Bitcoin, the leading cryptocurrency, has seen a slight increase of 0.28% in the last day. This modest rise comes amidst a general market downturn and diminishing bullish enthusiasm.

Despite this seemingly muted price movement, crucial on-chain indicators reveal that demand is quietly increasing beneath the surface, potentially setting the stage for more significant gains soon.

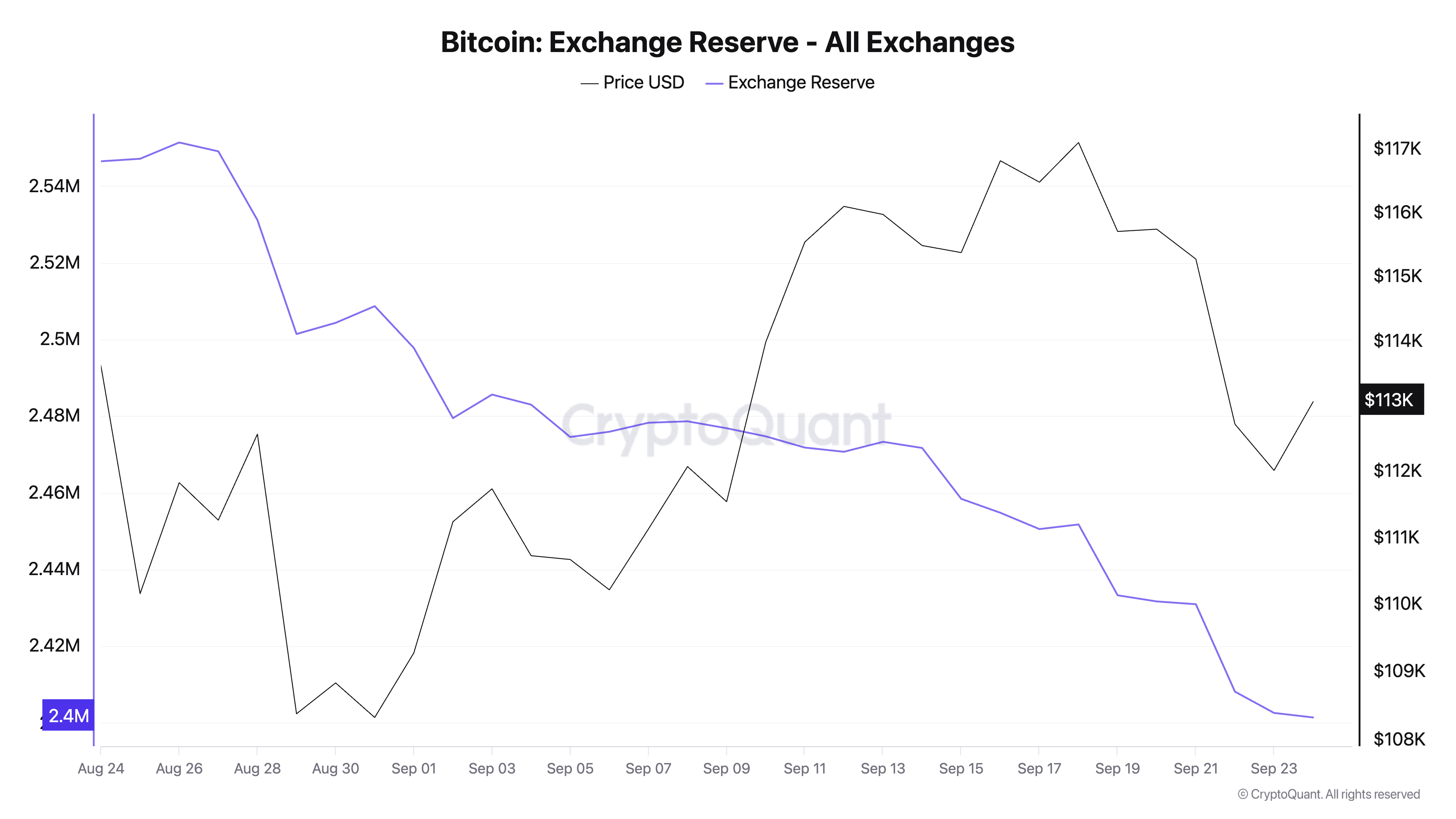

Exchange Reserves Reach Yearly Low

A particularly noteworthy development is Bitcoin’s exchange reserves continuing to decline. Data from CryptoQuant shows that these reserves hit a year-to-date low of 2.4 million on Tuesday.

If you’re interested in more insights like this one about tokens and market trends: Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

The measure of BTC held on centralized exchanges is represented by its exchange reserves. A continuous decrease suggests fewer coins are available for immediate sale, indicating investors are moving assets into cold storage or holding them long-term.

Even though Bitcoin’s price performance has been lackluster recently, the consistent reduction in its exchange reserves over recent weeks underscores traders’ confidence despite broader market sentiment weakening.

