The recent reduction of 25 basis points represents the first decrease in the U.S. Federal Reserve’s policy rate since December 2024.

Bitcoin Surges Past $116K Following Fed Rate Cut, Then Dips

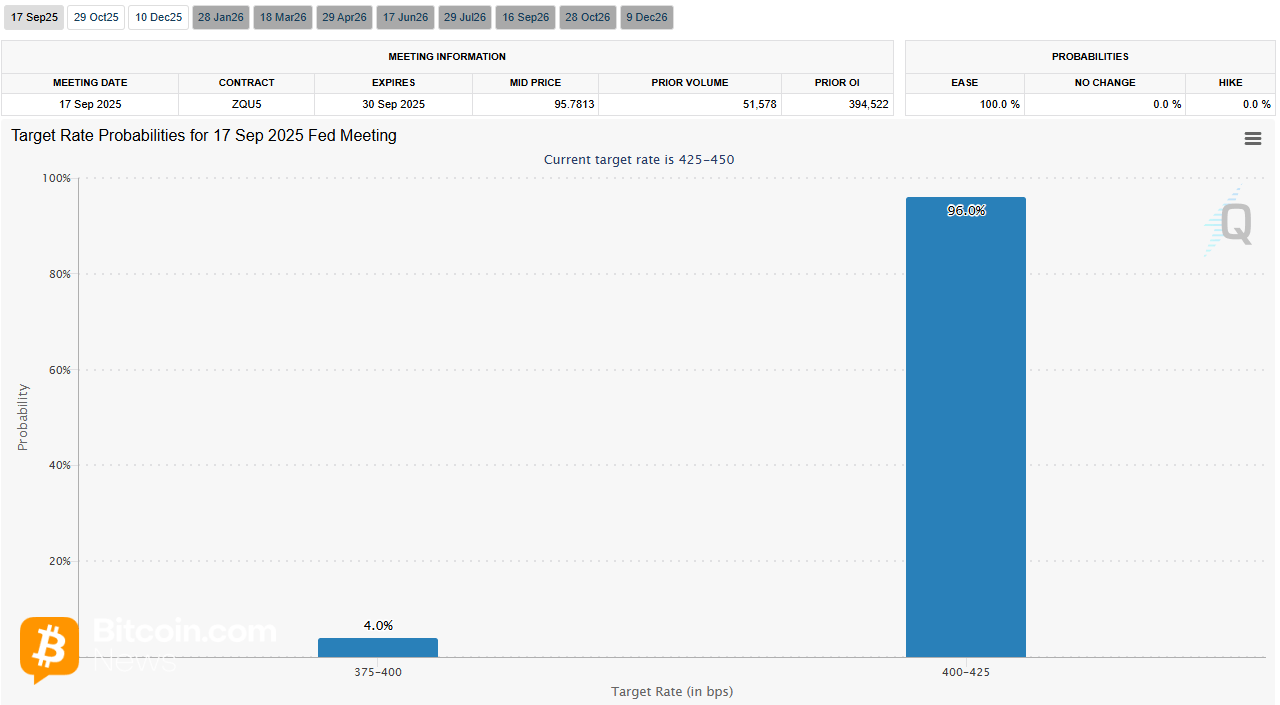

The interest rate cut announced by the U.S. Federal Reserve on Wednesday was largely anticipated. Just moments before the official statement, CME Group’s Fedwatch Tool indicated a staggering 96% likelihood of a 25-basis-point cut and only a 4% chance for a more significant reduction of 50 basis points. Despite many analysts suggesting that this adjustment had already been factored into market expectations, Bitcoin (BTC) experienced an immediate spike to over $116K before quickly retracting to around $115K.

(Most analysts predicted a cut of 25bps just minutes prior to Wednesday afternoon’s announcement / cmegroup.com)

Last week saw an increase in expectations for lower policy rates after unexpected employment data revealed an unprecedented rise in new unemployment claims. Additionally, Stephen Miran, nominated by Trump and confirmed as one of seven members on the Federal Reserve Board yesterday, bolstered predictions for today’s rate cut. Miran had attended central bank meetings and was notably the sole member advocating for a larger reduction of 50 basis points.

Even with this being the first interest rate decrease in nearly twelve months confirmed, Bitcoin continues to hover within the $115K-$116K range. Many anticipate further cuts from the Fed during its upcoming meetings in October and December later this year—potentially paving the way for one last rally for BTC heading into late 2025.

The Fed’s press release stated: “The Committee is mindful of risks affecting both sides of its dual mandate and assesses that downside risks related to employment have increased.” They added that “to support its objectives amid shifting risk dynamics,” they decided to adjust their target federal funds rate downwards by one-quarter percentage point to between four percent and four point twenty-five percent.

