During the early hours of trading today, Bitcoin surged past $117,000, marking its highest point since early August. This movement comes as traders adjust their positions in anticipation of the Federal Reserve’s decision on interest rates.

The results from today’s Federal Open Market Committee (FOMC) meeting are expected to shape the risk environment for the remainder of the year.

Recent market sentiment has been bolstered by expectations for a more lenient monetary policy.

A report from Bitwise indicates that recent softening in US inflation figures has led futures markets to fully incorporate a quarter-point rate cut into their pricing, with nearly 93% probability that total cuts will reach 75 basis points by year-end.

This potential for looser financial conditions has invigorated cryptocurrency markets. Bitwise noted a “return to slightly bullish sentiment,” reflecting an increasing appetite for risk among investors.

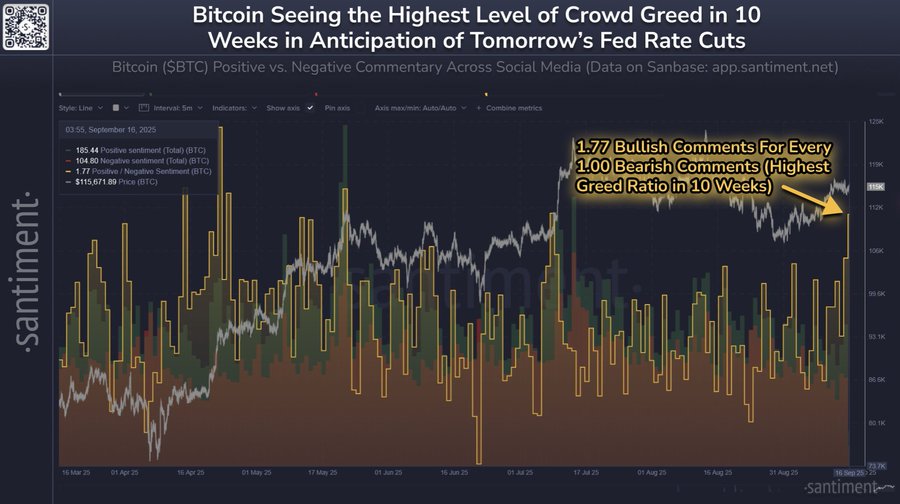

This perspective aligns with insights from blockchain analytics platform Santiment, which observed a significant rise in bullish sentiment across social media platforms like X.

Santiment reported that optimistic discussions now constitute 64% of all conversations related to cryptocurrency—marking its highest level of “crowd greed” since July.

