Bitcoin has reached unprecedented heights, surpassing $125,000 and reaffirming its status as the preeminent cryptocurrency globally. The impressive climb to $125,708 during trading hours wasn’t just a fluke.

This surge is indicative of a strategic accumulation pattern seen in past cycles, fueled by investor trust and fundamental demand.

Optimism Among Bitcoin Enthusiasts

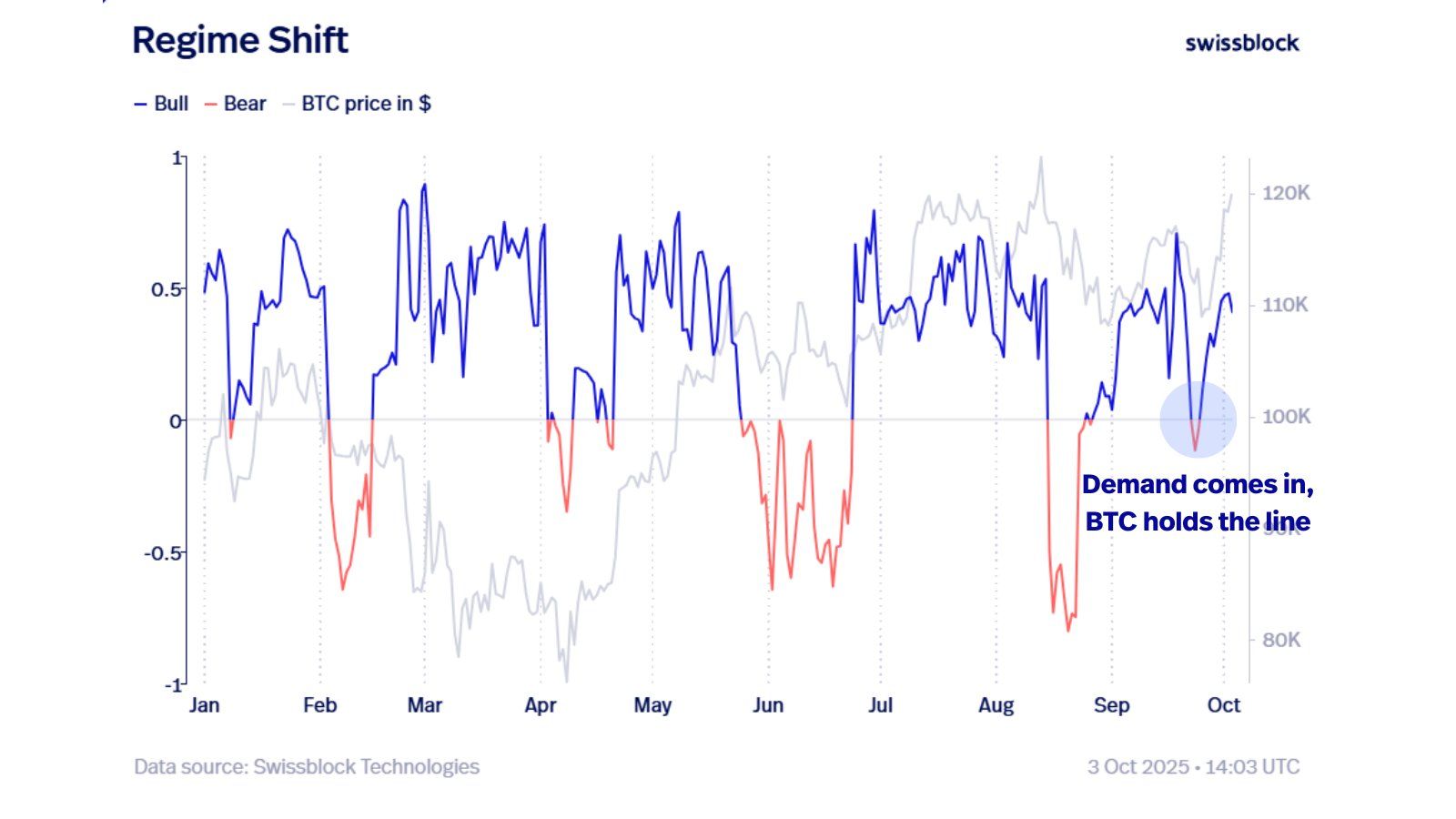

Insights from Swissblock’s analysis reveal that the recent rise in Bitcoin was driven by authentic demand rather than mere speculation.

Despite a brief market correction before this ascent, the appetite for BTC continued unabated. The upward trajectory of the Structure Shift throughout this period underscores investor confidence.

This ongoing demand suggests a robust market adjustment rather than vulnerability. With institutional interest coupled with increasing retail involvement, there’s been a consistent influx of capital into Bitcoin.

This resilience indicates that participants view downturns as buying opportunities instead of signals to exit their positions.

