Bitcoin ( BTC) derivatives markets showed signs of renewed activity Thursday, with total futures and options open interest (OI) trending higher as BTC traded around $121,280 during the afternoon session, following an intraday low of $120,923.

BTC Options Data Reveals Bullish Tilt With 59.57% Calls vs 40.43% Puts

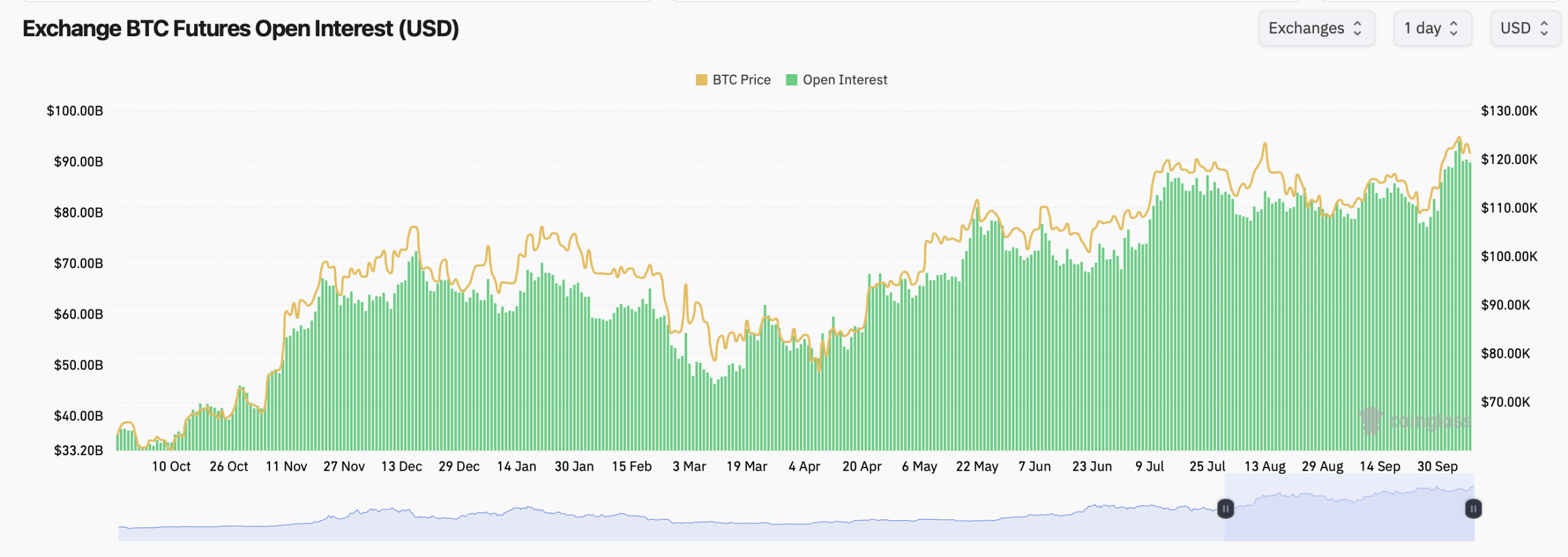

Data from Coinglass revealed that total BTC futures open interest reached roughly $100 billion, reflecting elevated leverage and institutional positioning.

The CME exchange retained its lead with 149.94K BTC in OI ($18.17B), accounting for more than 20% of the total market share. Binance followed closely with 131.83K BTC ($15.99B) and posted a 1.74% increase in OI over 24 hours, indicating fresh inflows from retail and derivatives traders.

Bitcoin futures open interest via Coinglass on Oct. 9, 2025.

Other exchanges showed varied performance. OKX’s open interest fell 0.85%, while Bybit saw a 1.23% decline over the same period. WhiteBIT recorded the largest 24-hour OI growth at +2.66%, signaling increased trading activity on mid-tier platforms.

