As of September 15, 2025, Bitcoin is valued at $115,051 with a market cap of $2.29 trillion. The trading volume over the past day reached $39.26 billion, and the price fluctuated between $114,790 and $116,689, indicating a period of tight consolidation amidst an unclear market trend.

Bitcoin

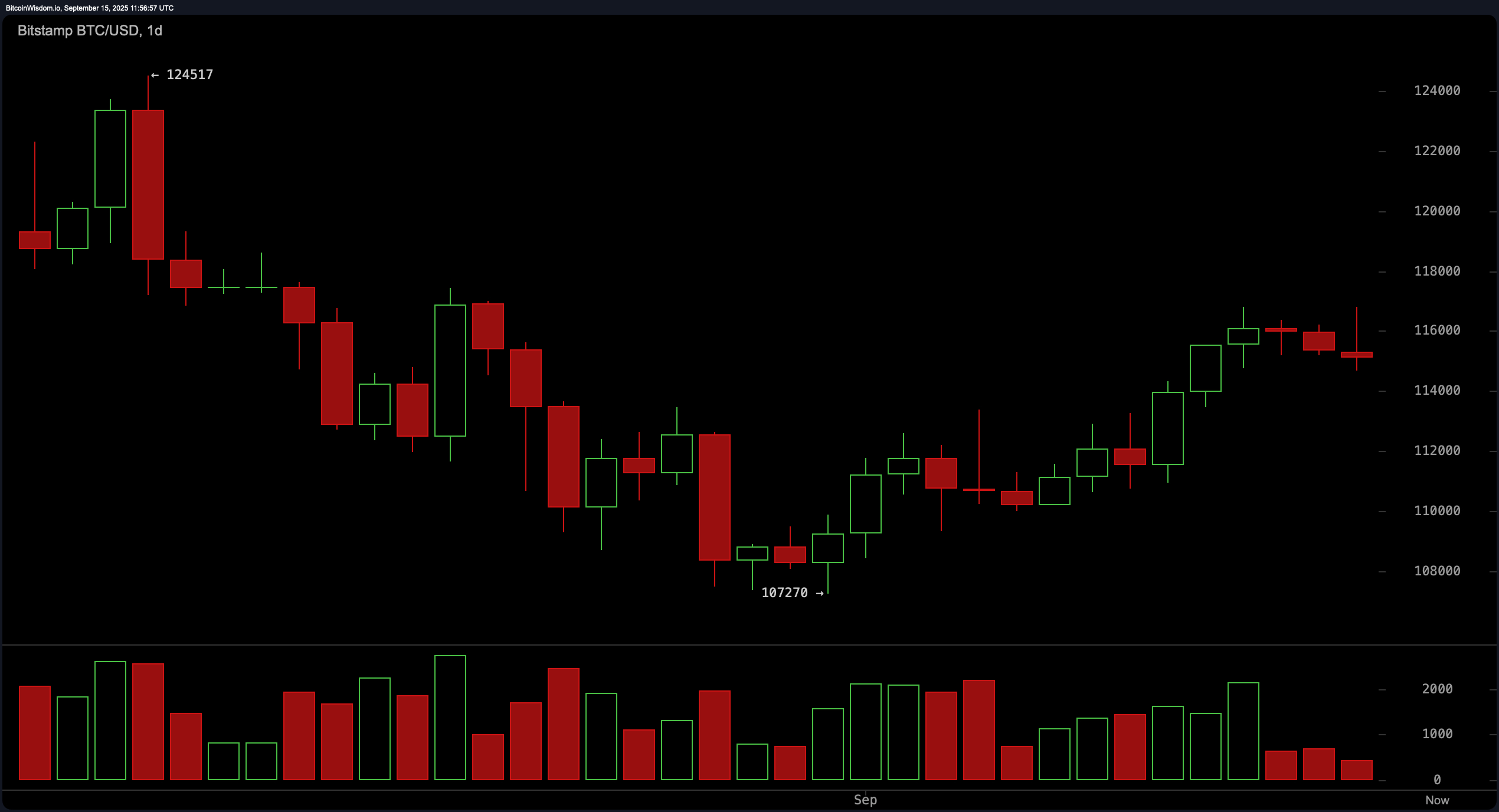

The daily chart indicates that Bitcoin is currently in a recovery phase after experiencing a significant pullback from its previous high of $124,517. The price action reveals an upward trend characterized by higher lows and higher highs. A crucial support zone has emerged between $112,000 and $113,000 where buyers have previously entered the market. However, momentum seems to be waning near the resistance level around $116,000 as evidenced by smaller candle bodies and reduced bullish enthusiasm. A daily close above the threshold of $117,000 could initiate movement towards the next target at approximately $120,000; conversely any drop below the key level of $110,000 might jeopardize this bullish outlook.

