Avalanche is embarking on an exciting new phase in its development, marked by significant partnerships with major corporations and the integration of stablecoin payments in South Korea. A surge in on-chain metrics indicates a notable increase in network activity.

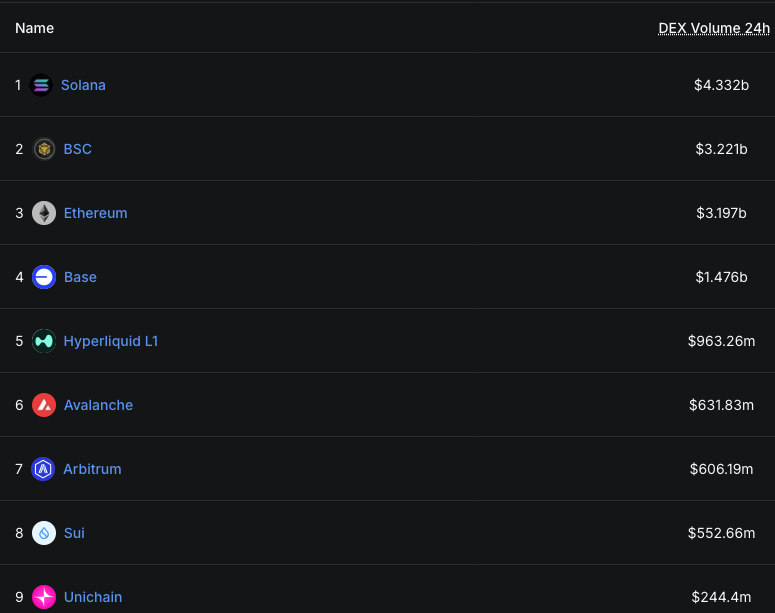

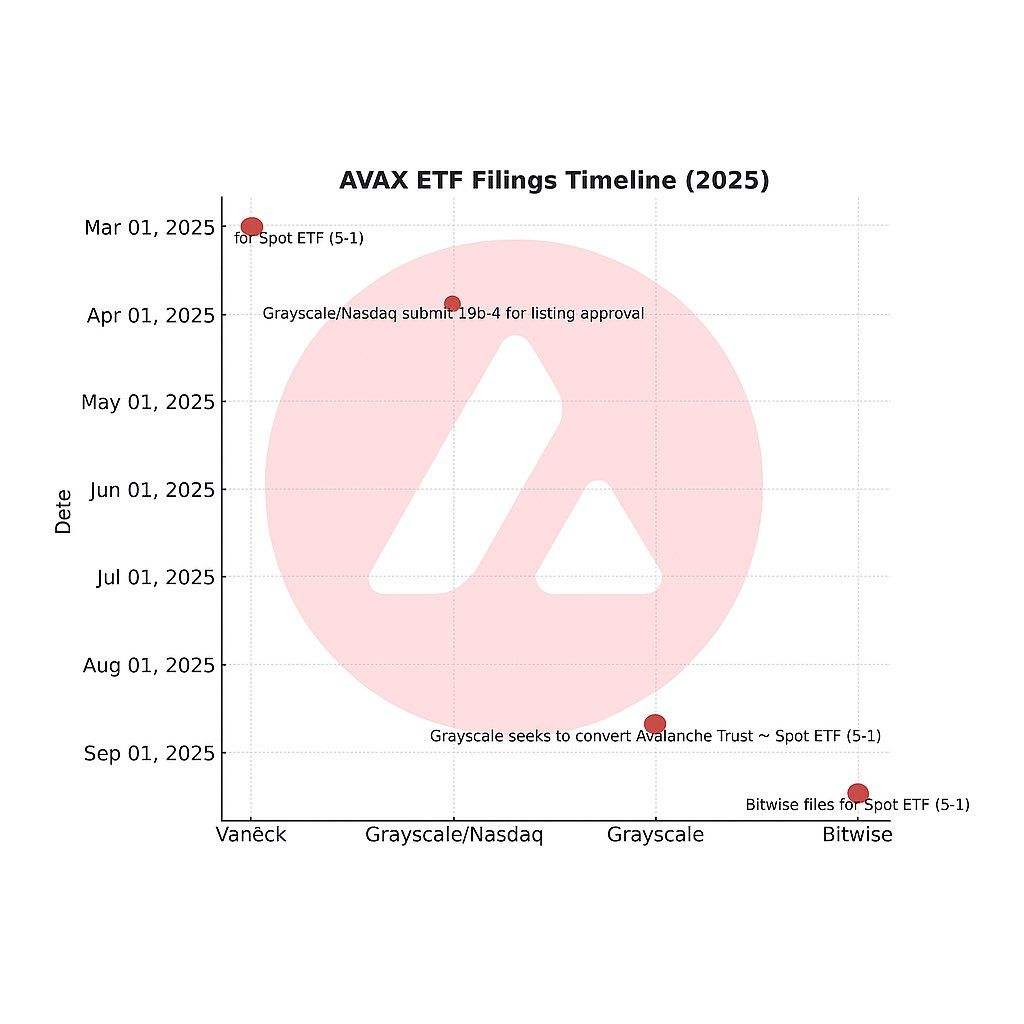

These developments go beyond mere promotional tweets; they are backed by tangible operational data, including decentralized exchange (DEX) trading volumes and Bitwise’s ETF application. This data reflects a robust demand, liquidity, and interest from institutional investors.

Growing Presence in Asia

Avalanche (AVAX) is at the forefront of digitizing Asia’s economy, particularly within South Korea—a dynamic cryptocurrency market boasting over 15 million accounts across local exchanges.

