October has traditionally been a robust month for Bitcoin (BTC), and this year is no exception, with the cryptocurrency experiencing what many in the industry call “Uptober.”

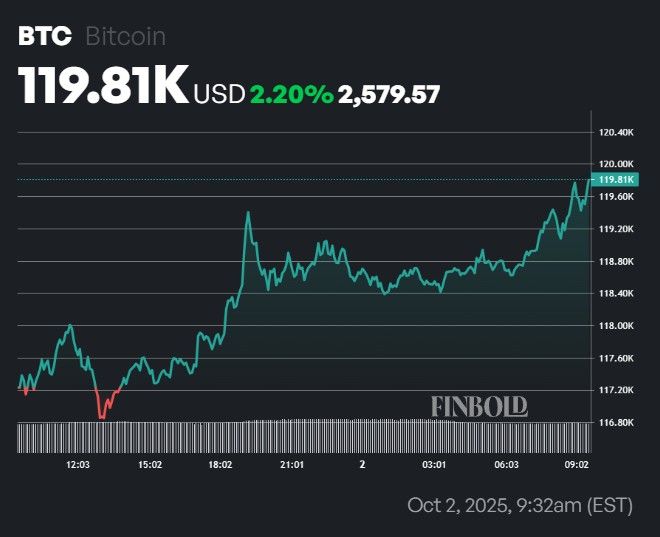

Currently trading at approximately $119,810, Bitcoin has seen an increase of over 2% on a daily basis and more than 7% over the past week.

The daily trading volume is also on the rise, reaching about $67.86 billion after a 2.2% increase. Meanwhile, the total market capitalization has returned to $2.38 trillion following a 1.83% boost in the last day.

This surge marks Bitcoin’s highest point in over two months, coinciding with this week’s official U.S. government shutdown.

Bitcoin Price Forecast for October 2025

Given October’s strong historical performance and Bitcoin’s approach toward the significant $120,000 mark, Finbold utilized its AI Signals tool that combines large language models (LLMs) with momentum-based market technical indicators to make predictions.

The forecasts suggest that by late October 2025, Bitcoin could reach around $127,734—a potential gain of 6.78% from current levels.

The most optimistic LLM was Claude Sonnet 4 which predicted a target price of $135,000(+12.85%); GPT-4o and Grok 3 were slightly less bullish, estimating prices would climb to $123,200 (+ 2. 9 %) and $125,&thinsp001 ( + &thinsp 4. &thinsp 4&thinsp % ) , respectively .

While these projections are quite positive , they may be justified . For example , interest in Bitcoin ETFs is resurging , having attracted net inflows totaling $676 million on Wednesday , October &num ;1 &comma ; marking their third consecutive day of gains .

Furthermore , even some long-time skeptics are beginning to reconsider their stance on this asset . Among them is Warren Buffett who recently praised not only Bitcoin but also gold and silver despite his previous aversion towards these investments .

Technical indicators have also garnered attention lately : notably ,,Bitcoin’s monthly Bollinger Band Width ( ; BBW ),an essential measure of volatility,is now compressed at historically low levels indicating potential setups similar those preceding explosive rallies up-to-200%.

Featured image via Shutterstock