Over the weekend, Bitcoin surged to unprecedented heights, leading experts to anticipate a fresh accumulation phase that might propel its value to $150,000 by year’s end.

Bitcoin (BTC) reached a new peak above $125,700, with its market cap momentarily surpassing the $2.5 trillion mark for the first time in cryptocurrency history, as reported by Cointelegraph on Sunday.

This upward trend was influenced by various macroeconomic elements such as the recent US government shutdown — an event not seen since 2018 — which analysts suggest has reignited interest in Bitcoin’s role as a store of value.

Historically, similar scenarios have resulted in “significant price milestones,” according to Fabian Dori from Sygnum Bank’s digital asset division.

The shutdown has sparked renewed conversations about Bitcoin’s function as a store of value amidst political instability highlighting interest in decentralized assets,” Dori shared with Cointelegraph. “Simultaneously, factors like loose liquidity conditions and business cycle acceleration are drawing attention towards digital assets,” he noted further.

BTC/USD chart for this year. Source: Cointelegraph/TradingView

The ultimate impact of the government shutdown on crypto markets hinges on how it affects Federal Reserve decisions regarding interest rates,” Jake Kennis from Nansen explained to Cointelegraph.

“A resolution could diminish uncertainty and potentially lead the Fed towards more favorable policies,” Kennis added.

While some see this situation hinting at a potential market bottom for cryptocurrencies, Kennis believes it’s too early for such conclusions without sustained stability over several weeks above key support levels.”

A New Era of Accumulation Begins for Bitcoin

Certain analysts interpret Bitcoin’s recent performance as indicative of large-scale entities entering an accumulation phase due to reduced selling pressure from major holders based on blockchain data insights.”

“Data suggests current price movements are tied to an accumulation period,” remarked Sygnym Bank’s Dori.”

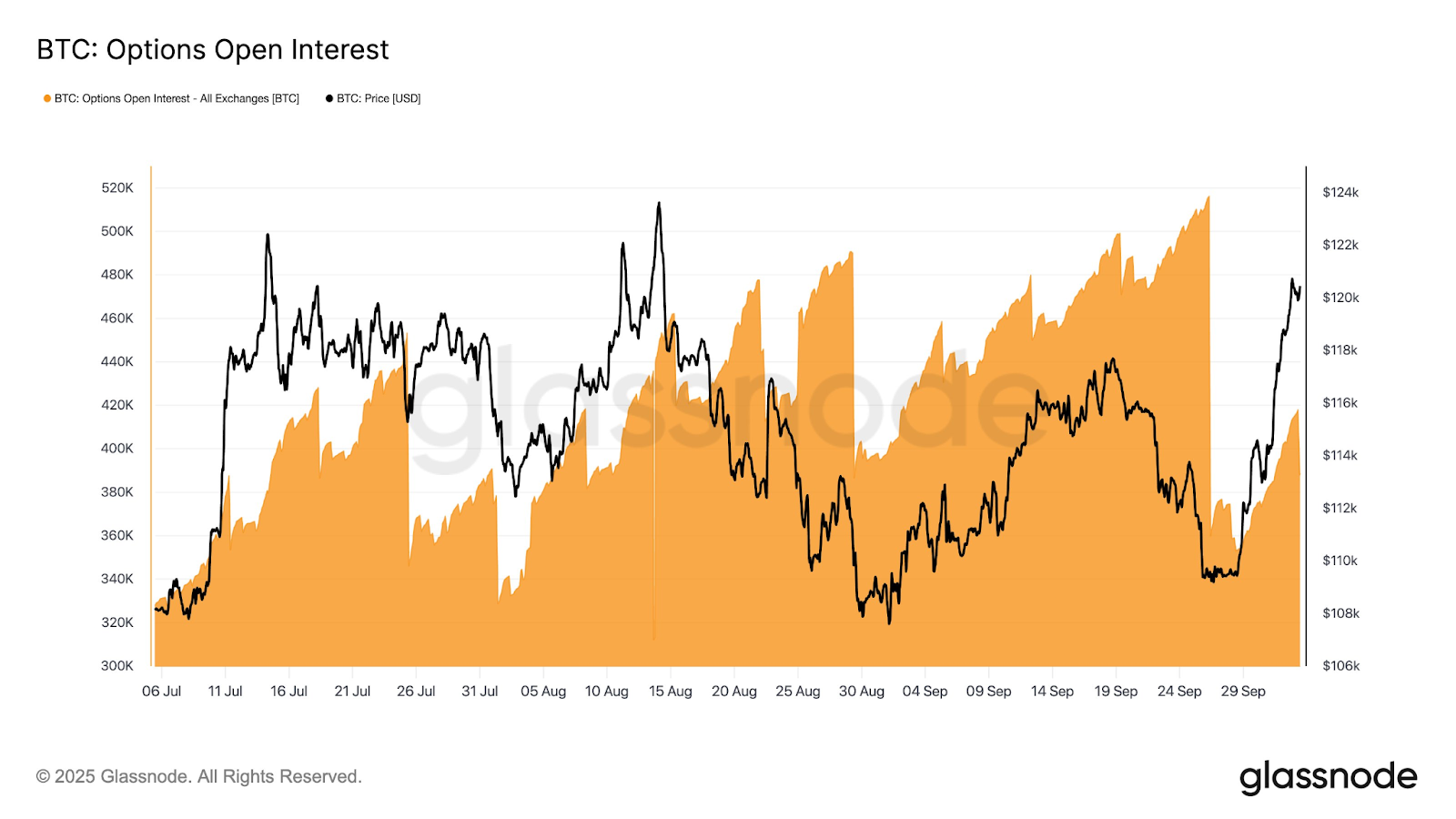

Source: Glassnode

If speculative activity continues declining while maintaining momentum above crucial psychological thresholds like $120K then analyst Charles Edwards predicts BTC could reach up-to-$150K during Q4 2025 according Token2049 conference insights provided exclusively via CoinTelegraph reporting services.”

Magazine:Bitcoin to see ‘one more; b&g& i&t&h&r&s&t’ t&o &36;&49;&53;&48;&75;, E&T&H p&r&e&s&sure builds” </P