Bitcoin was trading at $112,686 on September 22, 2025, boasting a market capitalization of $2.24 trillion and a 24-hour trading volume of $51.67 billion. The cryptocurrency exhibited significant volatility during the day, fluctuating between $111,986 and $115,776 across various timeframes.

Bitcoin

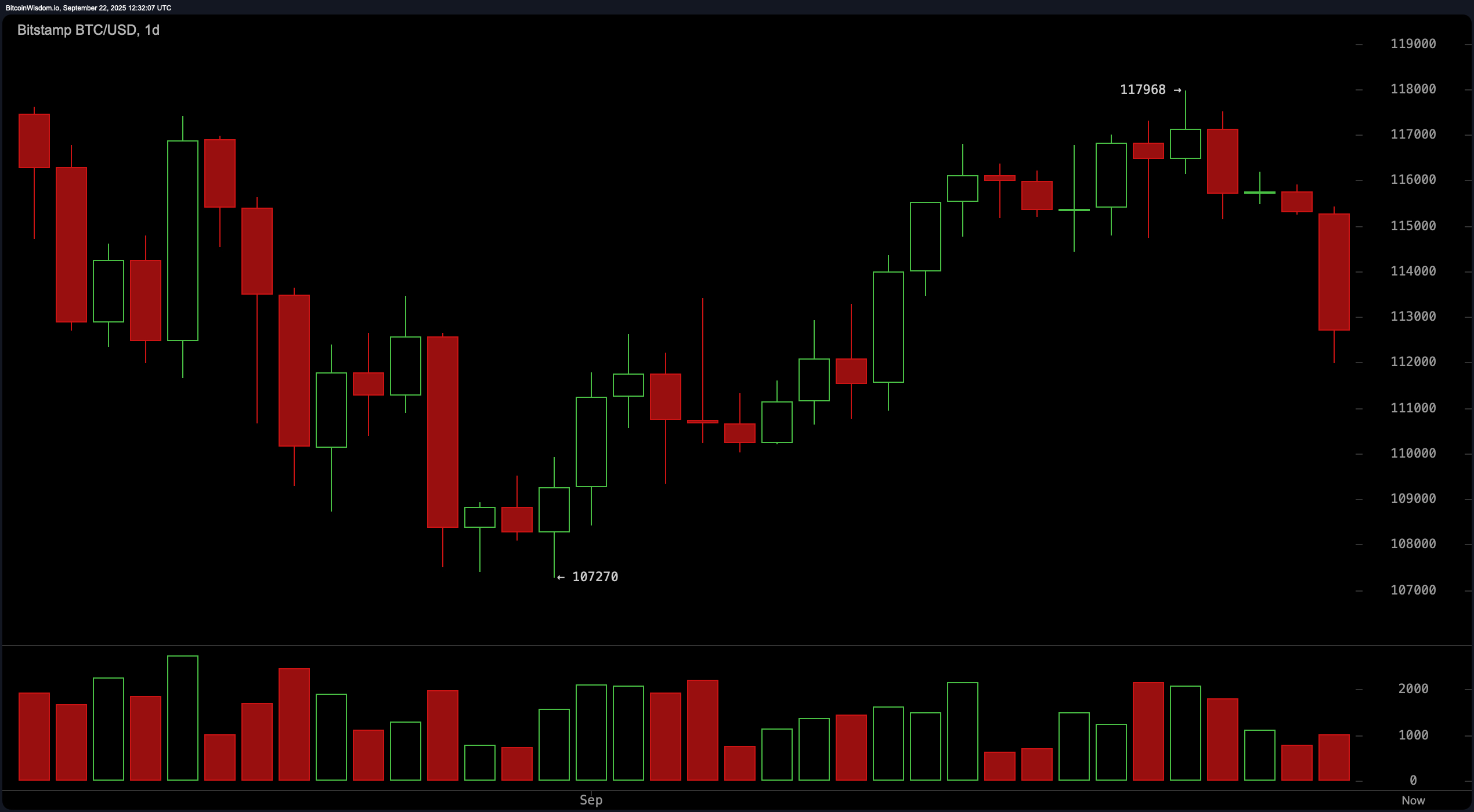

The daily chart indicates that bitcoin is currently undergoing a corrective phase after reaching a peak near $117,968 following a short-term uptrend. A bearish engulfing candle emerged as the price reversed with notable volume, dropping towards a support range between $112,000 and $113,000.

While previous bullish momentum was triggered around the local bottom at $107,270 in the past, current price movements advise caution. At the daily level, it is advisable to await confirmation of support before re-entering positions. Potential upside targets lie within the range of $1160-117500 with stop-loss protection below$111000.

