JPMorgan has dubbed Bitcoin the “debasement trade,” suggesting that many may underestimate its potential. As the largest investment bank globally, JPMorgan doesn’t assign such labels lightly. Over 17 years, Bitcoin has demonstrated unwavering resilience, and now even Wall Street acknowledges what cypherpunks have long believed: when confidence in fiat currencies wanes, there is no substitute. The era for mere cautious optimism is over.

Wall Street often speaks in riddles, but JPMorgan’s recent statements are surprisingly direct. By labeling Bitcoin as the “debasement trade,” they signal to clients that in a world dominated by stimulus checks, trillion-dollar deficits, and rate cuts amidst ongoing inflation, holding cash or bonds is futile. As Marty Bent of TFTC puts it:

“You are not bullish enough.”

This isn’t about speculation anymore; it’s about safeguarding assets. With the dollar’s purchasing power steadily declining, Bitcoin’s limited supply and decentralized nature seem perfectly suited for today’s economic climate.

With central banks engaging in fiscal gymnastics and U.S. government deficits exceeding $2 trillion annually, “asset protection” now equates more with digital scarcity than traditional investments like blue-chip stocks.

If JPMorgan’s institutional investors are turning to Bitcoin en masse, it’s because they foresee an inevitable wave of currency debasement that no policy change can halt.

‘Growing Out of Debt’

President Trump recently claimed America will “grow [itself] out of debt.” While optimism is expected from politicians, growth alone won’t fill multi-trillion-dollar gaps quickly enough. Crisis-driven stimulus checks fly out regularly while rate cuts keep markets afloat amid simmering inflation—each solution seems to spawn new challenges.

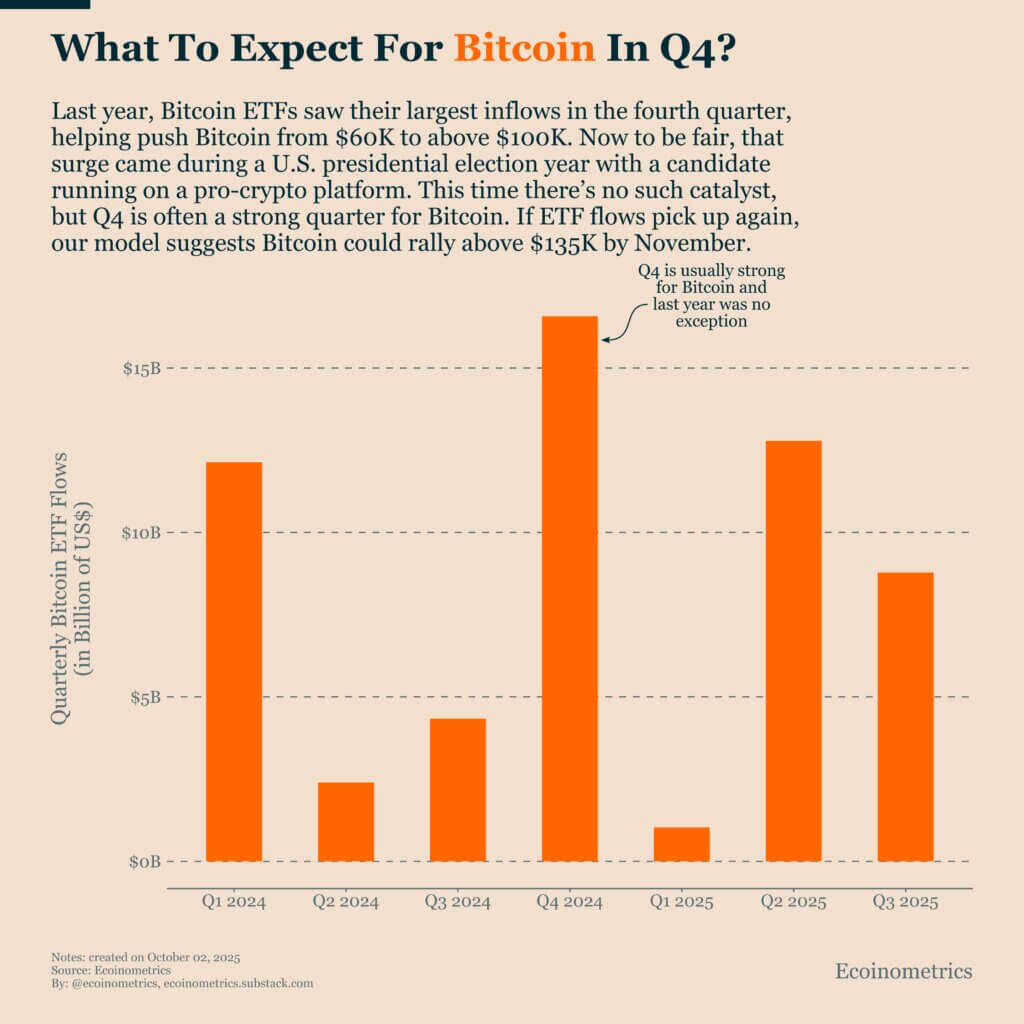

Beneath this financial spectacle lies a growing relevance for Bitcoin with every monetary stimulus round or debt-fueled spending spree adding momentum behind its rise during governmental shutdowns suspending key job data releases further supporting its case as Ecoinometrics notes Q4 historically favors bullish trends towards cryptocurrencies like bitcoin due year-end portfolio rebalancing bonus checks seeking yields institutions racing ahead latest announcements regarding rates/stimulus packages etcetera…

Last year’s ETF inflows propelled prices from $60k past $100k if similar patterns emerge again we might witness BTC reaching around approximately ~$135K within next month alone!

Moreover analysts’ forecasts suggest even higher targets Citigroup predicted ~$133K meanwhile JP Morgan estimated roughly ~$165K arguing undervaluation compared gold whereas Standard Chartered projected staggering figure close ~200 thousand dollars per coin! Bitwise CIO Matt Hougan remarked:

“Q4 promises excitement”.

The Intersection Of Macro And Momentum

Bitcoin transcends being merely another trade option instead rapidly solidifying itself into position serving role akin “hedge against devaluation” possessing superior asymmetric risk-reward dynamics amidst liquidity-obsessed marketplace conditions

The previous year saw unprecedented ETF-driven quarterly closure propelling BTC beyond psychological threshold crossing over hundred-thousand mark—all indicators point towards possible repetition especially considering looming deficit expenditures coupled anticipated Fed interest reductions slated occur sometime during upcoming years while maintaining fixed total supply cap twenty-one million units available ever circulating…

Let us face reality together honestly here—you aren’t nearly optimistic sufficiently supported ample evidence backing claims made herein today already proving time-tested durability predictability reliability surpassing former bastions representing perceived safety logos emblazoned across once-respected financial institutions worldwide

When powerhouse entities such as JP Morgan begin treating cryptocurrency cornerstone defensive strategy they’re essentially wagering technological innovation triumphing antiquated systems entrenched status quo paradigms…