Currently, Bitcoin is valued at $115,329 and boasts a market cap of $2.29 trillion. In the last 24 hours, it experienced a trading volume of $38.62 billion, fluctuating within a narrow price range from $114,509 to $115,995—indicative of the prevailing uncertainty in the market.

Bitcoin

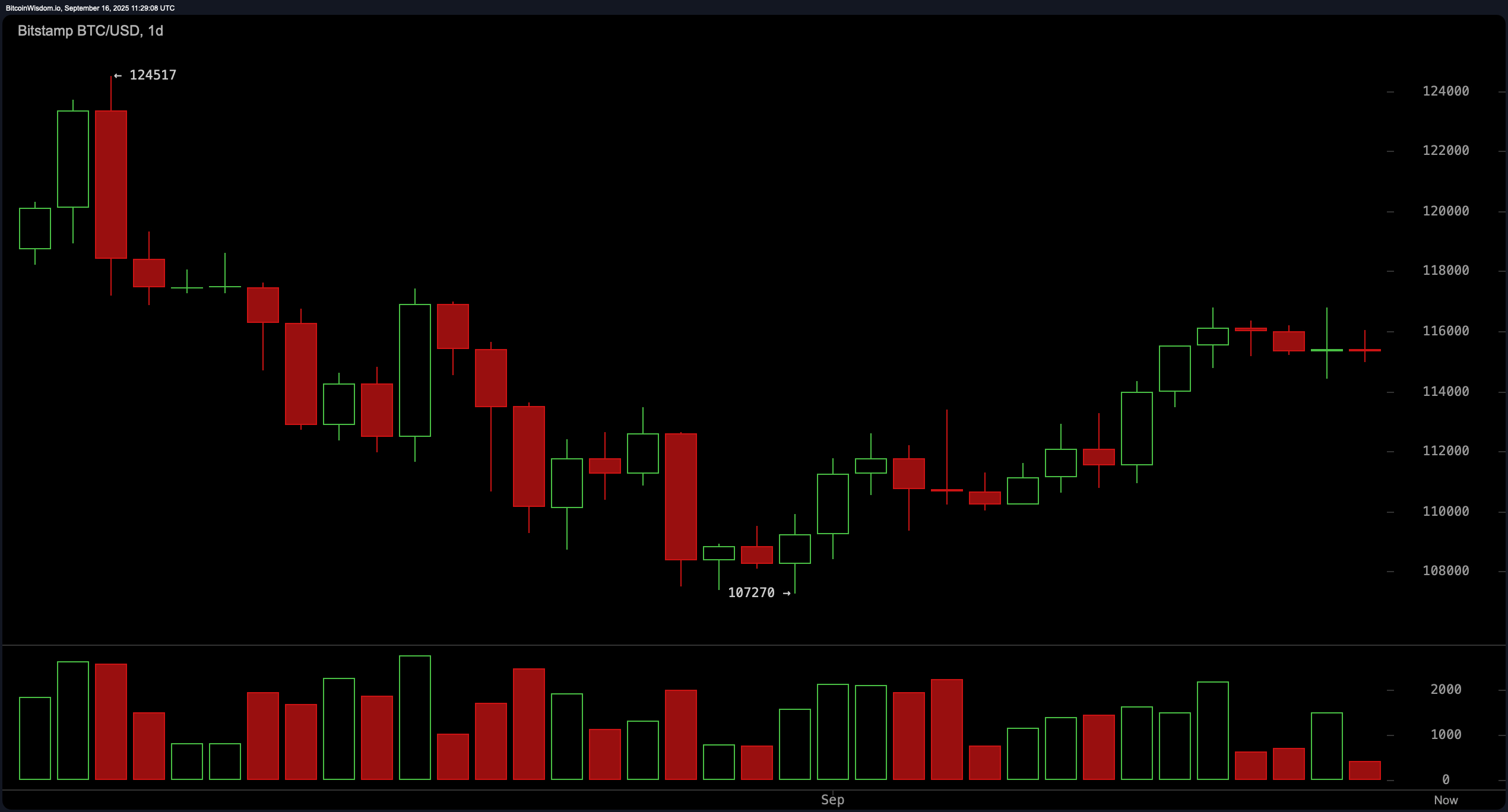

The daily chart indicates that Bitcoin’s bullish trend may be losing strength after bouncing back from a local low of $107,270. Initially characterized by consistent green candlesticks and robust trading volume during its recovery phase, recent sessions have shown declining volume—a potential sign that bullish momentum is diminishing. Currently, prices are consolidating just below the resistance zone ranging from $116,000 to $117,000. Traders should keep an eye on levels between $112,000 and $113,000 for possible long positions if selling pressure remains subdued. It’s advisable to consider profit-taking near resistance unless there’s a notable increase in volume.

BTC/USD 1-day chart via Bitstamp on Sept. 16, 2025.

On the four-hour timeframe chart for Bitcoin shows it reached a peak of $116,805 on September 13 before entering into sideways movement between prices of approximately $114,800 and up to around $116K. This pattern could either represent a bull flag or signal potential distribution depending on how volume behaves moving forward. While support appears at around $$112289$, bearish candlestick formations alongside indecisiveness create an ambiguous setup here; thus caution is warranted.

BTC/USD 4-hour chart via Bitstamp on Sept. 16 ,2025.

The one-hour bitcoin analysis presents an increasingly bearish perspective with local highs reaching only up until about $$116786$ before plunging downwards towards $$114421$. Following this drop were subsequent lower highs which suggest bearish divergence has set in place; noteworthy was also how volumes surged during declines yet remained weak throughout recoveries—a classic dead cat bounce scenario indicating possible distribution or profit-taking among short-term holders . A significant move above $$116K$ accompanied by strong volumes would be necessary for reinstating any bullish momentum while breaking below $$114K$ could pave way towards testing support at$$112K$ again.

BTC/USD hourly chart via Bitstamp on Sept .16 ,2025.

