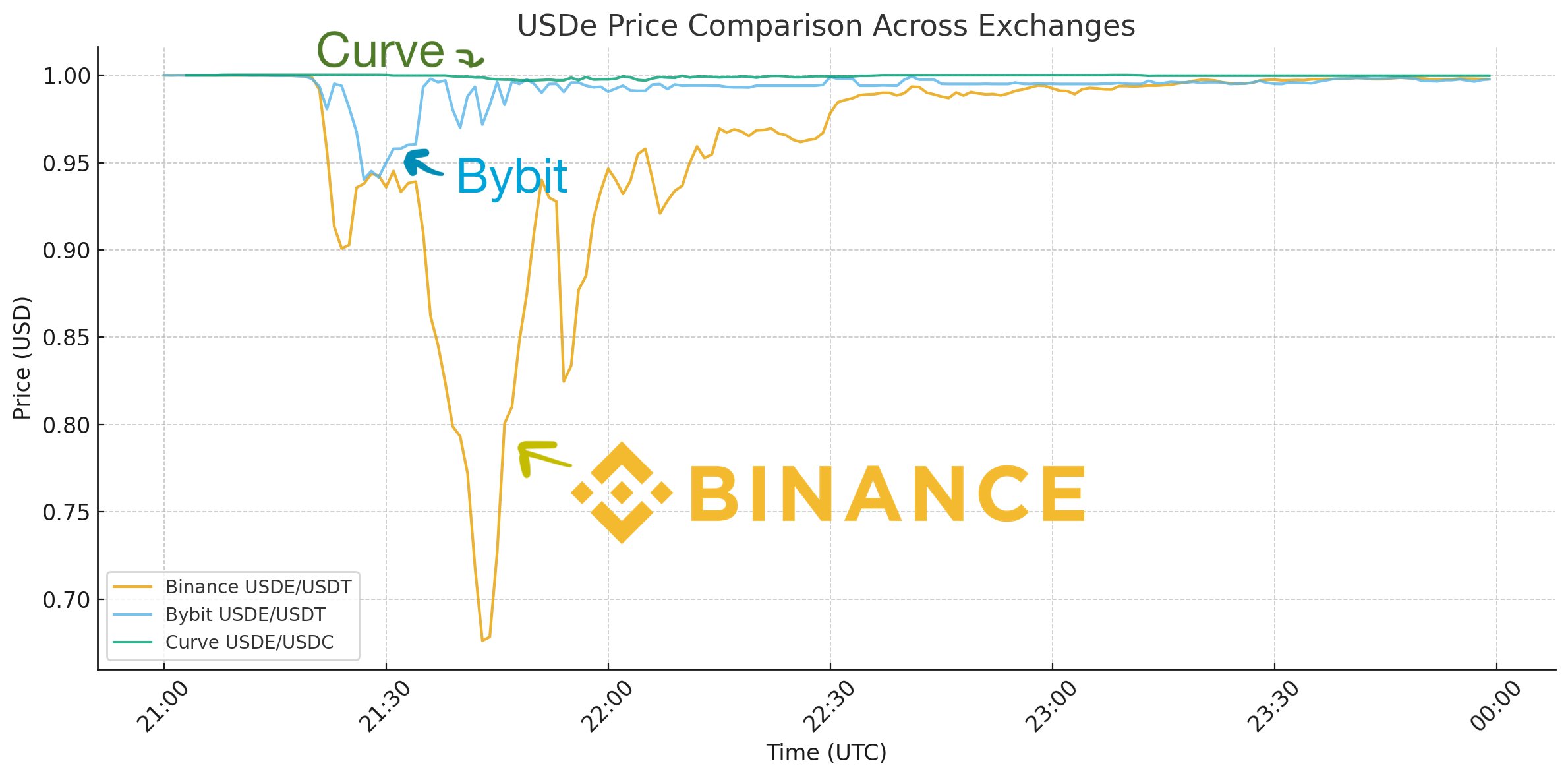

Jeff Yan, co-founder and CEO of Hyperliquid, has raised concerns about how centralized cryptocurrency exchanges, particularly Binance, report data. He suggests that these platforms might not fully represent the extent of liquidations.

In a post on X this Monday, Yan highlighted a documentation page from Binance—the leading crypto exchange globally—stating that it only includes the most recent liquidation occurring within each second in its order snapshot stream.

“Given that liquidations often occur in rapid succession, this method could result in significant underreporting by as much as 100 times under certain conditions,” Yan noted.

This sentiment aligns with an earlier post from CoinGlass on Saturday. The crypto data platform indicated that “the actual amount liquidated was likely much higher” because “Binance reports just one liquidation order per second.”

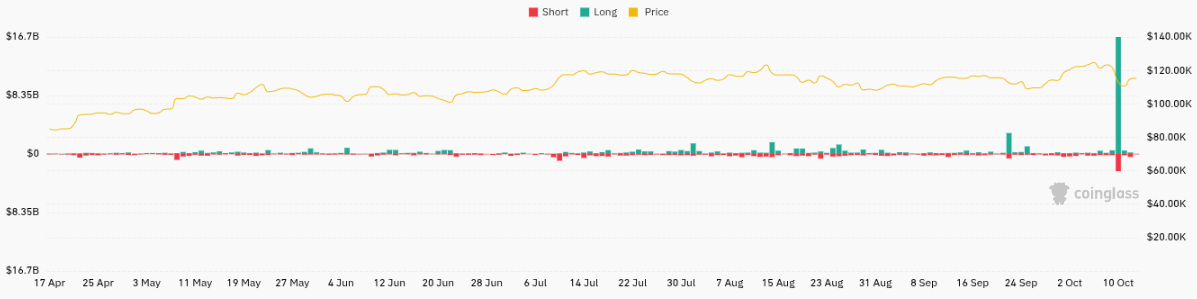

Source: CoinGlass

Related: The crypto market witnessed $1.8 billion in liquidations within a day: Is this the final flush or just the beginning?

$19 Billion Liquidation Event

The price of Bitcoin (BTC) plummeted to $102,000 last Friday following US President Donald Trump’s announcement of extensive tariffs on China. Similarly affected were Ether (ETH), which dropped to $3,500 and Solana (SOL), which fell below $140 amid widespread market sell-offs.

Citing CoinGlass data, Friday marked an unprecedented event with long positions worth $16.7 billion and short positions totaling $2.456 billion being liquidated—the largest such occurrence in cryptocurrency history.

The Liquidation Order Snapshot Stream is designed to provide real-time updates on force-liquidated positions for improved performance; however, according to Yan’s explanation—by reporting only the latest liquidation—it risks underrepresenting large-scale events where more than 100 orders can be processed per pair every second.

Total Crypto Liquidations Chart Source: CoinGlass

A Stumble for Centralized Finance

“On Binance,” Hanzo shared during downtime incidents via pseudonymous identity online “buttons ceased functioning; stop orders froze while limit ones hung—all except perfect execution upon respective liquefactions!”

“Specific trading pairs like IOTX/USDT recently had their minimum price movement decimal places reduced causing zero displays across user interfaces due solely toward display issues—not actual pricing discrepancies.”