Bitcoin’s current market trajectory raises questions about the rally’s durability, with defending the $111,000 level being essential to prevent further declines.

According to Glassnode on September 25, Bitcoin’s pullback from nearly $117,000 after the Federal Reserve’s rate announcement illustrates a classic “buy the rumor, sell the news” scenario.

The recent drop from Bitcoin’s peak of $124,000 to $111,012 is a mere 10.5% decrease—relatively minor compared to previous corrections of 28% or even more severe downturns in past bull markets.

However, this apparent stability conceals underlying market fatigue that requires close monitoring.

On-chain data reveals troubling trends in capital flow dynamics. This cycle has seen net inflows of $678 billion through realized cap growth—almost 1.8 times greater than during prior cycles.

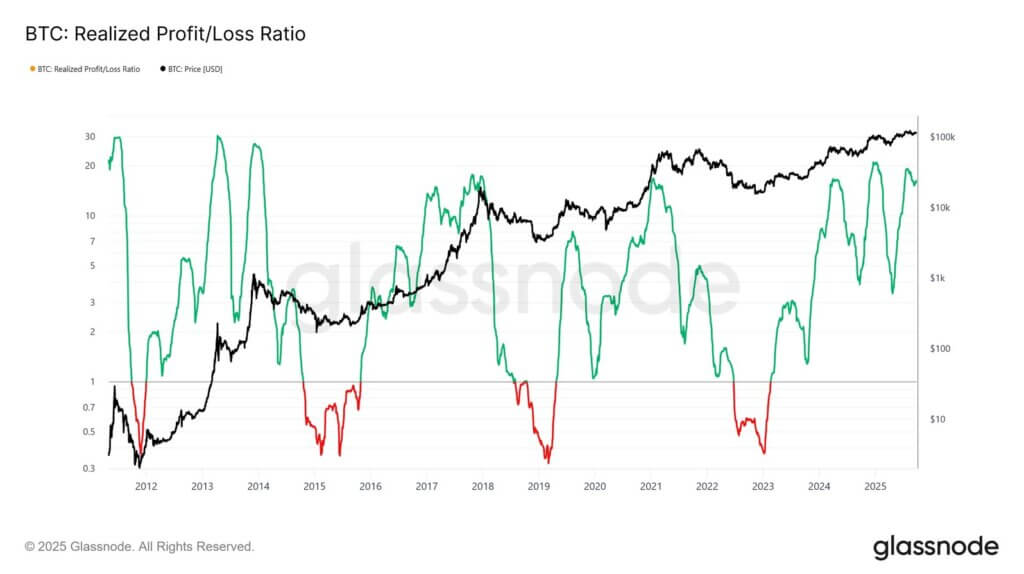

Long-term investors have sold off 3.4 million BTC at a profit—a figure surpassing earlier cycles and underscoring significant selling pressure from experienced traders. The market structure shows a delicate balance between institutional interest and long-term holder distribution.

The inflow into US-traded Bitcoin spot ETFs—which previously mitigated heavy selling—plummeted from an average of 2,600 BTC daily to virtually none around the FOMC meeting period.

This coincided with an increase in long-term holder distribution reaching up to 122,000 BTC monthly—a mismatch that contributed to weakening conditions.

The derivatives sector exacerbated this correction via forced liquidations and deleveraging processes. Futures open interest sharply declined from $44.8 billion downwards as Bitcoin fell below $113,000; dense liquidation zones between $114k-$112k fueled intense selling activity.