U.S. President Donald Trump is currently on an official visit to Britain and did not respond immediately following this announcement regarding interest rates. The president has previously criticized Fed Chair Jerome Powell for not lowering rates sooner while also attempting unsuccessfully to dismiss Fed Governor Lisa Cook—a Biden appointee—over allegations related to mortgage fraud issues; another former governor nominated by Biden mysteriously resigned amidst these tensions.

Market Overview

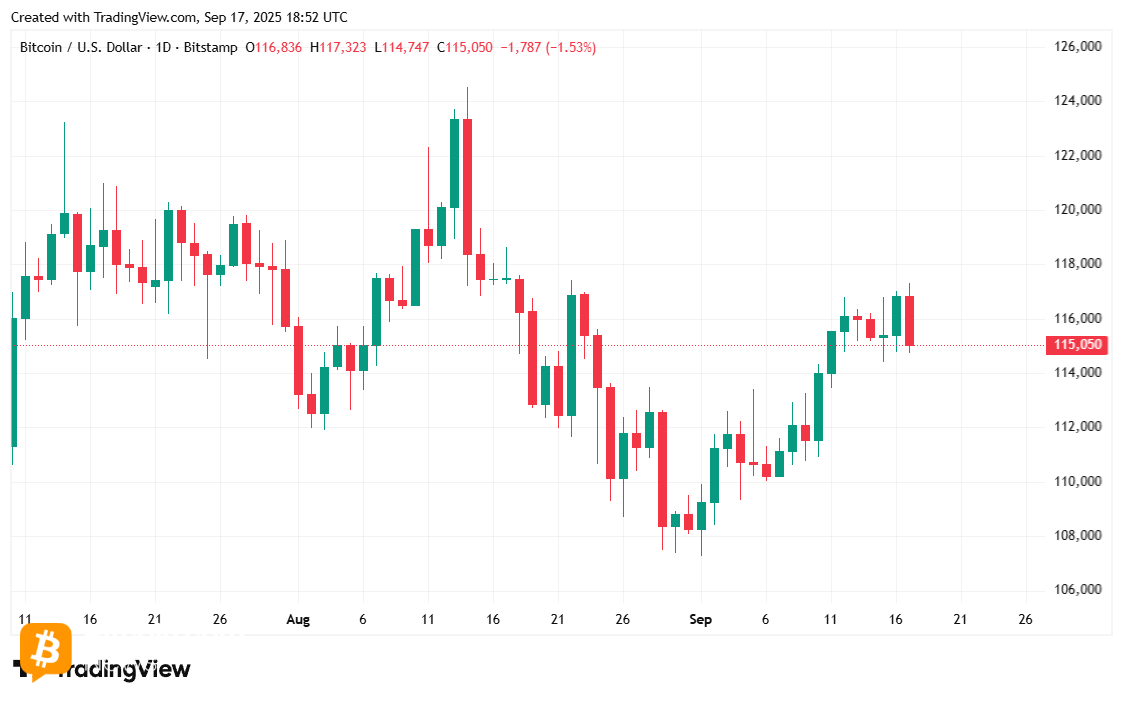

In spite of this latest interest rate drop, Bitcoin remained approximately down by about one percent over twenty-four hours at around $115,143.95 at publication time according Coinmarketcap data analysis; since Tuesday it has fluctuated between prices ranging from $114,803.05 up through highs near $11732861

.

(Price movements observed with Bitcoin / Trading View)

The trading volume within twenty-four hours increased significantly by eight point zero two percent reaching forty-nine billion dollars while overall market capitalization dipped slightly down towards two point three trillion dollars—a minor retreat equating roughly zero point ninety-five percent loss overall observed throughout daily fluctuations noted thus far . Initially stagnant during much part earlier day , bitcoin dominance ultimately fell marginally falling back again -downward trend arriving finally settling close enough around fifty-eight .09 %

( Dominance metrics associated specifically concerning bitcoin price activity tracking viewed via Trading View )

Open interests across total futures contracts tied specifically toward bitcoins dropped approximately zero .71 % compared against previous day arriving now calculated at eighty-three billion dollars based upon statistics compiled directly sourced via Coinglass platform services ; furthermore liquidations occurring throughout past twenty-four hour period reached cumulative totals nearing estimated figures totaling roughly twenty-five million three hundred ninety thousand dollars wherein long positions accounted primarily making up fourteen million five hundred ten thousand outlayed alongside remaining amounts representing short trades approximating ten million eight hundred eighty-thousand respectively