BTC/USD 1-day chart via Bitstamp on Sept. 15,2025.

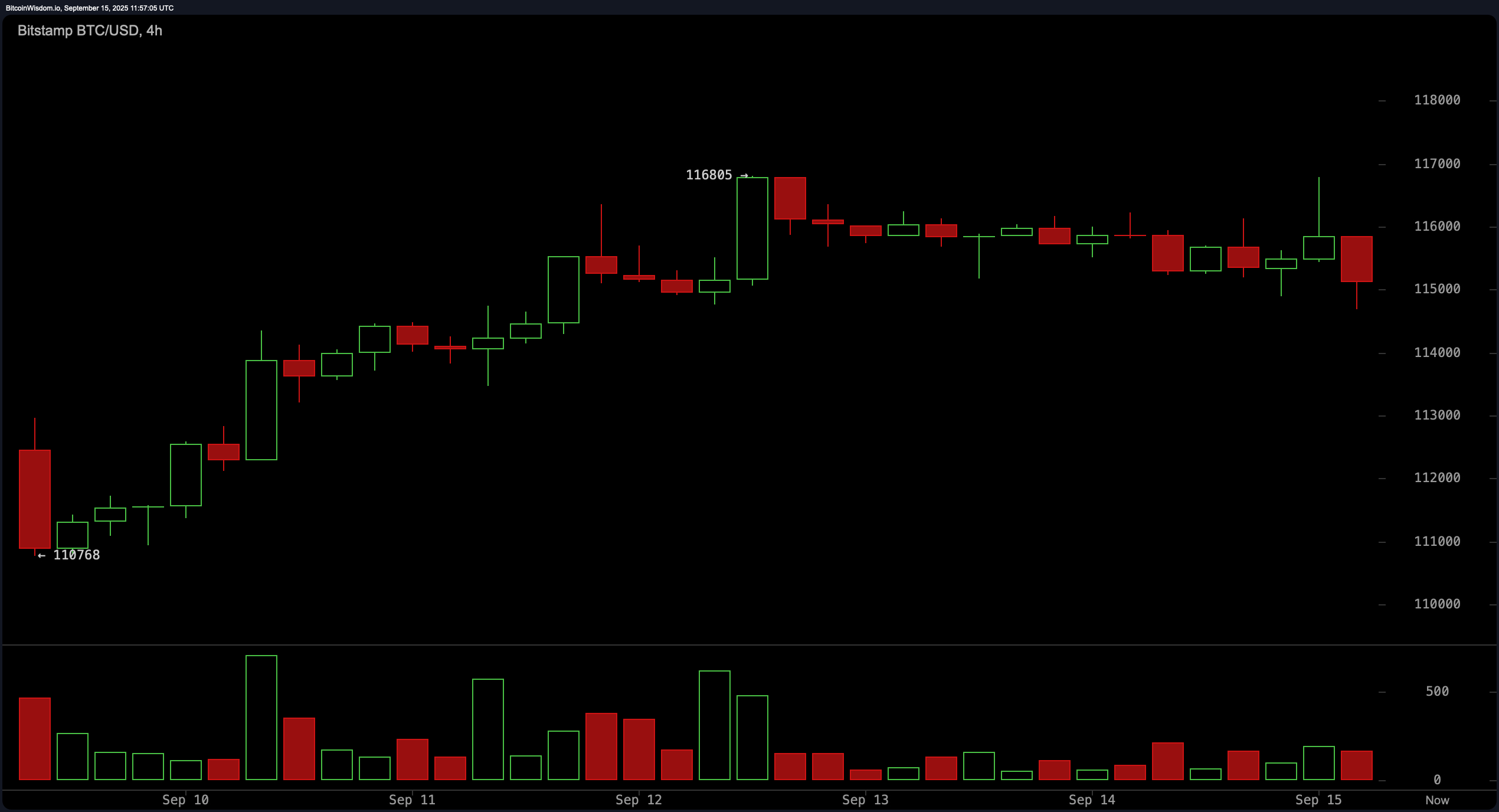

The four-hour chart shows that Bitcoin has been trading sideways within a narrow range from about $110,768 to approximately $116,805 during this consolidation phase. The absence of significant trading volume suggests that traders are waiting for some catalyst to break free from this stagnation pattern. If prices can rise above $116,800 with increased volume support following this flat top formation near resistance levels it may indicate potential for further bullish continuation; however until such confirmation occurs traders should remain cautious while observing either for breakout signals or retracement towards the support area around $114,000.

A strong resistance barrier persists between $117,500 and $118,000 which could limit upward movements in the short term.

BTC/USD 4-hour chart via Bitstamp on Sept。15、2025.

On examining the one-hour chart we see evidence pointing toward bearish activity emerging after rejection occurred near pricing levels around $116、700 where sellers took control leading downwards toward values closer to about

$114、600.

This price action demonstrates difficulty reclaiming back up through levels marked at roughly

$115、500 indicating short-term selling pressure remains prevalent.

The observed structure resembles what could be classified as mini double tops increasing chances further downside unless those earlier mentioned prices are reclaimed successfully during intraday sessions.

Traders focusing on shorter timeframes should keep watch over critical points like

$114、500—if broken downward accompanied by substantial volumes it may push pricing downwards reaching targets closer towards

113،000 while decisively moving beyond

115،500 would present opportunities targeting nearer proximity up through

116،200。

BTC/USD 1-hour chart via Bitstamp on Sept。15、2025.

The oscillator indicators provide mixed signals regarding technical analysis outcomes—the relative strength index (RSI) stands at reading point fifty-six suggesting neutral momentum exists whereas stochastic oscillators reflect eighty-five also residing within neutral parameters

Meanwhile commodity channel index (CCI) registers one hundred twenty-three implying negative conditions alongside momentum indicator readings hovering around four thousand four hundred eighty supporting similar views but contrastingly moving average convergence divergence (MACD) sits firmly positive signaling possible upward shifts adding complexity into short-term sentiment assessment whilst average directional index ADX maintains eighteen confirming lack thereof strong trending movements presently observed across markets.

