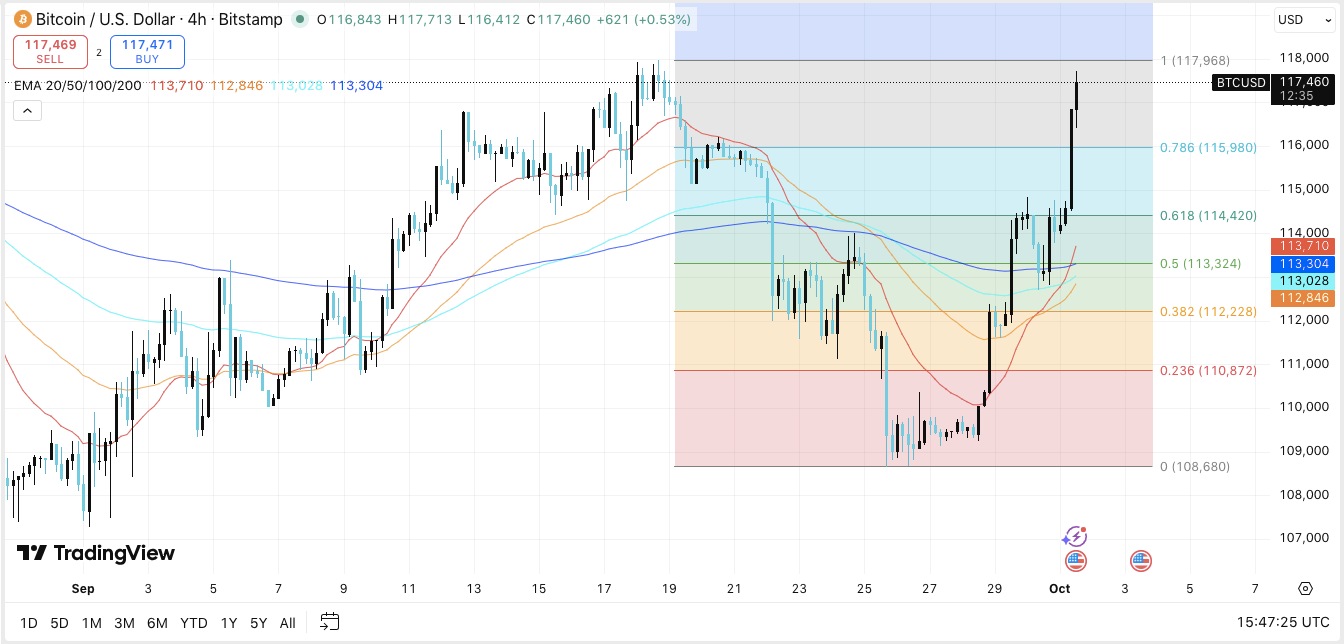

Recently, Bitcoin has exhibited impressive resilience by regaining significant Fibonacci retracement levels on its 4-hour chart. This development indicates a resurgence of bullish energy as the cryptocurrency nears crucial resistance areas.

Investors and traders are keenly observing the $117,968 mark, which has served as a temporary barrier. A strong breakthrough above this point could propel Bitcoin to higher targets, potentially reaching between $118,500 and $120,000 in the short term.

Crucial Levels and Trend Analysis

The immediate support for Bitcoin is found around $115,980 and $114,420—these correspond to the 0.786 and 0.618 Fibonacci levels respectively. If selling pressure increases significantly, the area around $113,324—aligned with several EMAs—provides robust demand support. Should there be a deeper market pullback beyond that point; then $112,228 becomes an essential level of defense.