BTC/USD 1-day chart via Bitstamp on Sept. 22nd ,2025

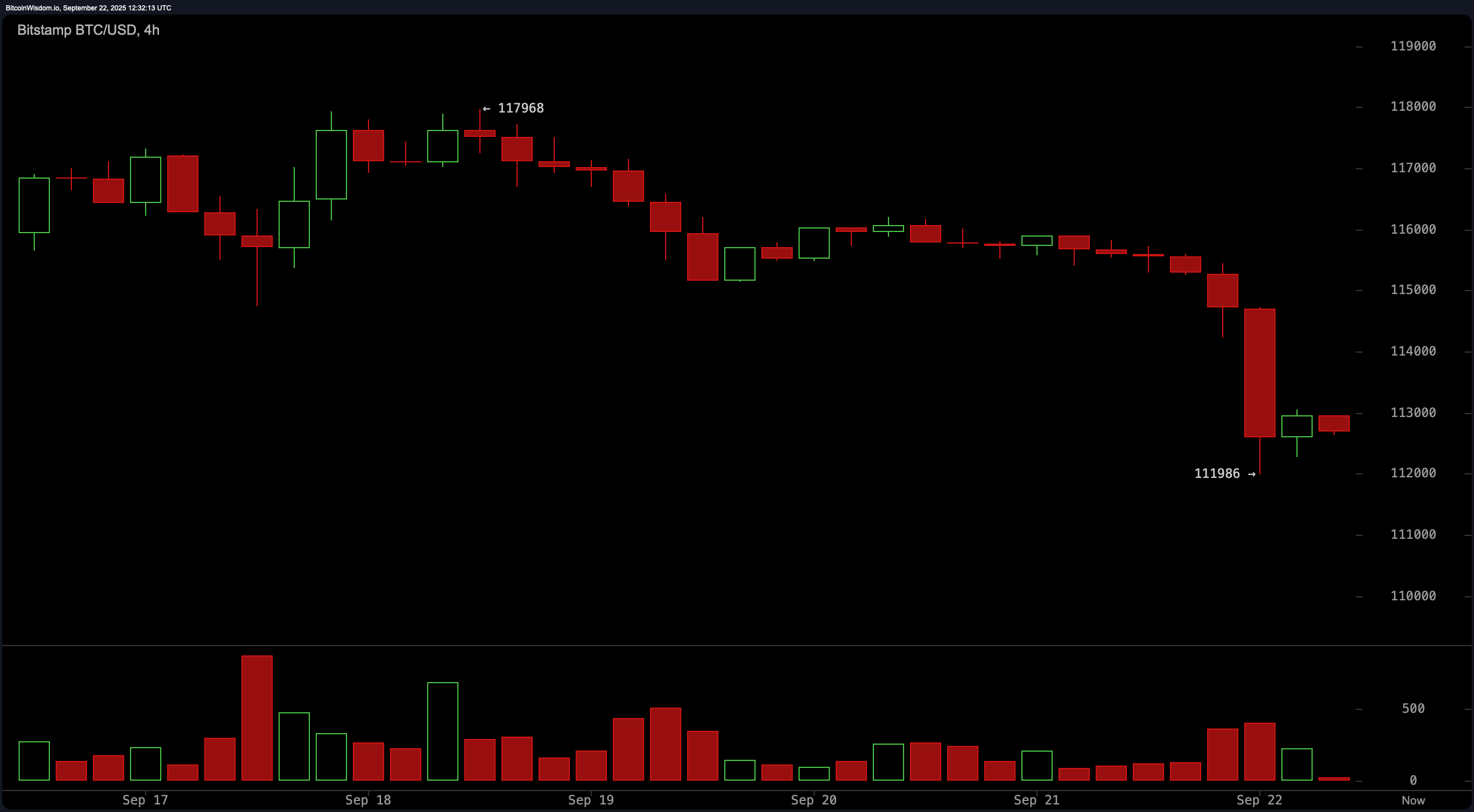

The four-hour chart illustrates bitcoin’s sharp decline from$117968 to$111986 followed by a minor rebound accompanied by increased volume suggesting possible capitulation during this downturn.While short-term trends remain bearish signs indicate stabilization as evidenced by decreasing selling pressure in recent candles.A neutral-to-bullish stance may be warranted if prices consolidate above$113500.An entry point near$112000-$113500 could lead to profits up to$116000 provided that support remains above$111500.

BTC/USD4-hour chart via Bitstamp on Sept .22nd ,2025

The one-hour bitcoin chart depicts an ongoing micro downtrend with prices oscillating between%112500 and%11300.A surge in volume upon reaching %11986 suggests potential capitulation often signaling an impending reversal.Although bearish momentum persists its strength appears to be waning.Accumulation may be taking place at current levels.A breakout beyond %13300 supported by strong volumes could present short-term opportunities targeting%11450-%11500.However any scalp entries should have tight stops set at %12000.

BTC/USD1hourchartviaBitstamponSept .22nd ,2025

From an oscillator perspective indicators are predominantly neutral.The relative strength index (RSI)standsat44theStochastic oscillator registersat54thecommodity channel index (CCI) sitsat-21andtheaverage directionalindex(ADX)is17indicating indecision.The Awesome oscillator showsavalueof27101alsoneutral.Howeverthemomentumindicatorindicatesbearish -3443andthe moving average convergence divergence(MACD)level standsat551 alsosuggesting abearish signal.These collectively suggest market uncertaintywithbearishtendencies.

Moving averages(MAs)supportashortto medium term bearishtrend.Exponentialmovingaverages(EMAs)fors10,s20,and30periodsall sitabovecurrentpricesindicating downwardpressureasdothesimplesmoothingaverages(SMAs).The50-periodEMAsandSMAscontinueinabearishalignment.Nevertheless,the100-periodexponentialmovingaverage(EMA)$11882and200-periodEMA@$105991flashesbullsignalspointingtodeeper trendsupport.Longtermbullstructure remainsintactbutshorttermpositionsshouldbe carefullymanagedduetoprevailingsellingpressure.

BullVerdict:

In spiteofthecurrentpullbackbitcoinmaintainsitsbullstructureonhigher timeframeswithkeylongterm movingaveragessuggestingcontinuedupwardmomentum.Acertainreboundfromthesupportzoneof&112000-%113000coupledwithbreakoutabove&13500couldrestorebullcontrolaimingtoreturntorecenthighsnear&17500andalsohigher.

BearVerdict:

Bitcoinsinabilitytoholdabove shorttermmovingaveragespairedwithincreasinglyweakeningmomentumindicatorsanda bearishlyengulfedpatternonthedailychartimpliesthatthedirectionoffewestresistanceremainstothenegative.Failingtosustainthesupportzoneof&120001100mayopenupfor deeperretracementswithcontinuationoftobearsifpricesfallbelow &11500.