Bitcoin Bull Bear Indicator. Source: Swissblock

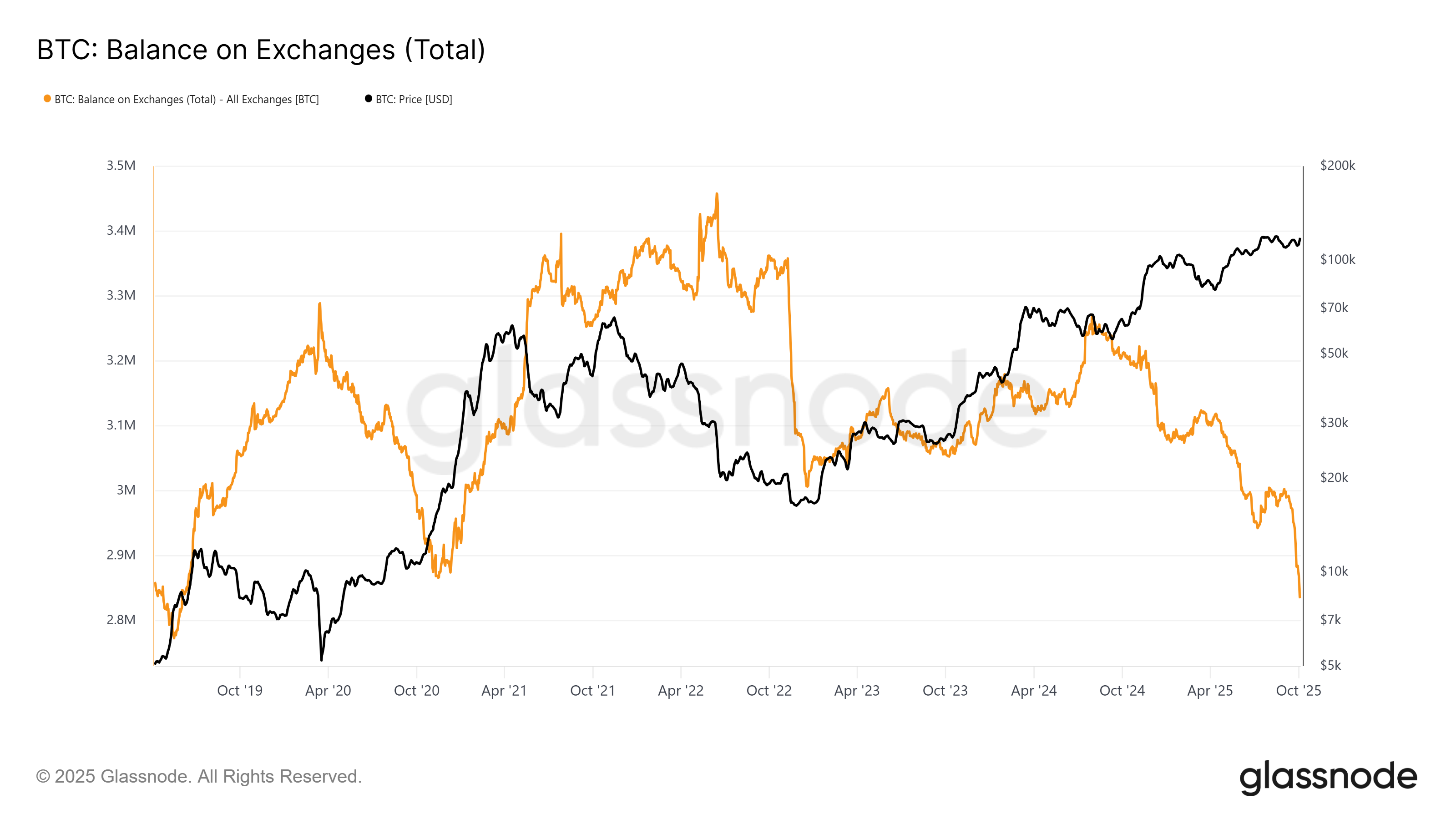

The broader outlook for Bitcoin remains optimistic. Data from exchanges shows BTC supply at its lowest point in six years with only 2.83 million coins available on platforms now—demonstrating significant accumulation over recent weeks and indicating strong long-term faith in this asset class.

A reduced supply on exchanges often signifies less selling pressure—a historically positive indicator—confirming that many saw recent corrections not as weaknesses but chances to acquire more BTC assets instead!

Bitcoin Balance On Exchanges. Source: Glassnode

A New Peak For BTC Prices

The price of Bitcoin achieved an all-time high at $125,708 before stabilizing around $122,963—a healthy pullback considering recent gains—and maintaining above $122k is crucial for sustaining momentum going forward!

BTC Price Analysis.Source: TradingView

The blend between strong demands alongside limited supplies could potentially help set another record high soon enough—with continuous inflows from institutional investors further supporting such trajectories ahead too! However should profit-taking become more pronounced then prices might dip below key levels like those nearabouts ~120k mark temporarily delaying next leg upwards possibly even longer term yet still…

The post titled “What Lies Ahead After Record Highs? More Gains Or Corrections?” originally appeared first published via BeInCrypto platform initially itself…