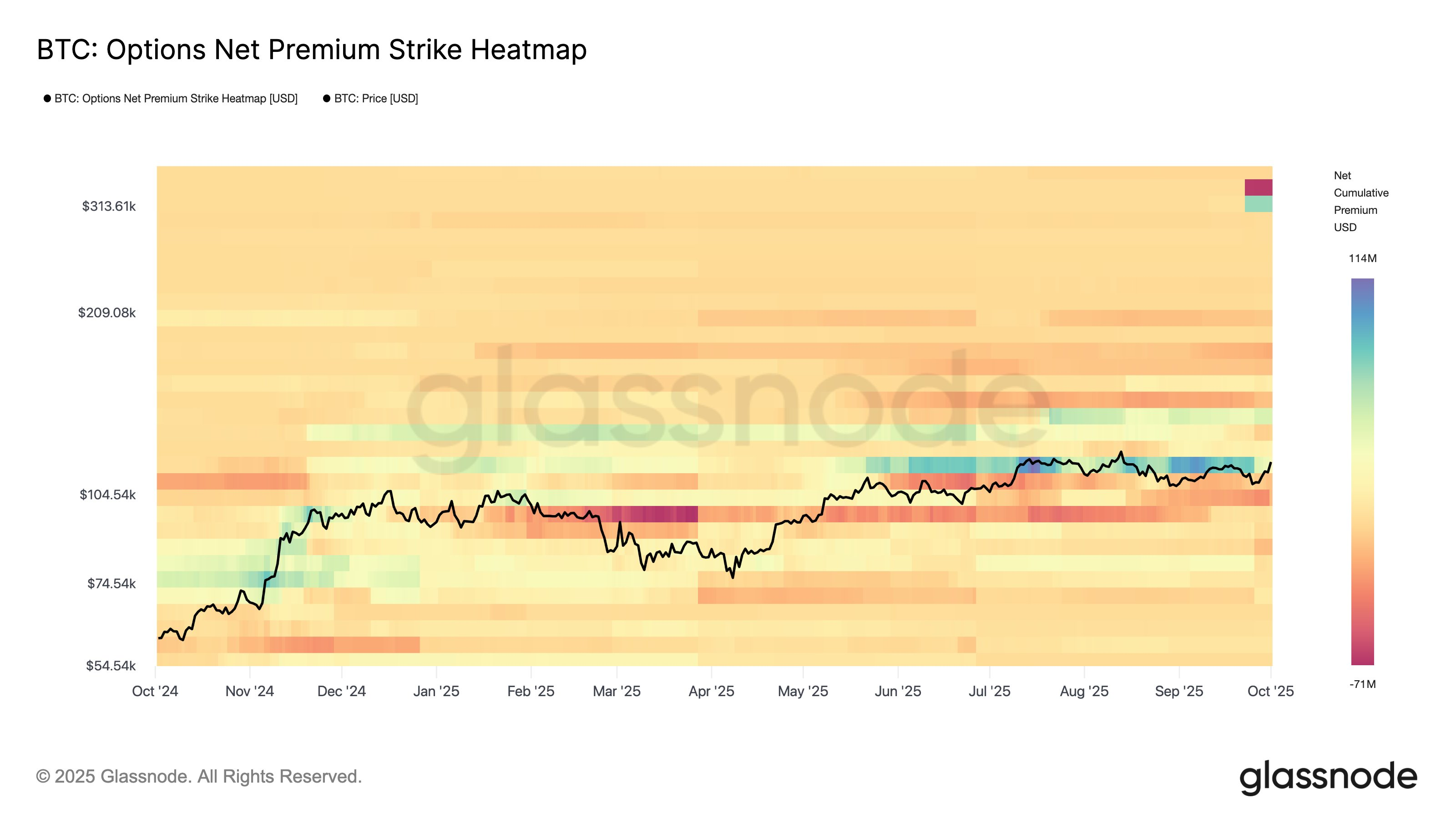

The Bitcoin options market is currently seeing a significant concentration of bets in the $100,000 to $120,000 range. Some traders are even making ambitious wagers on prices reaching as high as $300,000.

Bitcoin options are primarily focused between the $100,000 and $120,000 marks. There is cautious optimism among traders with some placing speculative bets at the higher end of this spectrum. Although hitting a price point of $300,000 seems improbable, these options remain affordable and indicate an interest in potential upward movements.

Data from Glassnode on October 2nd revealed that Bitcoin’s option activity was heavily concentrated around its current value near $120,000. This indicates a demand for exposure to potential price increases within this range.

The market also shows notable call activity at the $130,000 level which suggests an optimistic trend. Furthermore, there is increasing interest in high-risk options targeting up to $300,000—despite their low likelihood of success—reflecting growing enthusiasm for possible gains.

Overall analysis suggests that most traders anticipate Bitcoin (BTC) will continue fluctuating between the aforementioned ranges with slight optimism towards further growth beyond these levels.

ETF Inflows Boosting Bitcoin Optimism

A major factor contributing to this positive outlook is consistent institutional investment through both treasury firms and exchange-traded funds (ETFs). Economic uncertainties such as those stemming from U.S government issues have redirected investments away from stocks into assets like gold and Bitcoin instead.

B2BINPAY analysts attribute recent surges past the critical threshold ($120k) largely due to substantial ETF inflows amounting up-to approximately 1.3 billion dollars by October second—a continuation reflecting broader favorable trends observed over preceding weeks;

“Looking forward we foresee testing grounds set around $130k-$140k under base-case scenarios bolstered via recovering ETF flows alongside relaxed Federal Reserve expectations. However risks include sharp corrections reverting back downwards towards $105k-$&dash110K if macroeconomic tightening resumes;”– B2BINPAY Analysts

You might also find interesting: Here’s why gold and bitcoin surge amidst faltering US stock markets

Can government shutdowns significantly impact crypto spaces?