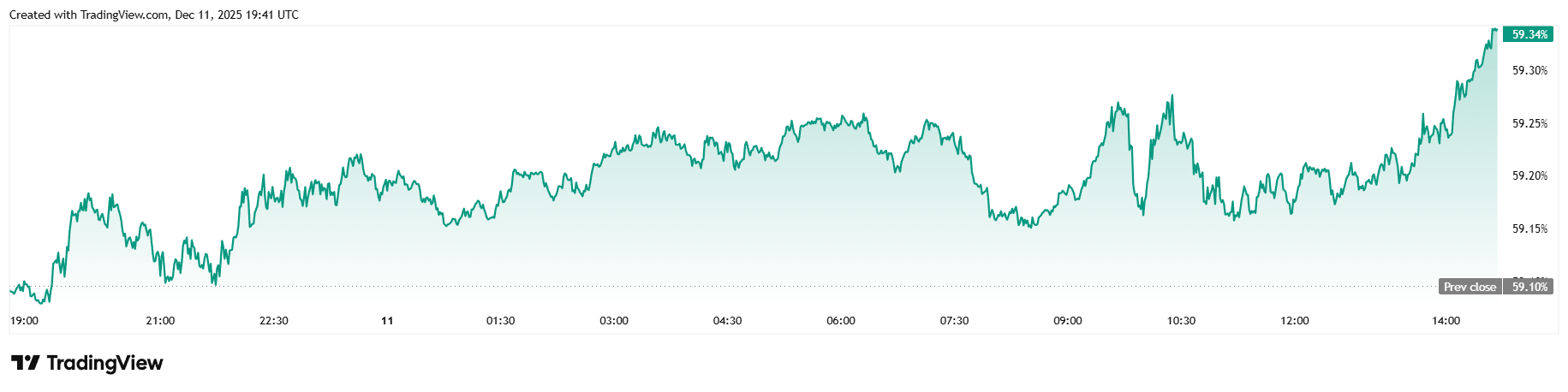

Daily volume surged by nearly fourteen percent reaching approximately $65 billion while overall market capitalization dropped to about $1.82 trillion even though bitcoin dominance rose slightly above fifty-nine percent (59.&.34%).

Total open interest on bitcoin futures remained relatively stable with a marginal increase (+0.&.20%) closing near sixty billion dollars ($59.&.74B), according to Coinglass data sources.

Liquidations almost doubled Thursday totaling more than one hundred eighty million dollars ($180.&.23M). Long positions bore most losses accounting for roughly one hundred thirty-one million ($131.&.81M), whereas shorts lost close to forty-eight million ($48.&.42M) due mainly to excessive leverage betting against price rises.

Frequently Asked Questions ⚡

Why did Bitcoin drop after today's Fed announcement?

Investors reacted nervously because new projections indicated just one possible rate cut next year.

What changes occurred inside the Federal Reserve?

Three FOMC participants dissented from lowering rates recently highlighting increasing internal disagreements.

How does this dot plot projection impact cryptocurrencies?

A hawkish stance signals tighter monetary conditions ahead which generally pressures risk assets such as BTC.

What is now expected regarding interest rates for 2026?

The median forecast stands at about three point four percent (3&.4%), suggesting minimal easing compared with today's range between three point five zero percent (3&.50%) and three point seventy-five percent (3&.75%).