SOL Price Dynamics (Source: TradingView)

The upward movement from a low of $108,680 has turned both the 50 EMA and 100 EMA zones into supportive regions near approximately $113K. Sustaining momentum above the threshold of roughly $116K may inspire buyers to push towards new peaks; however failing to maintain above about$115K might lead to retracements toward an EMA cluster within$113-$113k range

Futures Market Activity Reflects Ongoing Interest

This year saw Bitcoin futures open interest soar—from under$20 billion at its start—to over eighty billion dollars by October indicating heightened speculative activities alongside increased institutional involvement

Source: Coinglass

An expanding open interest supports positive outlook yet also suggests greater volatility during sharp price fluctuations Currently standing at eighty-billion-dollar level signifies substantial market engagement reinforcing Bitcoins dominance within derivatives trading realm

Source: Coinglass

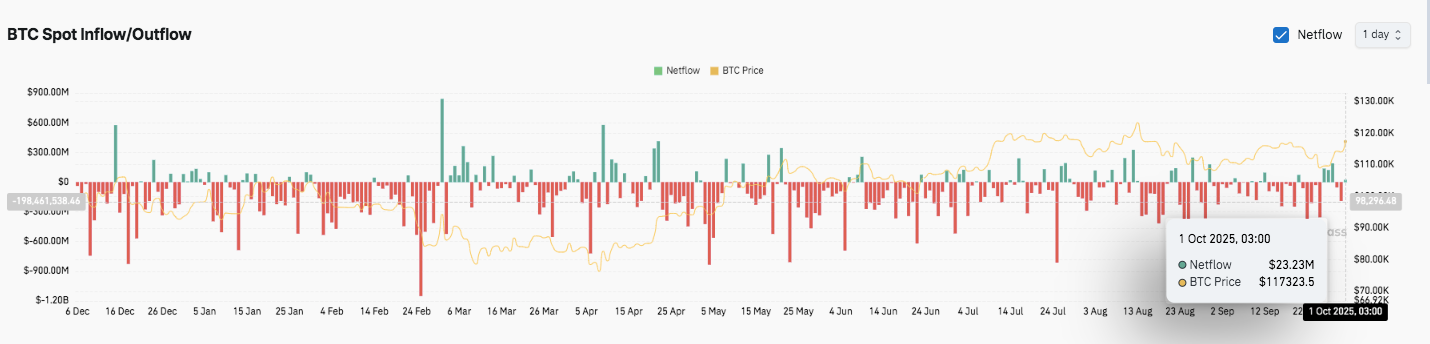

Cautious accumulation patterns reflected through recent inflows/outflows On October first there was modest positive outflow amounting twenty-three million dollars suggesting minor short-term selling pressures Despite this broader accumulation trends remain intact supporting mid-to-long term bullish perspectives

Michael Saylor’s Bold Trillion-Dollar Plan

Executive chairman Michael Saylor unveiled ambitious vision regarding corporate adoption bitcoins He likens transformative potential breakthroughs such electricity oil describing it digital energy His trillion-dollar endgame involves acquiring bitcoin scale redefining corporate treasuries strategies According him offers unique blend property capital cyberspace enabling value transfer across time space creating opportunities businesses institutions seeking preserve wealth long-term Significantly strategy influence practices engagement digital assets among corporations institutions alike .

Technical Overview For Bitcoins Price Movement Hthree Key Levels And Trends Outlook Upside Targets Short-Term Ceiling Potential Extensions Towards Higher Range Buyers Maintain Strength Downside Support Zones Immediate Resistance Cluster Critical Bulls Sustain Upward Pressure Consolidation Above Major Clusters Decisive Breakouts Likely Expand Volatility Continuation Either Direction Maintaining Critical Holding Near-Term Trajectory Depends Breaching Successful Drive Momentum Failure Retracements Futures Inflows Indicate Accumulation Alongside Strong Institutional Participation Positive Developments Including Vision Add Structural Narrative Reinforcing Long-Term Store Value Disclaimer Information Presented Informational Educational Purposes Only Does Constitute Financial Advice Coin Edition Responsible Losses Result Utilization Content Products Services Mentioned Readers Advised Exercise Caution Before Taking Action Related Company >