This discreet withdrawal from exchanges implies holders remain optimistic about Bitcoin’s future potential, thereby reducing immediate selling pressure.

Cautious Optimism Among Traders

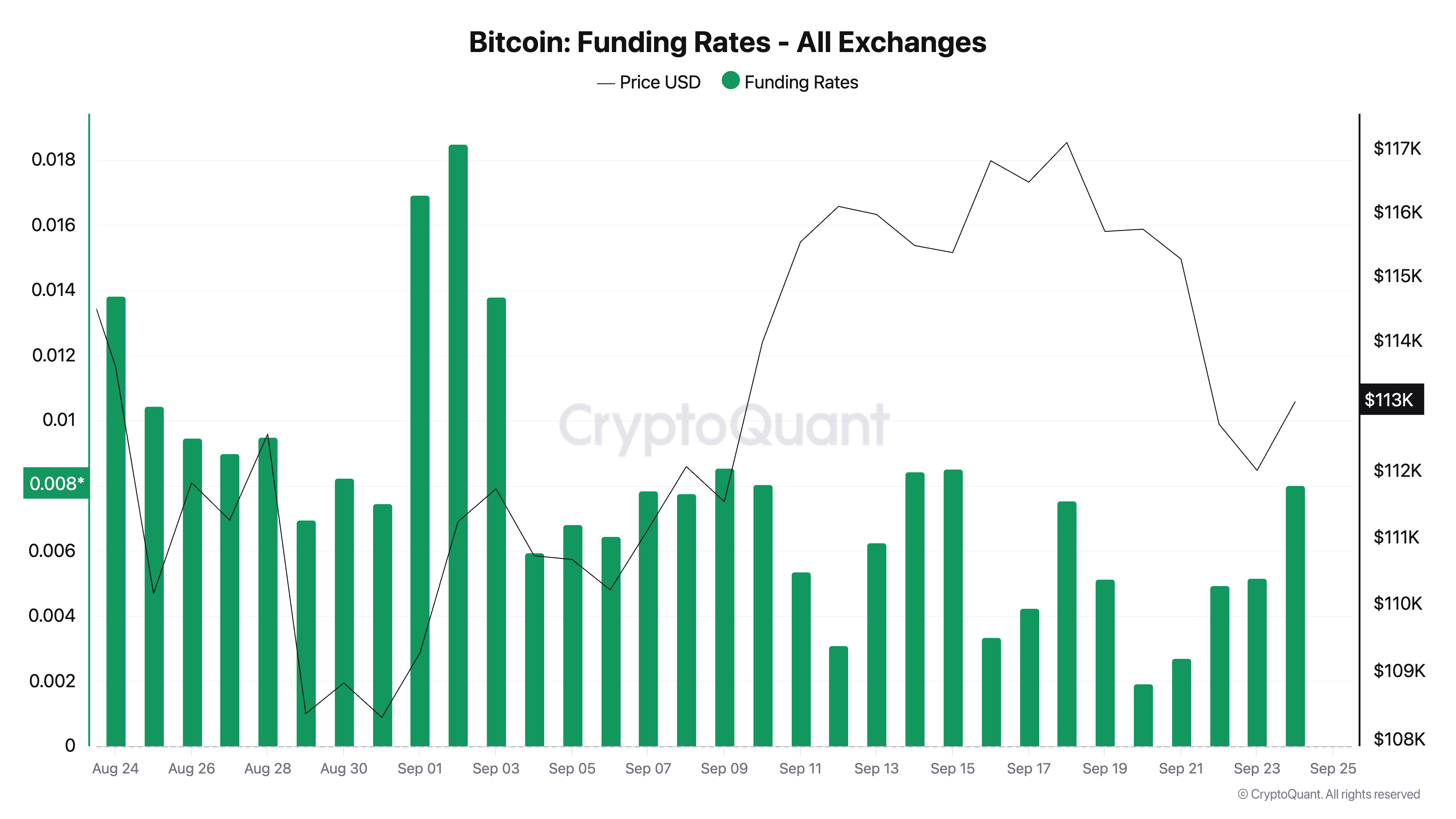

Additionally, BTC’s funding rates across major platforms continue to be positive at 0.079 at present. This indicates futures traders maintain a bullish stance.

The funding rate plays an essential role in perpetual futures contracts by aligning contract prices with spot prices. A positive rate means long positions pay shorts indicating most traders favor upward movements while negative rates show shorts paying longs suggesting bearish sentiment.

Potential Path Forward for Bitcoin

If buyers leverage this underlying support effectively there could be room for further upward momentum potentially pushing BTC towards $115000 soon but should market weakness persist current rallies might stall resulting either consolidation below $111961 support levels or triggering dips instead

The article titled Why Bitcoins Small Gains Could Be Hiding Bigger Breakout was originally published on BeInCrypto