As of October 13, 2025, Bitcoin is valued at $114,846 with a market cap reaching $2.29 trillion. Over the last day, trading activity has been robust with a volume of $84.28 billion and price fluctuations ranging from $113,696 to $115,792.

The daily chart for Bitcoin reveals a significant bearish pattern characterized by a double top near the $126,000 mark followed by a sharp decline due to heavy selling pressure. This downturn was marked by an engulfing bearish candle that wiped out several bullish sessions and pushed the price down to around $108,652 before finding temporary support.

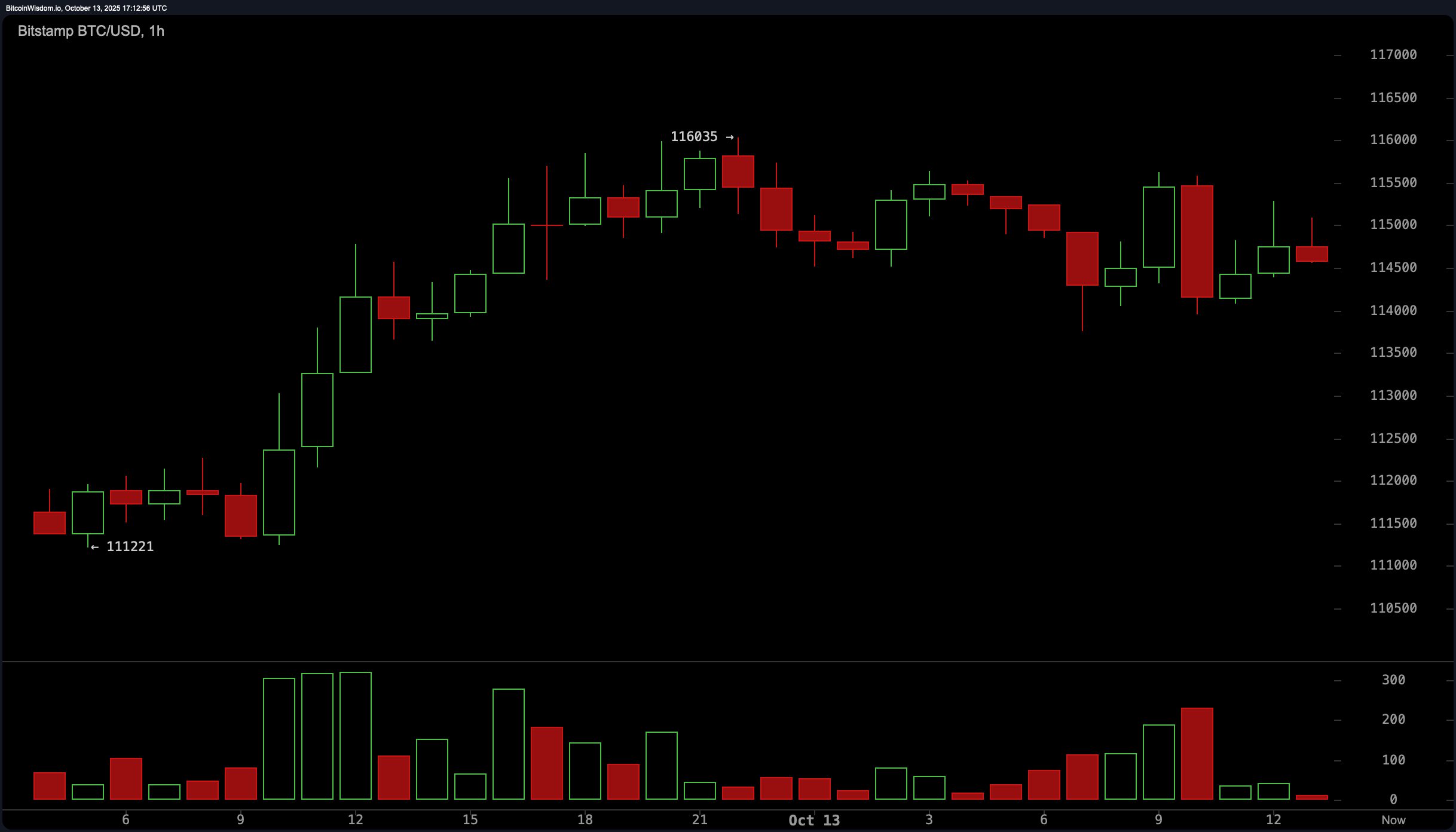

Although there was a brief recovery attempt, insufficient buying volume suggests that upward momentum remains weak. The current consolidation between the range of $114,000 and $116,000 indicates market uncertainty and underscores the necessity for stability above the crucial level of $116,500 for any potential upward trend continuation.

The four-hour chart echoes this cautious sentiment as Bitcoin managed to break through its descending trendline with higher highs and lows but struggled to maintain gains beyond $116,000. Currently, a consolidation phase is evident between $114,000–$116,00&#59;&#59;

On an hourly basis, Bitcoin shows signs of being confined within narrow boundaries after bouncing back earlier&#46 Repeated failures near &dollar116&comma&00 highlight resistance overhead while short-term support appears solidly positioned around &dollar114&commas00- &dollar11 ampersand semi colon45 zeros0 zeroes significantly dried up during this timeframe often foreshadowing larger directional shifts under these circumstances breaking past dollarsign1 six two hundred could prompt rapid testing towards one eighteen thousand yet failing hold fourteen thousand risks deeper retracement into lower supportive zones<br/>

BTC/USD 1-hour chart via Bitstamp on Oct. 13, 2025.

Oscillator readings largely underscore neutral-to-weak momentum environments. The relative strength index (RSI) reads forty-seven suggesting lack directional conviction while stochastic oscillator twenty-four commodity channel index CCI negative twenty-six both remain neutral zones meanwhile average directional ADX stands moderate trend strength without clear direction however bearish signals emerge awesome oscillator momentum indicator moving average convergence divergence MACD read negative five eighty-three seven thousand six fifty-six three ninety-eight respectively each pointing lingering downside pressure

Moving averages across multiple timeframes generally skewed bearish shorter end ten-period exponential EMA eleven sixty-eight forty-two simple SMA nineteen zero sixty-two positioned above current indicating downward similar alignment observed twenty thirty fifty EMAs SMAs however signs longer-term support evident hundred-period EMA thirteen five fifty-two two-hundred period near eight thousandsix nine ninety-two all showing potential divergence suggests technical crossroads awaiting confirmation define next direction

Bull Verdict:

Should bitcoin reclaim sustain levels above sixteen-five hundred volume confirmation recent resolve favor bulls open path retesting eighteen-thousand-twenty zone particularly reinforced bullish candlestick formation improving indicators

Bear Verdict:

If fails hold fourteen-thousand retreats increasing renewed test eleven-ten-eights likely presence multiple sell signals oscillators short-term reinforces vulnerability absence strong recovery above sixteen-thousand