The term “Uptober,” referring to October’s traditionally strong performance in the crypto market, is proving accurate as Bitcoin ascends towards unprecedented heights, with altcoins also experiencing upward momentum.

After a brief surge past $125,000 on Sunday and a subsequent pullback, Bitcoin rallied again on Monday. It reached a new peak of $126,223 during U.S. trading hours. Recently priced around $125,200, Bitcoin has seen an increase of 1.5% over the last day.

The weakening dollar has contributed to this rally as Bitcoin hit new highs against the euro at over 106,000 EUR and surpassed its January record while breaking mid-August levels in Swiss francs (99,642 CHF), according to TradingView data.

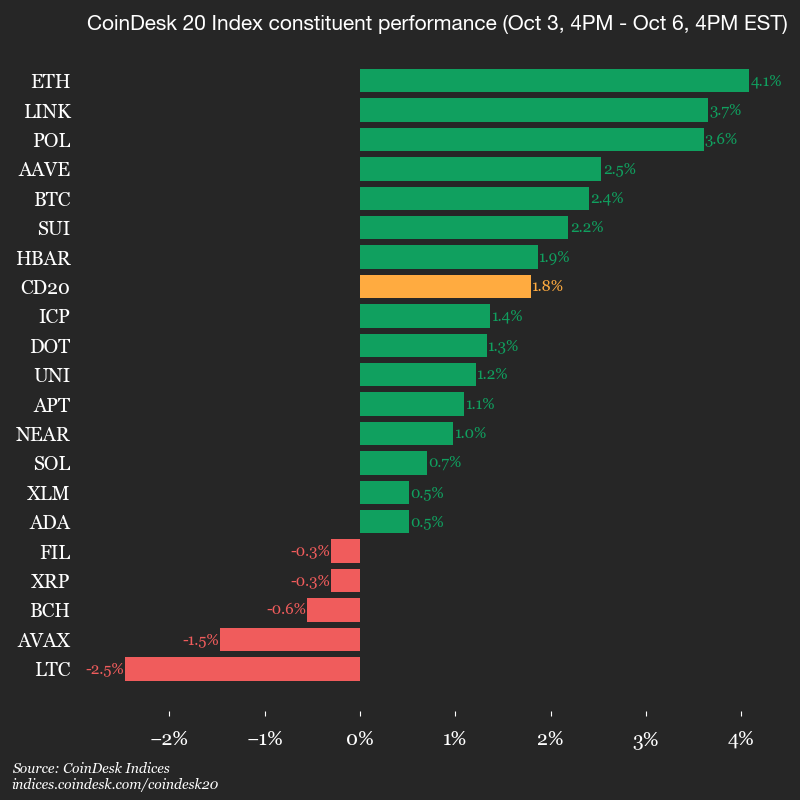

Bitcoin’s robust performance resonated across the cryptocurrency landscape. Ethereum’s ether climbed by 4% to reach $4,700, marking its highest value in more than three weeks and boosting the CoinDesk 20 Index overall. The popular memecoin DOGE rose alongside Binance-linked BNB token by approximately 6% each.

CoinDesk 20 Index members (CoinDesk Indices)

Monday saw mixed outcomes for crypto-related stocks: Robinhood dropped by 3% following Galaxy Digital’s launch of GalaxyOne—a platform similar to Robinhood’s offerings—leading Galaxy Digital shares up by 7%, driven by investor interest in its direct competition within crypto brokerage services.

Other companies tied to cryptocurrencies like Coinbase(COIN), Circle (CRCL), and Michael Saylor’s parent company Strategy (MTSR), all ended about 2% higher; a reflection of broader positive trends within the market where most cryptos experienced modest gains according to CoinDesk’s index.

The largest advances came from mining stocks due partly due OpenAI striking an agreement involving tens billions dollars worth AI chips from AMD; a deal potentially granting OpenAI up-to-10 percent stake chipmaker; rippling through sectors exposed artificial intelligence technologies.

A Perfect Storm for BTC

“Bitcoin is riding high thanks ‘perfect storm’ macroeconomic factors,” noted Jean-David Péquignot CCO Deribit—recently acquired Coinbase COIN—in statement Monday update.”

With US government shutdown prompting moves into perceived safe assets such gold & ;BTC &comma ; coupled strong inflows ETF dwindling spot supplies exchanges&comma ; we’re witnessing self-reinforcing bull cycle .”

Technical indicators suggest further growth potential&comma pointing short-term targets between $ ;128k -130k possible upside reaching even $ ;138k&period However he cautioned current overbought conditions mean temporary dips back range may occur&period

“Monitor volatility spikes any shifts put volume red flags near-term corrections” Péquignot advised “&bulls eyeing beyond while bears could capitalize squeezed positions”&period