Bitcoin’s impressive rise at the beginning of October has sparked renewed enthusiasm in the market, fueling hopes for a sustained upward trend. Could this month truly mark a memorable “Uptober”?

This development has revived interest in the “4-year cycle” theory, which suggests that Bitcoin’s bullish and bearish phases follow a predictable sequence linked to its halving events.

Exploring Historical Trends

Joao Wedson, who leads investment analysis at Alphractal, is concentrating on an intriguing figure: 548 days.

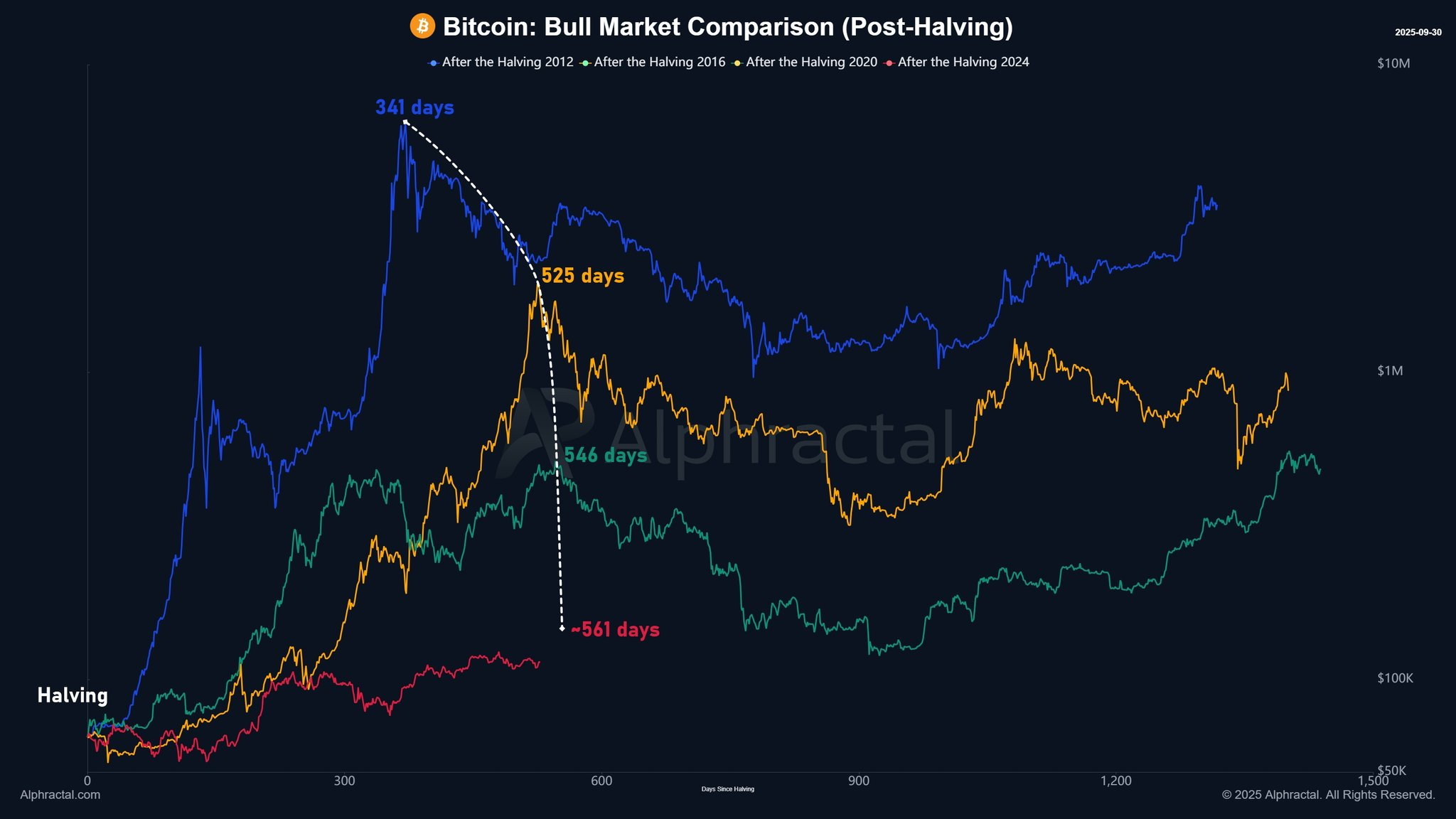

A study of Bitcoin’s historical cycles reveals slight variations in the duration between each halving and its subsequent peak. The 2012 cycle lasted 371 days, followed by 525 days in 2016, and then extended to 546 days in 2020.

This gradual lengthening indicates that we might be nearing the end of the current cycle. Wedson notes that this observation aligns with other indicators such as fractal patterns and market cycles like fractal cycles and Max Intersect SMA.

He posits that day number 548 could be pivotal for reaching a price zenith. Currently, Bitcoin is at day number 528 since its last halving on April 19, 2024.

Bitcoin: Bull Market Comparison. Source: Alphractal.com

If Bitcoin reaches its apex on day 548, it would fall precisely on October 19, 2025. Extending his theory further suggests that this peak might occur as late as November 1, 2025. Wedson stated: “if we assume consistency within these four-year cycles&44; a maximum of thirty more days remain before witnessing this cycle’s price summit.”

An Alternative Prediction: December 23, 2025

A different cryptocurrency analyst known as ‘seliseli46’ has also projected when this bull run might conclude. Upon examining previous Bitcoin cycles&44; a pattern emerges where each spans approximately 152 weeks&46; ‘Seliseli46’ shared insights via their X account indicating these durations translate roughly into 1&comma064-day periods.

The initial phase began after hitting bottom early during 2015,capping off with peaks seen towards late 2017.

The subsequent phase started near year-end throughout &lsquo18 peaking again come November &rsquo21.

If assuming another commenced following November&rsquo22 lows—adding up those same weeks lands around December twenty-third two-thousand twenty-five mark respectively according analysis made thus far noted how typically past all-time highs emerge twelve-to-eighteen months post-halvings though emphasized hypothesis subjectivity influenced externally regulatory sentiment technological advancements alike

The article titled “Is Uptober Here? Analysts Examine Four-Year Cycle” first appeared BeInCrypto website.