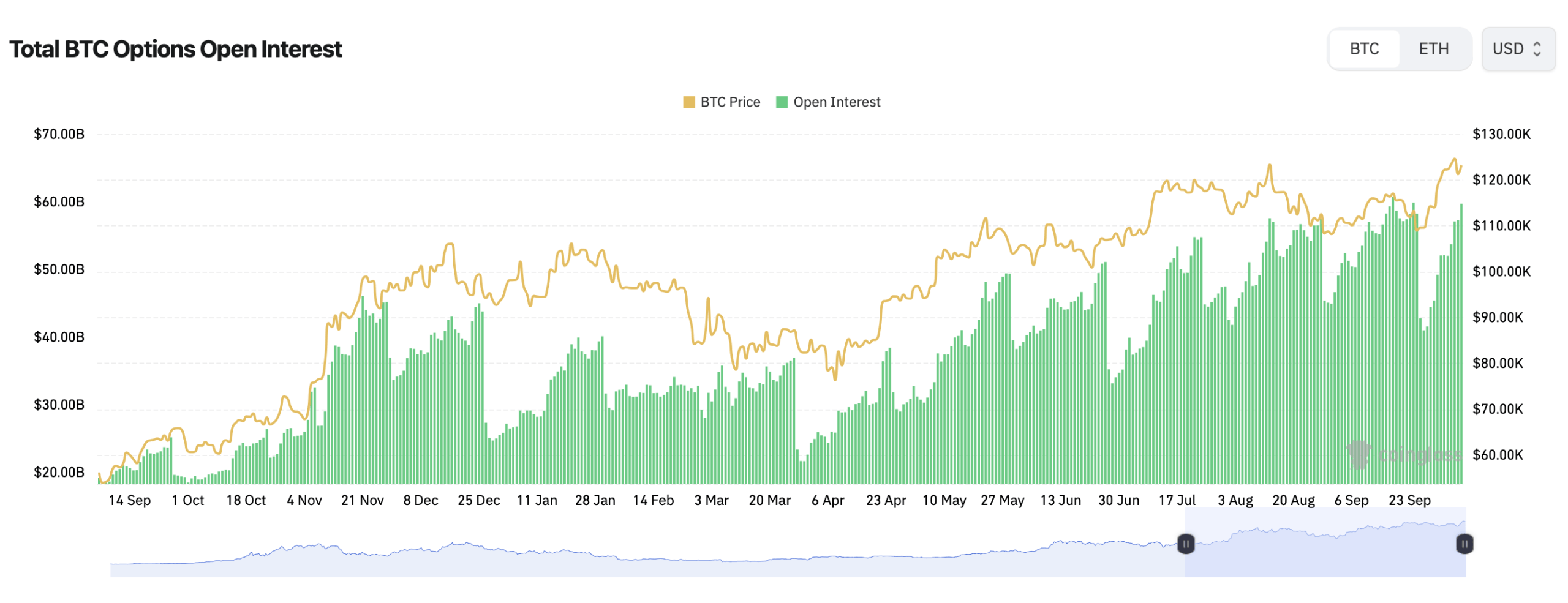

On the options side, data from Deribit showed a clear bullish bias, with 59.57% of total open interest in calls (264,371 BTC) versus 40.43% in puts (179,430 BTC). In 24-hour trading volume, calls also led with 55.47% (32,398 BTC)compared to 44.53% in puts (26,009 BTC)—suggesting that traders expect upward price movement through year-end.

Bitcoin options open interest via Coinglass on Oct. 9, 2025.

The largest open interest is clustered around long-term call options—contracts betting that Bitcoin’s price will still rise by late 2025. The most popular strikes include the $140,000, $200,000, and $120,000 December 2025 calls, suggesting traders expect Bitcoin to keep gaining value over the next year.

