Bitcoin continues to showcase its impressive market presence today, trading at $113,083. Its market capitalization stands at $2.25 trillion, with a 24-hour trading volume of $61.95 billion. Over the past day, Bitcoin’s price has oscillated between $112,009 and $114,762—a scenario that keeps traders either alert or on edge.

Bitcoin

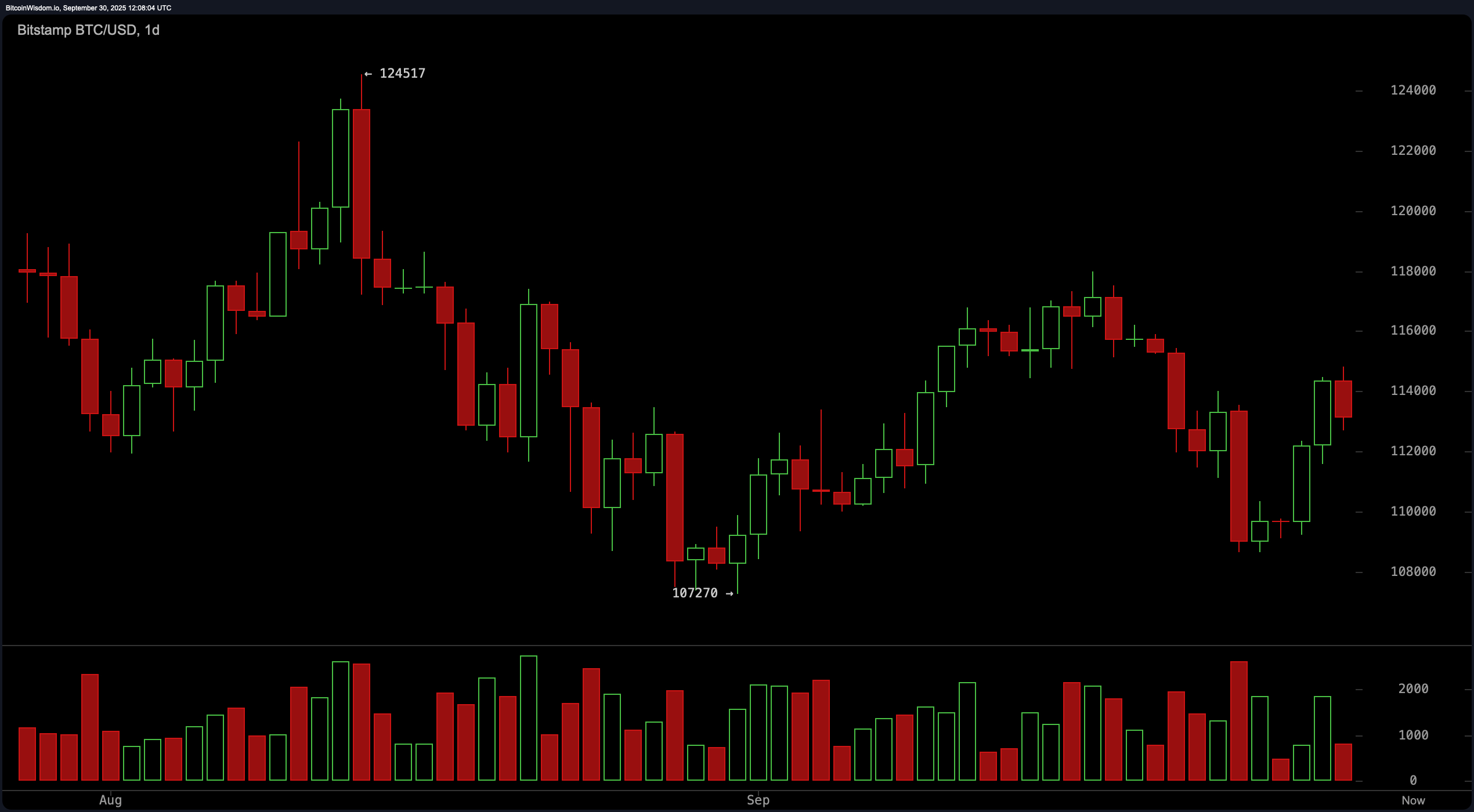

On the daily chart, Bitcoin is performing a balancing act after a sharp drop from its peak of $124,517 to as low as $107,270. It has since rebounded and is currently hovering above the crucial support area of around $108,000–$110,000 like it’s clinging to a lifeline.

The resistance zone lies between $118,000 and $120,000—ready to challenge any overconfident buyers. Traders with nerves of steel might consider entering around the dip zone of $111,000–$112,000, aiming for exits near that psychological barrier at $120K—if bullish momentum holds steady.

BTC/USD 1-day chart via Bitstamp on Sept. 30, 2025.

The 4-hour chart reveals Bitcoin’s impressive recovery from $108,&65252;&65252;&65250;&65250;, nearing $115,\”\”. Since then\&, price movements have settled in the vicinity of \#113\#, suggesting potential consolidation rather than decisive action\. Volume surged during this bounce-back\, indicating buyers are still present—but diminishing candle sizes hint at caution rather than exuberance\. A strategic long position near \#112,\#113,\ may offer lucrative exits between \#115,\500–\116,\00\, though any slip below \$111\, spells trouble faster than you can say “double top.”

BTC/USD 4-hour chart via Bitstamp on Sept. 30, 2025.

Narrowing down to an hourly perspective&comma bitcoin dipped briefly to &num109&comma239 before rallying back up toward &num114&comma842&period Now it rests comfortably around &num113&comma00&period While momentum has slightly waned&comma panic hasn’t set in yet&period Scalpers might find opportunities within &num112&comma800 and &num113 comma200 targeting gains from about nbsp114 comma500 dash nbsp115 comma00 but if prices fall beneath ampersand hash semicolon12comma500 it could trigger downside pressure straight towards ampersand hash semicolon11comma00 period

<img src=quote https colon slash slash cnews24 dot ru slash uploads slash97fslash97fbem1925793e205ff5a2875bb893d6efcb225ejpg quote size equals sign quot254014quot gt

BTCUSDchartviaBitstamponSeptperiodspace30commaspace20space25period

<P gt

Now let us delve into oscillators because every savvy trader knows these indicators cast more shade than crypto Twitter feuds period The relative strength index RSI Stochastic oscillator commodity channel index CCI average directional index ADX along with Awesome oscillator all scream neutral just like undecided jurors panel do period However both moving average convergence divergence MACD alongside momentum indicator aren t holding back they re signaling bearishness dragging negative values such minus two thousand six hundred forty three MACD level trailing behind four hundred nineteen point These bearish hints suggest bulls may be catching their breath or perhaps pacing themselves ahead next upward leg move point </P

Bottom line: As long as Bitcoin remains above dollar sign eleven thousand comma zero zero zero bullish bias stays intact targeting range dollar sign fifteen thousand dash eighteen thousandselloffcouldheadstraightforeightthousandthismarketisnottheweakheartedbutcertainlyentertainingpoint end paragraph >