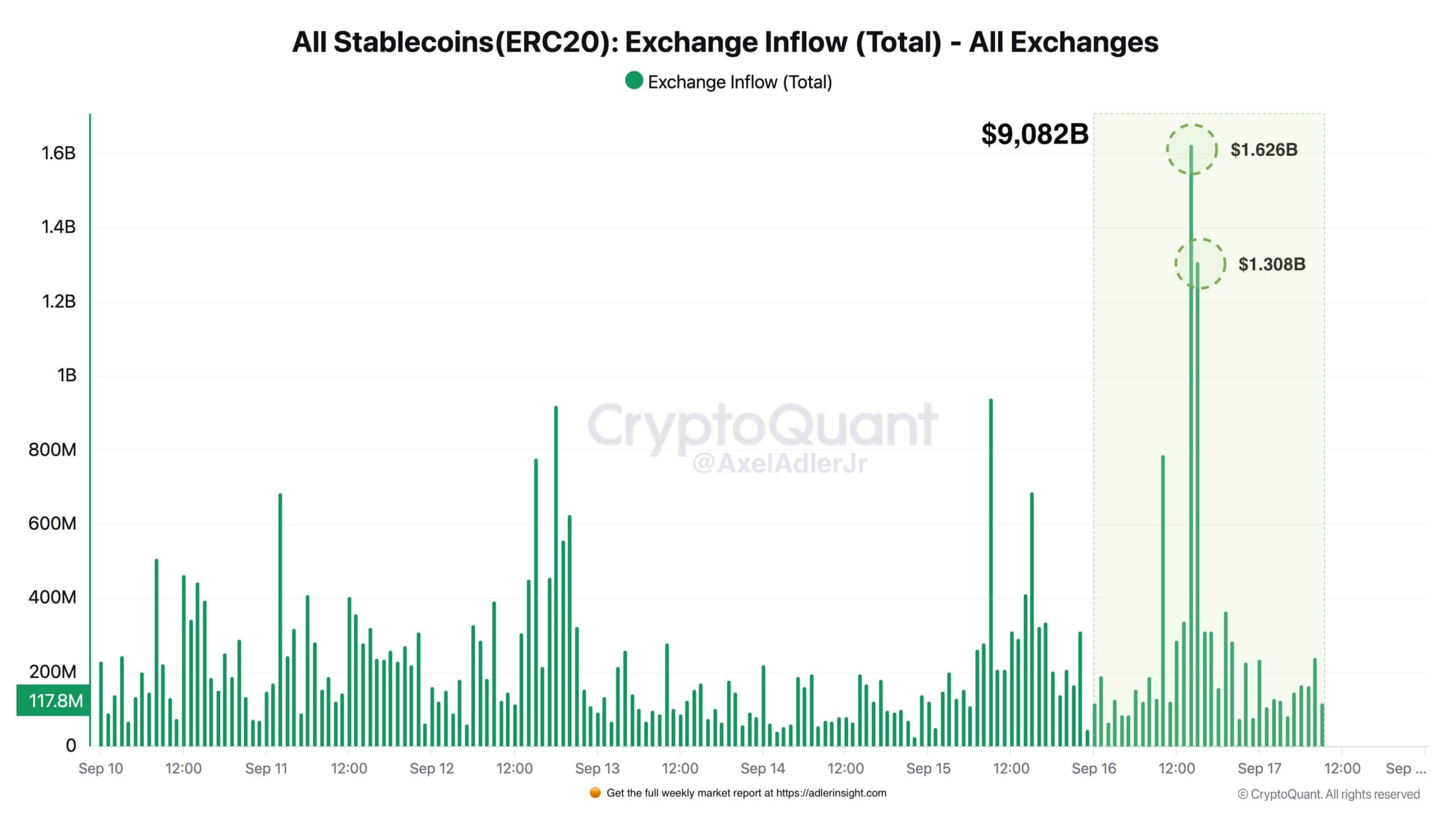

Additionally, inflows of stablecoins into exchanges indicate that substantial capital is poised to take advantage of market movements.

CryptoQuant analyst Axel Adler highlighted that approximately $9 billion worth of stablecoins have flowed into exchanges over the last 36 hours leading up to the Fed meeting. This suggests traders are ready to act swiftly following any announcements made by the Fed.

Caution Ahead

Nevertheless, despite prevailing bullish trends, Santiment cautioned that markets frequently move contrary to retail consensus; thus excessive optimism could leave traders vulnerable if unexpected decisions arise from the Fed’s meeting.