Recently, BDACS collaborated with Woori Bank to introduce KRW1, a stablecoin pegged 1:1 to the Korean won. Following a successful proof of concept (PoC), it has now entered the pilot stage. Avalanche offers secure and rapid infrastructure for KRW1’s operations. Additionally, INEX—an exchange that provides lifetime zero-fee trading—has signed a memorandum of understanding with Ava Labs to test both online and offline stablecoin transactions.

In Japan as well, Avalanche is making strides; Densan (with over 65,000 stores) has teamed up with SMBC—one of Japan’s top three banks—to create a national payment stablecoin. The initiative combines traditional elements like tokenized whisky from Bowmore & Suntory alongside innovative automotive financing models from Toyota Blockchain Lab—all showcasing AVAX’s appeal to global businesses.

“Avalanche stands out due to its proven track record with institutional clients,” stated Justin Kim | Head of Asia at Ava Labs during Tiger Research’s latest report. “From KKR’s healthcare fund tokenization last year to Wyoming’s upcoming state-backed stablecoin project set for 2025—these initiatives have consistently been pioneering and complex.”

Impressive Network Activity: AVAX Targets $42

The year 2025 sees Avalanche operating at full throttle as network transactions soar dramatically—driving unprecedented activity across Layer-1 networks. In August alone, DEX volume on Avalanche reached $12 billion; just within the past day alone it hit $630 million—a figure surpassing competitors Arbitrum and Sui (SUI). This represents an eightfold increase over just two months.

The value tied up in real-world assets (RWAs) on Avalanche has surpassed $450 million—with projects like Grove Finance aiming for $250 million in institutional credit while SkyBridge seeks to tokenize $300 million worth of investment funds. Uptop is also broadening its NBA loyalty program offerings.

Additonally ,Wyoming introduced FRNT—the first state-supported stablecoin designed for practical use—and Exit Festival implemented smart ticketing solutions catering to half a million attendees. These statistics highlight that AVAX not only attracts users but spans various sectors—from decentralized finance (DeFi) through entertainment industries.

The recent recruitment of Solana’s former communications head into Ava Labs is anticipated to enhance growth strategies by leveraging marketing expertise aimed at helping AVAX compete against other Layer-1 platforms effectively . Furthermore ,the appointment Of Lord Chris Holmes—a UK parliamentarian specializing In technology policy—to The board Of The avalanche Foundation strengthens regulatory credibility while supporting global expansion efforts .

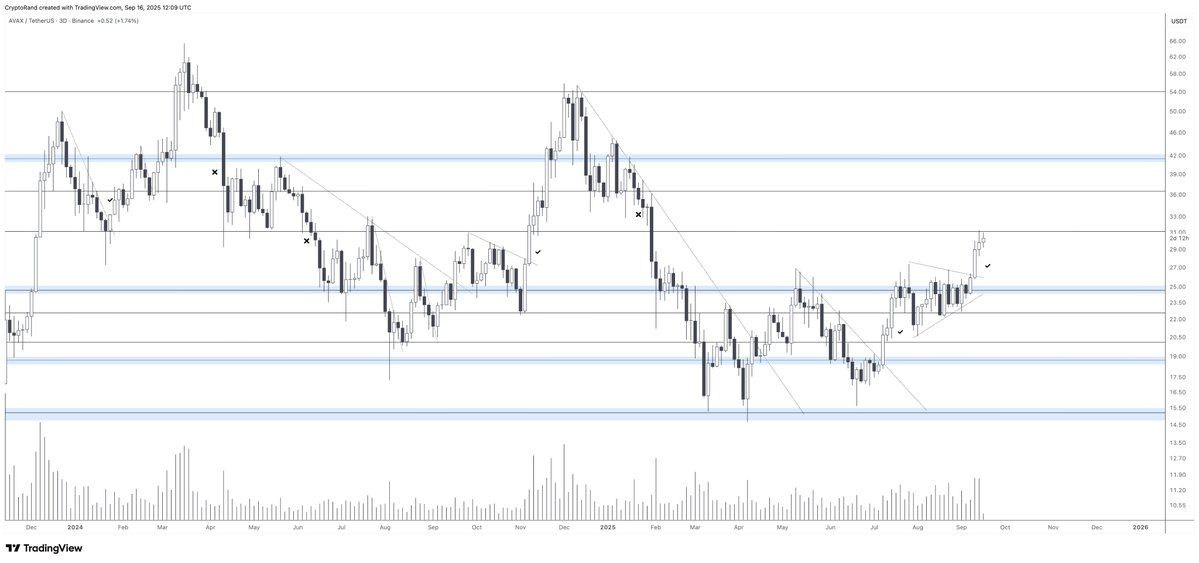

Pennant Breakout Signals Potential Growth

From an analytical standpoint ,AVAX exhibits no signs Of slowing down especially after breaking free From A bullish pennant formation . With solid support established around$27,many analysts speculate That reaching$42 could be next target . As this article goes live ,AVAX trades At$31 .82 showing A six percent rise Over The past twenty-four hours following news regarding Two separate deals involving$500million Treasury bonds aimed At expanding Institutional reach

This optimistic outlook stems From strong indicators emerging Within The network coupled With expectations surrounding potential inflows Of Institutional capital via planned AVA ETFs.Four applications For AVA ETFs have already been submitted And await approval By regulators come2025.Should SEC grant these approvals,it could lead To substantial influxes Of Capital propelling Prices Upwards akin To impacts witnessed During Bitcoin ETF launches

This article titled ‘Avalanche Expands Stable Coin Payments Across Korea And Japan’ was originally published On BeInCrypto.com