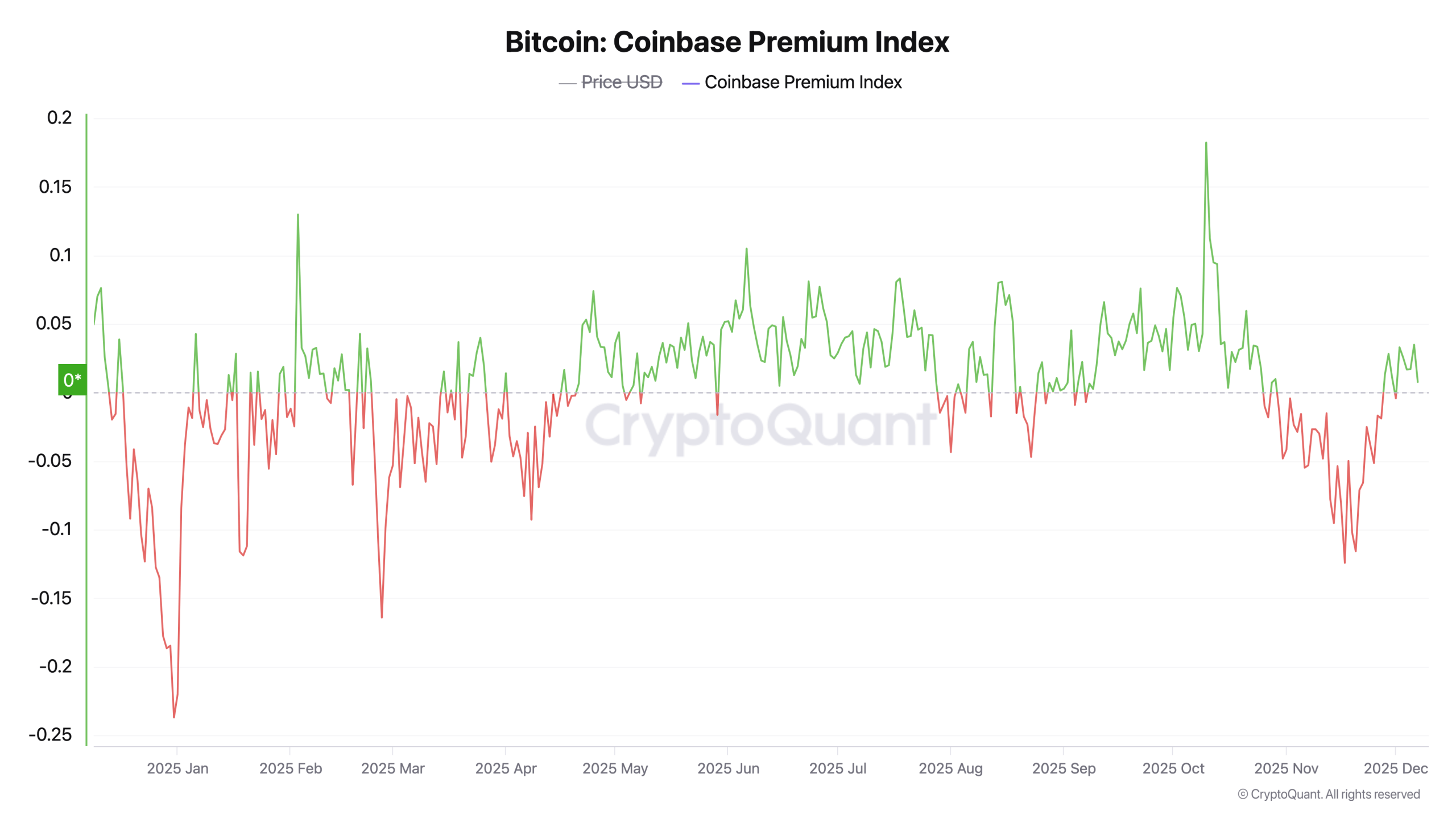

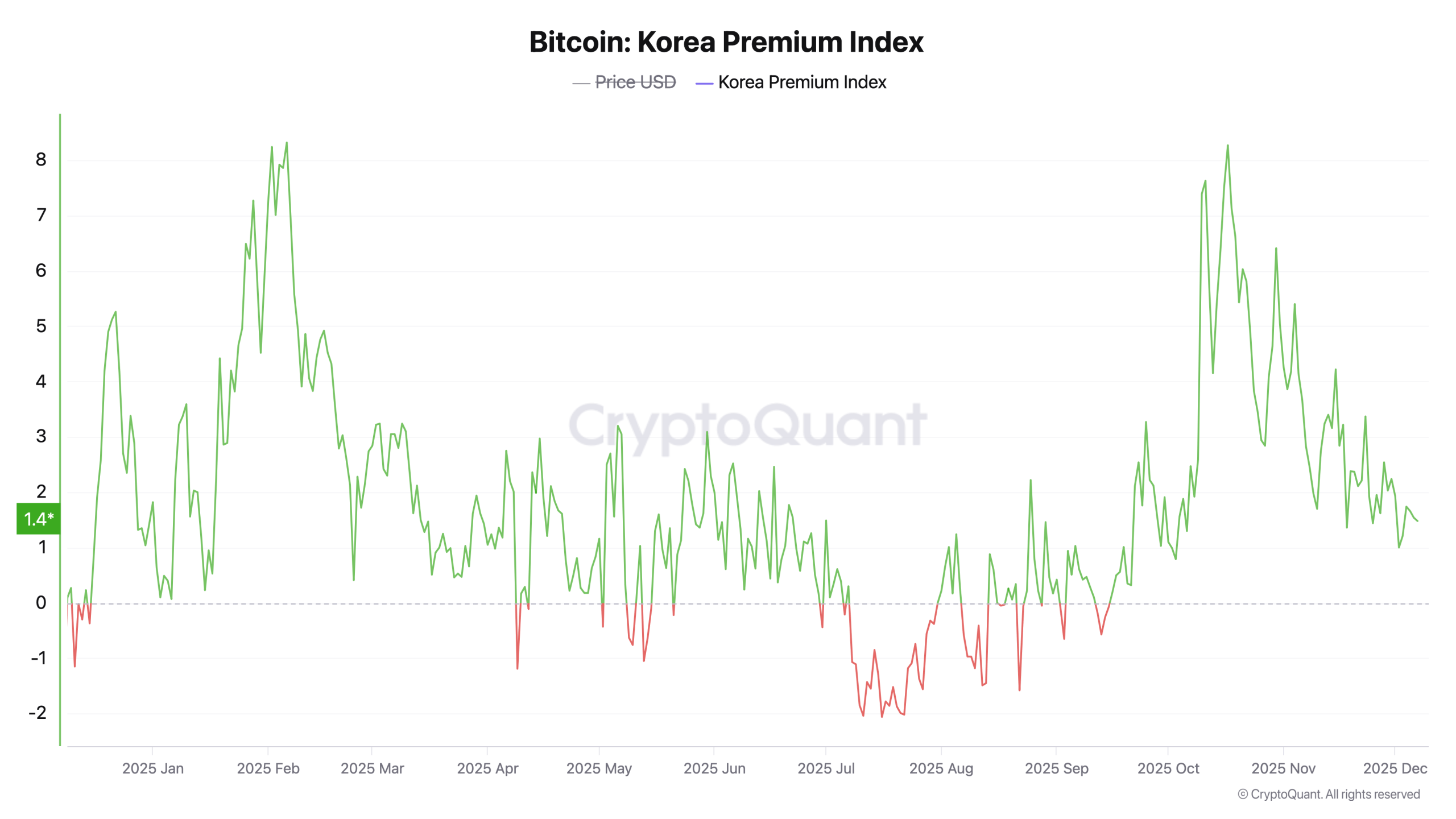

Recent reports indicate that the Coinbase Premium Index has finally emerged from a prolonged period of discounts since late October, now comfortably residing in positive territory. Simultaneously, bitcoin prices in South Korea continue to maintain their premium status, reflecting sustained demand.

Coinbase and South Korean Premiums Shine Despite Bearish Market Signals

The recent rise in bitcoin premiums arrives amid a challenging environment for the broader cryptocurrency market, which has been dominated by bearish indicators over the past several weeks.

Technical analysis, on-chain data, and sentiment measurements collectively suggest a cautious atmosphere rather than one of exuberance. Many experts warn that the earlier surge toward $126,000 might have marked a significant peak. Although bitcoin currently trades near $92,000 after bouncing back from deeper declines, growing voices anticipate a possible pullback toward around $74,000.

This pessimistic outlook is further supported by diminishing interest in ETFs, weakening momentum signals, and an extended phase of “Extreme Fear” sentiment—lasting longer than during notable crises like FTX and LUNA collapses. Yet amidst these bleak signs are emerging areas of resilience—chief among them being premium metrics.

The Coinbase Premium Index on cryptoquant.com turned positive on November 28th and has largely remained above zero except for a brief dip into discount territory on December 1st. This index tracks the price difference between bitcoin traded via Coinbase’s BTC/USD pair versus Binance’s BTC/USDT pair as a percentage figure to gauge directional pricing pressure.

A consistent positive premium reflects optimistic market sentiment alongside institutional confidence and fresh capital inflows into bitcoin. These factors can help drive rallies toward higher milestones such as $100,000—especially when macroeconomic conditions like anticipated Federal Reserve rate cuts provide additional support. Coupled with improved liquidity at Binance exchanges this dynamic helps reduce fragmentation across trading venues while fostering greater overall market stability.