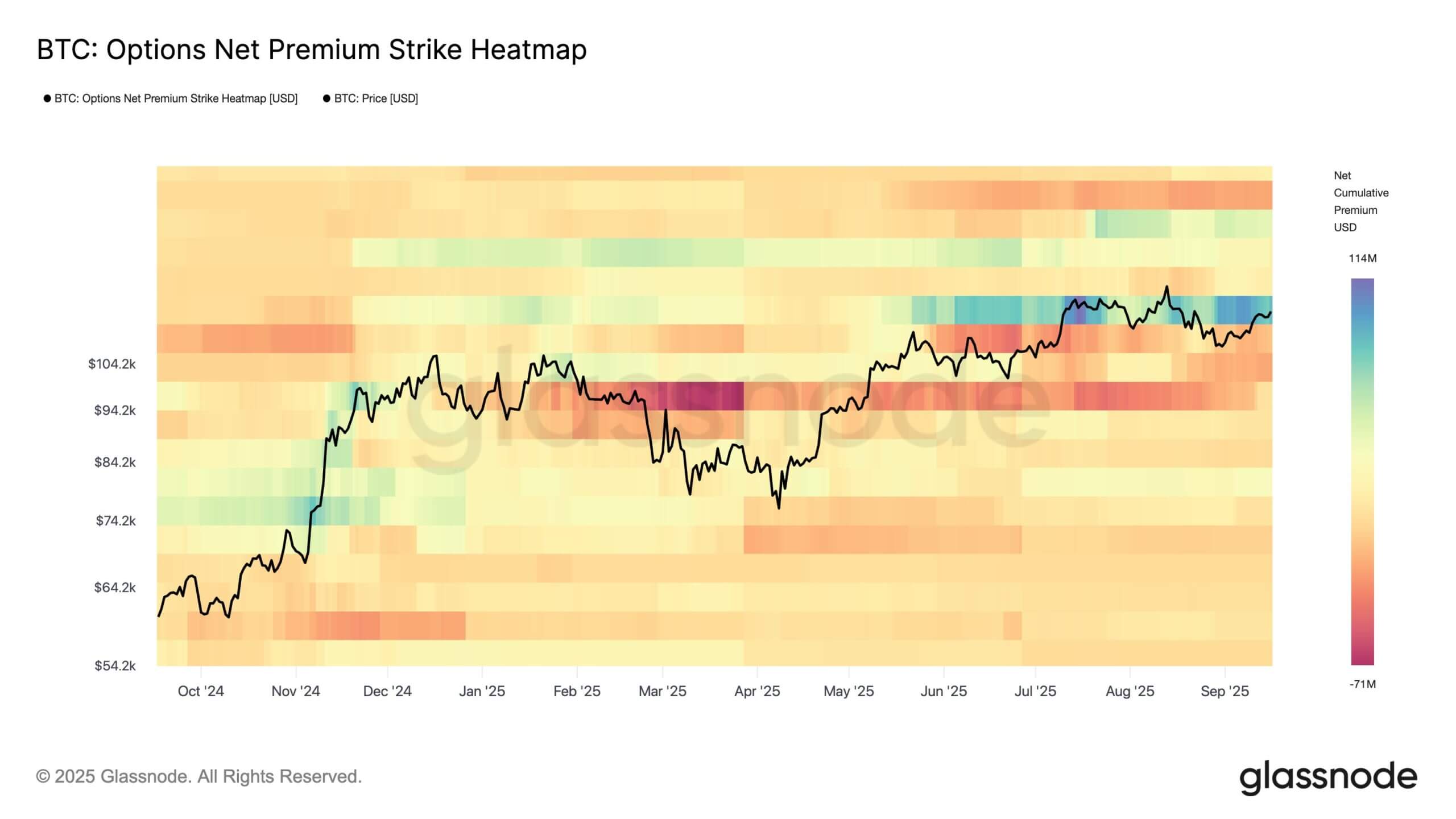

The blockchain analysis firm Glassnode also noted similar tensions within derivatives markets as options traders prepare for potential price fluctuations actively.

“Options traders are rapidly buying options either as hedges or positioning themselves ahead of anticipated volatility spikes—this reflects both uncertainty and expectations within the market regarding significant movements.”

Taking this into account, Timothy Misir—the head researcher at BRN—shared with CryptoSlate, stating “Bitcoin finds itself at a pivotal juncture.”

“A sustained breakthrough beyond $116,300 and $117,000 driven by liquidity from Fed actions could pave pathways toward higher levels around $120,000. However, this setup remains fragile; weak conviction zones and concentrated liquidation clusters combined with elevated geopolitical risks imply that one headline or remark from Powell could trigger a downward snap.”