A clearer optimistic bias emerges when reviewing moving averages since all major short- & long-term averages align favorably above current pricing metrics indicated throughout periods examined thus far

Exponential Moving Averages EMAs ranging across ten twenty thirty fifty hundred two-hundred signal positivity extending values stretching anywhere between approximately

one-hundred-fourteen-thousand-one-hundred-thirty-three down lower approaching even more foundational supports established upon two-hundred-period simple-moving-average SMA set firmly placed beneath its own level registering figures nearing one-hundred-two-thousand-six-fifty-eight providing solid ground if needed below certain thresholds witnessed recently.

This alignment beneath existing rates reinforces arguments advocating sustained pressures aimed upwards assuming no breaches occur crossing back under pivotal marks falling underneath targeted thresholds reaching out below ten thousand dollars overall respectively mentioned earlier prior here!

Bull Verdict:

Across broader timeframes Bitcoin continues maintaining structural integrity leaning positively influenced through various identified metrics supportive endorsing upside potentiality ahead

Sustained breakouts exceeding noted resistances found along borders drawn past sixteen-eight hundreds should pave pathways encouraging pushes onward nearing ranges approximating twelve grand easily attainable given confirmations arise verifying these moves effectively occurring without fail!.

Bear Verdict:

Caution must still prevail despite overarching bullish formations revealing themselves clearly visible overall patterns exhibited among higher timeframe analyses combined together yield mixed oscillator outputs suggestive hesitance remaining active during shorter engagements hence failure reclaiming benchmarks hitting fifteen-five ought raise alarms possibly leading accelerations spiraling downward trends pushing closer yet again testing limits situated just shy thirteen grand mark revisiting concerns surrounding possible breakdowns reintroducing bearish outlooks once more likely ensuing thereafter shortly thereafter following these events transpiring accordingly!