Bitcoin has encountered a significant rejection following a surge in liquidity above a crucial resistance zone. The current price is now approaching major support levels, where potential buyers might step in to defend the overall uptrend.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, BTC faced a strong rejection after surpassing $117K, leading to a rapid decline towards the highlighted support area. This drop pushed the asset slightly below the 100-day moving average around $113K, which has frequently acted as a pivotal level in recent market movements.

If this support zone holds firm, Bitcoin could see an upward movement towards $117K. However, there is also a possibility of a deeper retracement into the range of $108K–$110K. This particular area intersects with both the ascending trendline and previous significant swing lows, making it an essential battleground for bullish investors.

The 4-Hour Chart

The structure on the 4-hour chart clearly shows an increase in liquidity above $117K followed by breaking below the ascending trendline – indicating a notable shift in short-term momentum. The subsequent sell-off has driven prices towards demand zones around $110K where market participants are facing critical decision points.

A strong rebound from this level could potentially reset bullish momentum and maintain overall market structure integrity. Conversely, failure to hold at $110K may expose lower liquidity pools near $107k as potential targets if selling pressure intensifies.

On-chain Analysis

By Shayan

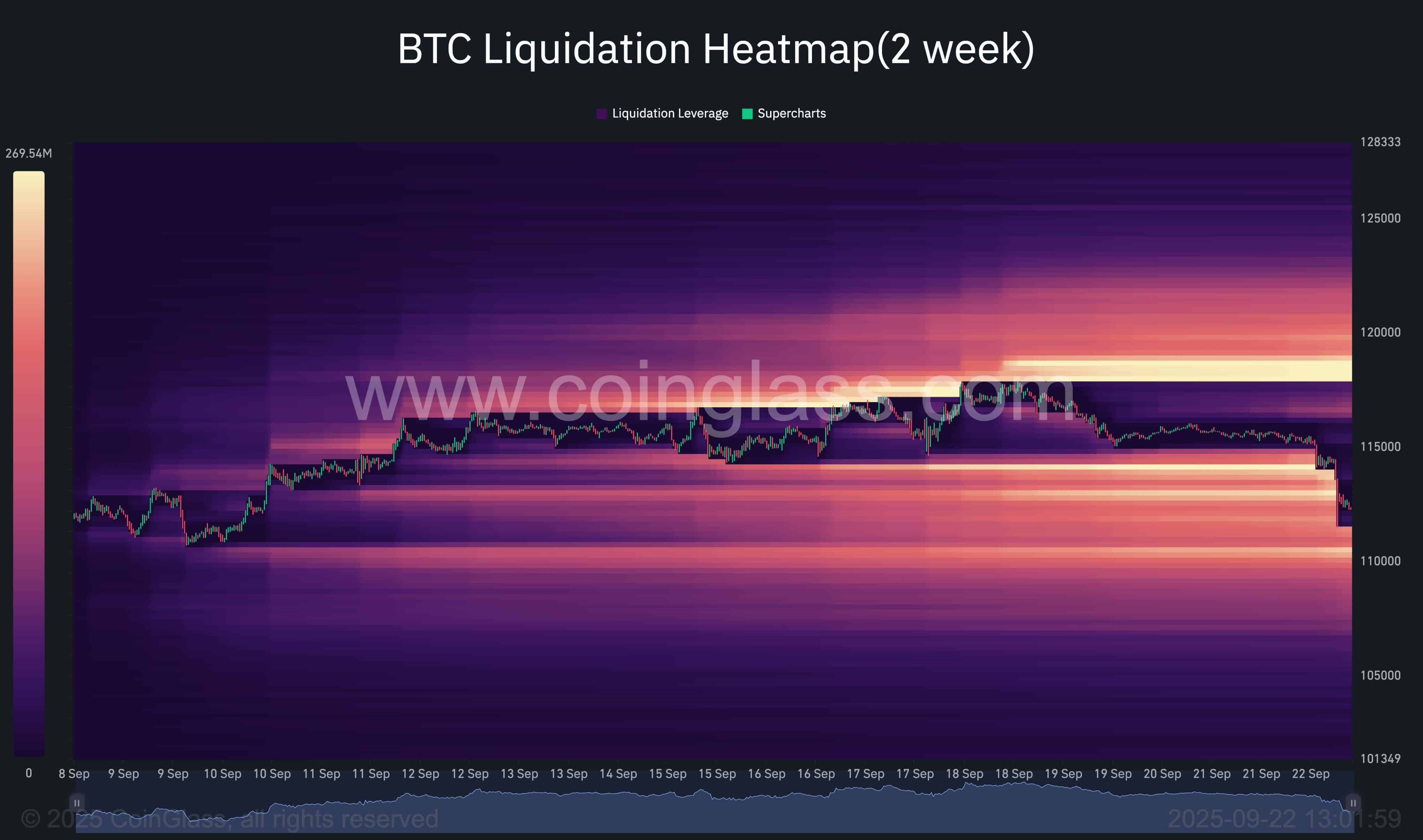

Analyzing liquidation heatmaps reveals that recent sell-offs were primarily driven by long squeezes. As Bitcoin surged into the range of $117k–$118k, excessive long positions accumulated leading to liquidations once prices failed to sustain above this cluster of liquidity – triggering accelerated declines.</P.

This cascade cleared leveraged long positions pushing prices down into regions between$110k-$112k where new clusters of liquidity are forming.This confirms that breaking past previous highs was not sustainable but rather acted as bait for downside momentum.

.

Broadly speaking,the market continues relying on events related to liquidity drives sharp movements.Long squeezes like witnessed recently serve as catalysts for aggressive corrections.Simultaneously,the heatmap emphasizes resting liqudity beneath current lows which could attract price if downward pressure persists.

.

The key question for bulls remains whether this purge has adequately reset leverage enabling more stable rebounds.If demand resurfaces around base at$110k,Bitcoin may attempt another recovery leg.Until open interest normalizes however,the market remains susceptible further squeezes and volatility.

.

.