Bitcoin’s Steady Phase: Anticipating Market Movement

The Bitcoin market is experiencing a period of calm this weekend. After several days of trading within the $106,000 to $108,000 range, Bitcoin seems to be in a phase of tight consolidation. Such patterns often precede significant price movements, and traders are keenly observing to determine the direction of the next major shift.

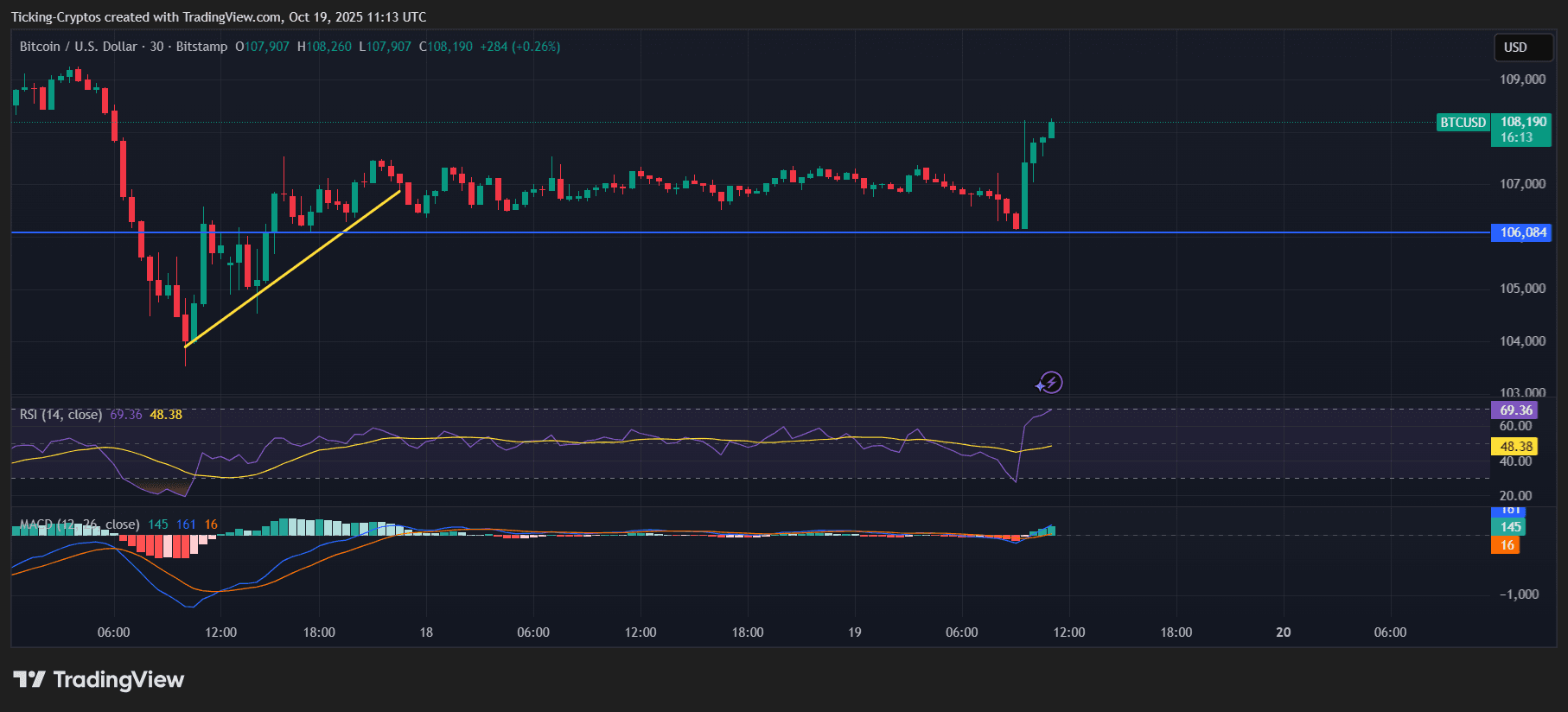

BTC/USD 30-mins chart – TradingView

The short-term analysis shows Bitcoin consistently testing the $106,000 support level. This area has provided strong support multiple times throughout the week. Meanwhile, attempts at recovery have struggled to surpass $108,000, forming a narrow trading band that confines price movement.

Analyzing Bitcoin: Key Levels Under Scrutiny

The BTCUSD 30-minute chart reveals that after briefly dipping to $106,136 earlier today, Bitcoin rebounded sharply with a distinct reversal pattern. This indicates robust buying interest at this point—a classic sign of accumulation activity. Momentum indicators remain balanced; RSI hovers around 50 while MACD histograms flatten out—both confirming ongoing consolidation.

BTC/USD 30-mins chart – TradingView

This period of tranquility can be misleading for traders as reduced volatility typically leads to expansion; hence quieter phases often herald stronger subsequent moves.

Forecasting Bitcoin: Support and Resistance Levels

Immediate Support: $106,000 – A breach here could see prices retreat towards $104,500 or even $102,000.

Immediate Resistance: $108,500–̫̚

Breakout Target: A daily close above $109,200 may propel BTC towards $$112K–$115K.

A drop below $106K would negate short-term bullish prospects and potentially initiate corrective action for BTC.

Market Dynamics: Low Volume Amid Uncertainty

This weekend sees lower trading volumes typical for such sessions due in part from reduced institutional participation keeping volatility muted but poised for change when markets resume on Monday.

Larger macroeconomic factors like Federal Reserve policy discussions alongside geopolitical tensions in Eastern Europe continue influencing broader market sentiment yet resilience near $\107K suggests dip-buying remains prevalent over risk aversion strategies among investors.

The Future Outlook For Bitcoins:

Bitcoin’s current lateral trend implies an equilibrium state which rarely persists long term given visible compression across shorter timeframes increasing likelihoods surrounding decisive directional shifts upcoming week.

Should momentum favor upward trajectory early next week targeting levels between $\112k-$115k possible before month’s end alternatively failing hold onto critical supports near $\106k risks sweeping through lower liquidity zones testing areas around $\104k instead.

For now though it appears bitcoins remain locked into wait-and-see mode characterized by steadiness brimming latent potential energy awaiting release…</Pgt;