The cryptocurrency market experienced a brief halt on Tuesday as Bitcoin swiftly retreated from its record highs above $126,000. Analysts highlighted signs of the rally overheating in the short term.

Bitcoin fell below $122,000, wiping out gains from the past three days and trading 2.4% lower over 24 hours. This decline affected the broader crypto market, with XRP, DOGE, ADA, and AVAX dropping between 5% to 7% during this period.

If Bitcoin’s price movements seem familiar, it’s because they are reminiscent of past patterns. Despite a year-to-date gain of 31%, bullish investors have had little time to enjoy their victories as each new high is quickly followed by sharp sell-offs. For instance, after reaching $109,000 just before Trump’s inauguration in January, it reversed downwards to $100,000 within hours and further dropped to $75K over three months.

In July when Bitcoin first surpassed $123K it faced about a ten percent decline in subsequent days; similarly mid-August saw another surge above$120k only for prices plunge around fifteen percent shortly thereafter.

This latest downturn occurred following an almost vertical sixteen-percent increase off late September lows below$109k

Jean-David Péquignot – Chief Commercial Officer at Deribit options marketplace predicted Monday that BTC might revisit between118-120k levels shaking out traders who missed earlier dips joining later rallies if such pullback happens he suggested would present buying opportunity given technicals & macro environment align potentially driving higher beyond130k through final quarter

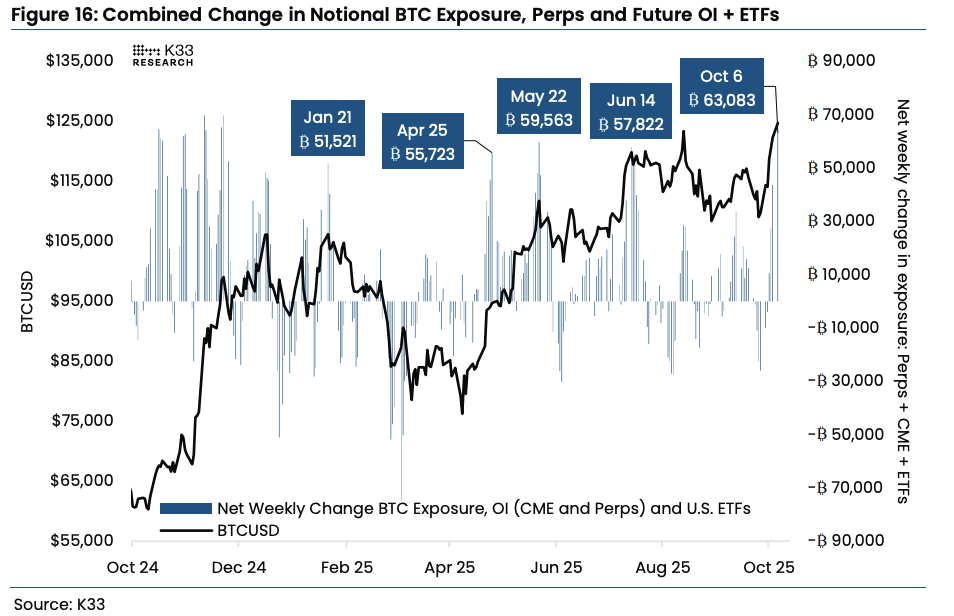

Change in notional BTC exposure combining perpetuals futures open interest ETF holdings (K33)

Fed’s Miran Advocates Neutral Rate Adjustment To0 .5%

Federal Reserve Governor Stephen Miran recently appointed under Trump administration expressed Tuesday his stance regarding neutral interest rate shifted dramatically during Managed Funds Association Policy Outlook2025 discussion now advocating0 .5percent citing tighter immigration policies evolving expectations surrounding federal deficit influencing reassessment

Miran’s observations imply long-term dynamics shaping US economy undergoing transformation smaller workforce may restrict growth while increasing fiscal challenges complicate Fed balancing act inflation employment His remarks emerge amidst policymakers deliberating extent central bank can reduce rates without triggering renewed inflationary pressures

Fed officials convene month-end decide potential additional rate cut however lack critical government data persists due ongoing shutdown

Miran acknowledged economic performance early year fell short forecasts hindered uncertainty trade tax policy yet adopted optimistic outlook upcoming months asserting much ambiguity resolved “With clearer policy signals expect steadier pace growth” commented

Crypto stocks impacted broadly declining crypto prices adversely affecting related equities notably Strategy MSTR dropped seven percent Coinbase COIN lost four percent Ether ETH treasury firms Bitmine Immersion BMNR Sharplink Gaming SBET decreased three seven respectively

Bitcoin miners predominantly experiencing losses led MARA Holdings declining four Riot Platforms RIOT three Hut8 HUT reduced two