Recently, Bitcoin ETFs experienced their first outflows in several days, prompting investors to seek security elsewhere. This shift led to a rise in the Swiss franc and brought gold close to setting a new record.

The ongoing trade tensions between the U.S. and China, coupled with significant declines in stock markets, have positioned Bitcoin, gold, and the Swiss franc as prominent safe-haven assets. The Swiss franc appreciated to 1.2500 against the dollar; meanwhile, gold approached an all-time high at $4,017. Bitcoin saw a recovery to $112,800 after briefly dropping to $107,000.

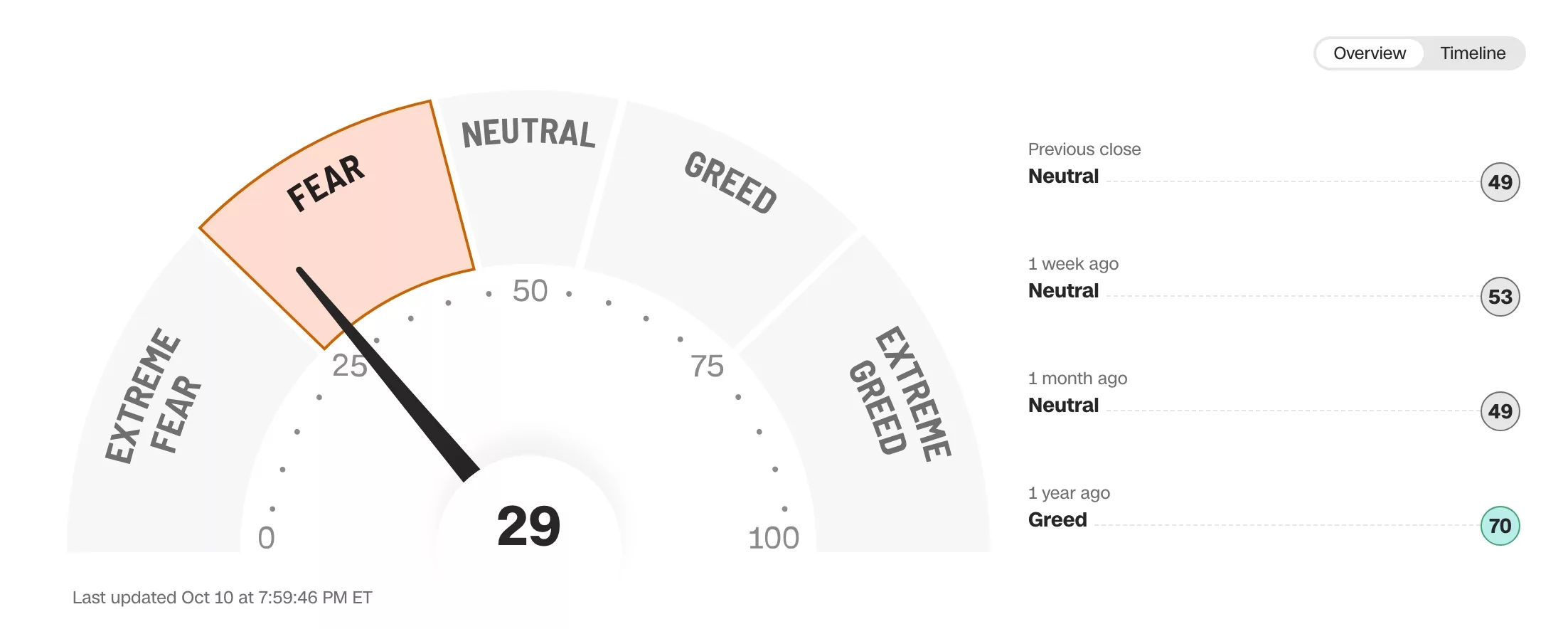

Despite experiencing a modest outflow of $4.5 million from spot Bitcoin ETFs on Friday, these products achieved a weekly gain of $2.7 billion. This brought total inflows above $62.7 billion—far surpassing the SPDR S&; &P 500 ETF’s outflow of $1.7 billion. Major U.S. indices fell by over 2% as investor sentiment shifted from neutral (53) on the Fear and Greed Index down into fear territory (29).

Safe Haven Assets

The recent escalation in trade disputes has seen Bitcoin , gold , and &the Swiss franc solidify their roles as reliable safe havens amid market volatility.

This week witnessed an increase in value for both gold ($4&commat&semi017 near its peak &41&semiand BTC (bouncing back from &dollar107&commat000 up towards &dollar112800)

You might also like: Can Solana price bounce from &dollar200 support as bullish pattern develops?

On Friday alone there was only minimal net withdrawal amounting just under four-and-a-half million dollars within Spot bitcoin exchange-traded funds compared against more substantial losses incurred via S&P500 related investments totaling one point seven-billion-dollar deficit overall throughout same period

Fear and Greed Index has plunged | Source: CNN

This drop coincided alongside increased demand across various other traditionally secure financial instruments such junk bonds further exacerbated deteriorating diplomatic relations currently existing between two largest global economies following imposition series retaliatory tariffs restrictions implemented respective governments involved

Why BTC Gold CHFF Considered Safe Havens?

The limited supply nature inherent within cryptocurrencies like bitcoin combined growing institutional interest continues underpinning perception them being viable alternatives traditional investment vehicles particularly given current economic climate characterized heightened uncertainty geopolitical instability worldwide

Read more: Crypto markets fall after Trump’s tariff threat: BTC falls below $ 117k