Read more: Crypto-to-Fiat Conversion at Checkout Reaches US Retailers via Oobit

Bitcoin prices have rebounded after dipping into the mid-$80K range briefly falling below $88K before recovering somewhat higher — suggesting bulls may still be active participants in this cycle. Institutional investors appear to be returning as ETF inflows pick up again while corporate entities such as Strategy continue accumulating BTC holdings.

Alongside Coinbase’s index performance is Cryptoquant’s Korea Premium Index which confirms that elevated pricing levels persist within South Korea’s markets too. Though not reaching mid-October highs exceeding 8%, current premiums hover around 1.4% above global averages according to exchange data from local platforms including Upbit and Bithumb supporting these findings.

A sustained premium within South Korea adds another bullish dimension indicating persistent appetite among traders there for bitcoin—the leading digital currency worldwide. Taken together with renewed strength seen across both premium indices plus firmer liquidity conditions at major exchanges along with modest price recovery suggests December’s dominant bearish narrative might not fully capture underlying market dynamics or potential upside momentum yet to unfold.

FAQ ⏱️

What does the Coinbase Premium Index represent?

It quantifies how much higher or lower bitcoin trades on Coinbase’s BTC/USD pairing compared to Binance’s BTC/USDT pairing—highlighting buying pressure specifically within U.S.-based markets.

Why do bitcoins trade at premiums in South Korea?

Heightened demand through prominent local exchanges like Upbit and Bithumb often pushes regional prices above global benchmarks.

How does maintaining a positive premium influence Bitcoin’s future prospects?

A steady positive spread typically signals robust buyer interest combined with institutional participation plus healthier liquidity environments—all favorable signs for upward price movement.

Which bearish elements remain weighing down Bitcoin?

Reduced ETF inflows alongside cautious investor sentiment coupled with technical breakdowns contribute ongoing risks pointing towards potential dips near lower support zones.