Analyzing oscillators reveals that relative strength index (RSI) stands neutral at value ’57’. The Stochastic oscillator currently reads high but still holds neutrality as well ; meanwhile commodity channel index (CCI) registers bearish signals clocking-in close-to ‘103’ whilst average directional index(ADX ) confirms lackluster trends sitting comfortably under ’17’. Awesome oscillator registers around ‘2373’ also suggesting neutrality overall however both momentum readings show slight positive bias hovering near ‘5136’ while MACD levels appear similarly inclined showing values nearing ‘543’ .

The moving averages continue supporting an optimistic long-term outlook with all essential exponential moving averages (EMAs) along with simple ones(SMAs) across periods such as ten , twenty , thirty fifty hundred & two hundred signaling positivity overall – notably EMA50 sits roughly @‘113518’, SMMA50 comes close @‘114358’; both remain beneath current pricing providing dynamic backing going forward! Nevertheless without substantial uptick seen within volumes these indicators might act more like guidelines aimed towards establishing longer-term positions rather than serving immediate conviction needs!

Bullish Outlook:

If Bitcoin can decisively breach past threshold set forth @‘16800’ accompanied by convincing trade activity we may witness continuation patterns emerge reflecting broader upward trajectories supported through strong alignments observed amongst key metrics including MACD/momentum indicators alike! Should this unfold retesting zones located anywhere between ’118k-120k’ becomes increasingly plausible especially given surge pressures accelerating buying behaviors confirmed through reliable breakout signals!

Bearish Outlook:

A failure maintaining supports established near level marked out previously ($’14000′) could trigger retracements targeting regions closer aligned toward lower end estimates surrounding potentially dipping even further should sell-side pressures ramp-up noticeably higher! Weakening profiles observed upon daily charts combined alongside divergences witnessed hourly lend credence urging caution ahead—often acting precursors hinting short-lived reversals might lie ahead too hence prompting traders adopting protective stances against downside risks until price action reclaims definitive structures exhibiting stronger confirmations leaning positively instead !