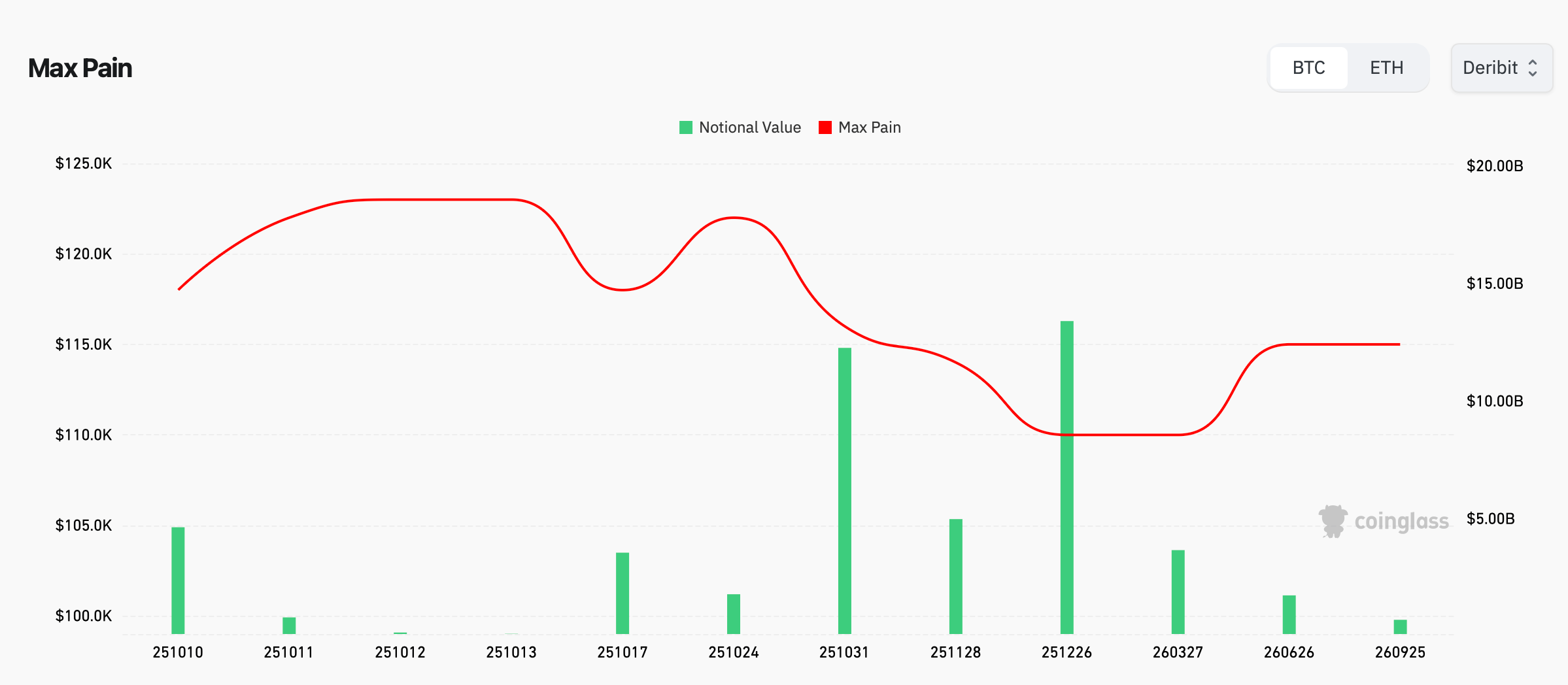

Meanwhile, the max pain point, which represents the price level where the most options expire worthless, hovered near $120,000—a potential area of gravitational pull as expirations approach.

Market analysts noted that rising open interest, coupled with stable prices, often signals accumulation or hedging activity rather than speculative blow-offs. With both futures and options markets heating up, BTC derivatives continue to serve as a key gauge of institutional sentiment.

💡 FAQ

What is Bitcoin open interest (OI)?Open interest measures the total number of active derivative contracts, signaling market participation and leverage.

Why is CME’s dominance significant?CME’s lead points to institutional engagement, as it primarily serves professional and regulated traders.

What does “max pain” mean in options trading?It’s the price at which most option holders (both calls and puts) lose money at expiration.

Are BTC options traders bullish or bearish?Current data shows a slight bullish bias, with more call options held than puts.

How does rising OI affect BTC price movement?Higher OI can amplify volatility, especially when traders unwind leveraged positions during rapid price swings.