The rapid rise in Bitcoin, gold, and stock values has captivated investors’ attention. However, analysts warn that this excitement might overshadow the looming concern of the U.S. deficit amidst short-term market fluctuations.

Nigel Green, CEO of financial advisory firm deVere, highlighted this issue in a statement to Decrypt. He remarked that every government shutdown and fiscal impasse underscores America’s overspending habits. “Investors seem to believe that record-breaking equity levels and abundant liquidity negate the significance of debt,” he noted. “They do not.”

In January, the Congressional Budget Office estimated a U.S. budget deficit reaching $1.9 trillion by 2025. Yet recent data from the Treasury Department reveals an actual deficit of $1.973 trillion—a $76 billion increase compared to last year’s same period.

As for Bitcoin’s performance at present: it has dipped by approximately 0.8% over the past day with its current value at $122,000 according to CoinGecko’s crypto price data. Earlier this week saw BTC hitting an unprecedented high above $126,000 but lately S&;P 500 Nasdaq100 along with gold silver have surpassed Bitcoin’s gains

CryptoQuant’s Head of Research Julio Moreno explained to Decrypt that it’s common for Bitcoin’s growth pace to trail behind stocks and precious metals.

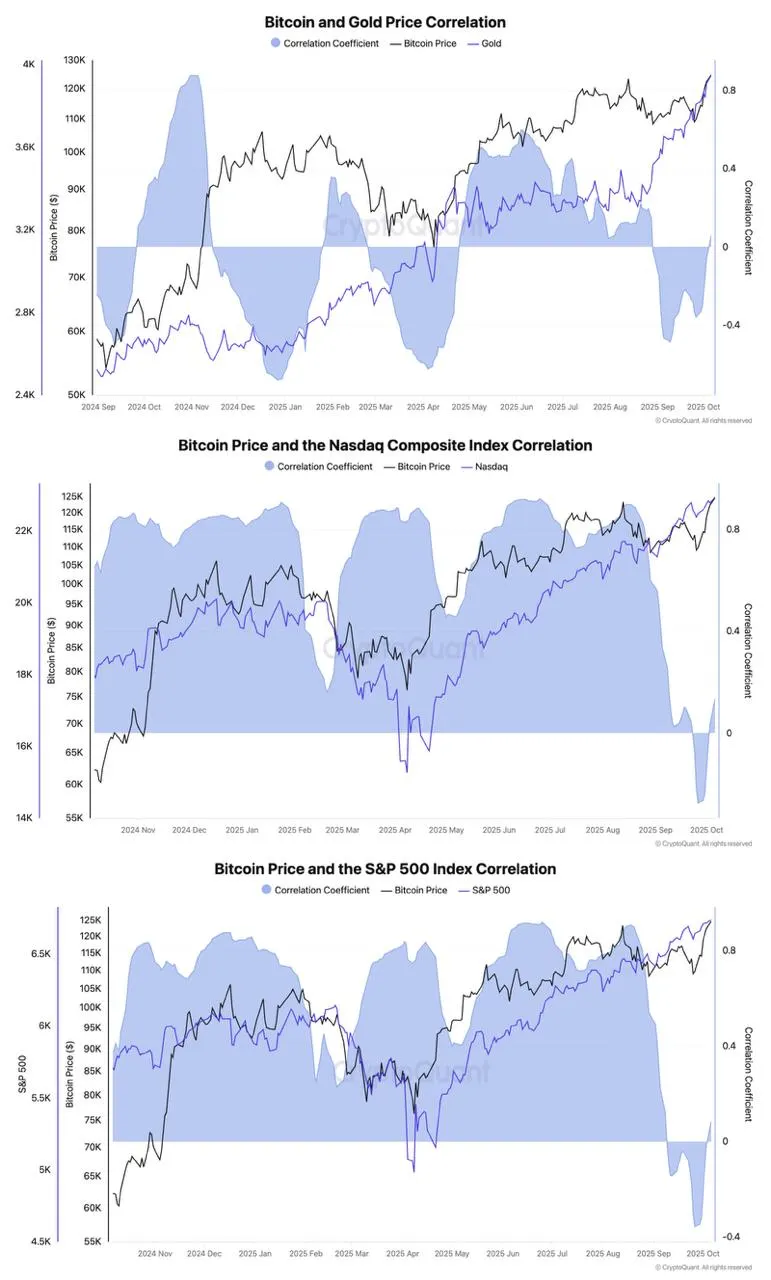

“Bitcoin could potentially align more closely with these assets soon as correlations have shifted positively after being negative for some time,” he stated.”Typically when it comes down specifically towards gold there tends be lagging behavior from bitcoin following suit”

Source: CryptoQuant

Source: CryptoQuant

The volatility index tracking changes within Bitcoins’ USD price based on standard deviation measurements across thirty-day windows recently experienced uptick too

This index dropped down around zero point eight-eight percent September twenty-eighth just days prior before October firsts’ governmental closure occurring yet since then steadily climbed back up one point seventeen percent Bitbo reports This remains comparable levels seen month ago although significantly lower than March end where tariffs triggered spikes two point eighty-seven percent range previously observed

Bitunix analyst Dean Chen told Decryptthat despite ongoing choppiness within cryptocurrency markets general support led primarily through continued positive ETF flow absence any new macroeconomic shocks emerging during US shutdown should persist next week “

Data sourced via London-based investment management firm Farside Investors indicates Friday morning sessions commenced strong showing bitcoin ETFs drawing equivalent inflows matching previous weeks figures already totaling around two-point seven billion dollars worth fresh funds acquired Thursday close alone"e;

Despite predictions favoring broad market support coming days Myriad platform owned parent company DASTAN users anticipate increased likelihood seeing bearish trends unfold weekend"e;

“ After New Yorks trading bell rang early Friday Myriad forecasters projected fifty-one-point-two percentage chance BTC experiences decline rather than growth candle patterns extending Monday October twelfth” they added “

“ Cryptocurrency exchange Bitfinex experts expressed mixed sentiments regarding both equities cryptocurrencies achieving record highs amidst persistent governmental closures saying While equity trades nearing peak levels suggest optimistic conditions fostering speculative asset appreciation concurrently may indicate disconnect obscuring escalating fiscal pressures official national metric releases remain pending”