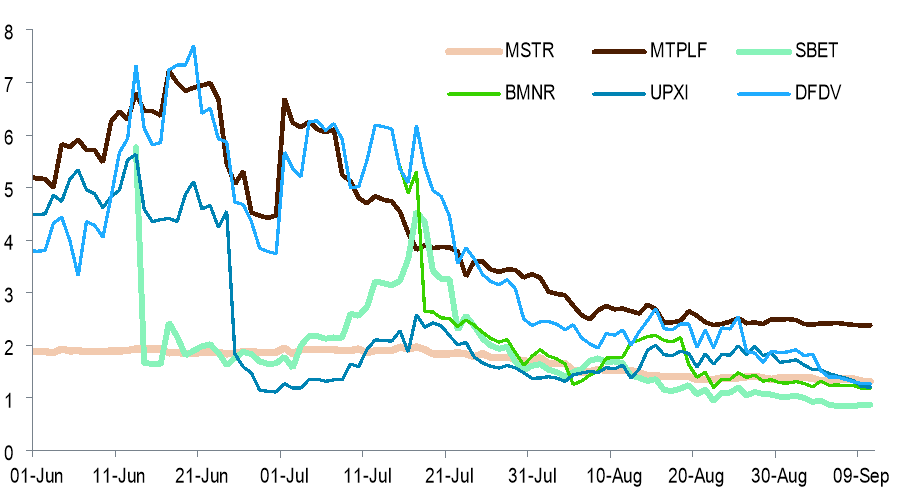

According to a study conducted by Standard Chartered Bank, which is based in London, the modified net asset values (mNAVs) of companies holding bitcoin as part of their treasury are on a downward trajectory.

Bitcoin Pauses as Digital Asset Treasuries Face Challenges

This Monday, Michael Saylor’s company, MicroStrategy (Nasdaq: MSTR), revealed that it had acquired an additional 525 bitcoins (BTC), raising its total holdings to 638,985 BTC. However, the mNAV for MSTR has decreased to 1.47. A research division at Standard Chartered Bank indicates that declining mNAVs are hindering digital asset treasury companies (DATs) and causing a slowdown in new purchases—this may shed light on why bitcoin’s recent surge seems to have stalled.

In the context of DATs, mNAV represents the relationship between a company’s enterprise value and its dollar-denominated bitcoin assets. Previously, firms like MicroStrategy enjoyed mNAV figures soaring as high as 3.00; this indicated that MSTR was valued at three times what its BTC reserves were worth in market terms.

However, with numerous companies entering the DAT space recently, these mNAV values have dwindled down towards the critical threshold of 1.00. According to Standard Chartered’s analysis, reaching this level poses significant challenges for DATs looking to expand their bitcoin acquisitions.

“Digital asset treasuries are currently facing difficulties,” stated Geoffrey Kendrick from Standard Chartered’s digital assets research team in a newsletter released on Monday. “A higher mNAV signifies greater sustainability for businesses and allows them more capacity for purchasing coins; conversely, lower mNAV suggests otherwise.”

Market Overview

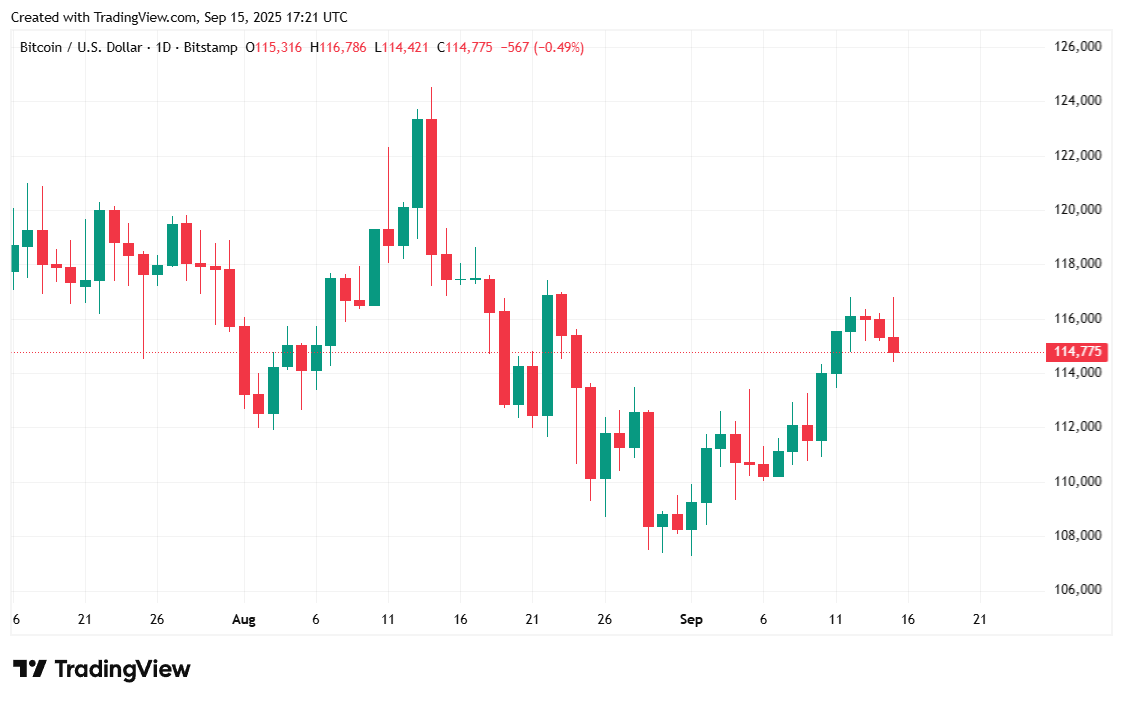

The price of bitcoin stood at $114,883.07 during this report—relatively stable but reflecting a slight decrease of 0.56% over the past day according to Coinmarketcap data. Since Sunday evening, Bitcoin has fluctuated between $114,461.06 and $116,747.88.

The trading volume over twenty-four hours surged by 55.56%, reaching $49.79 billion following weekend activity—a typical increase after Sundays’ trading sessions concluded.

The overall market capitalization remained relatively stable but dipped slightly by 0.56%, aligning with price movements and settling at approximately $2.

28 trillion.

In contrast,

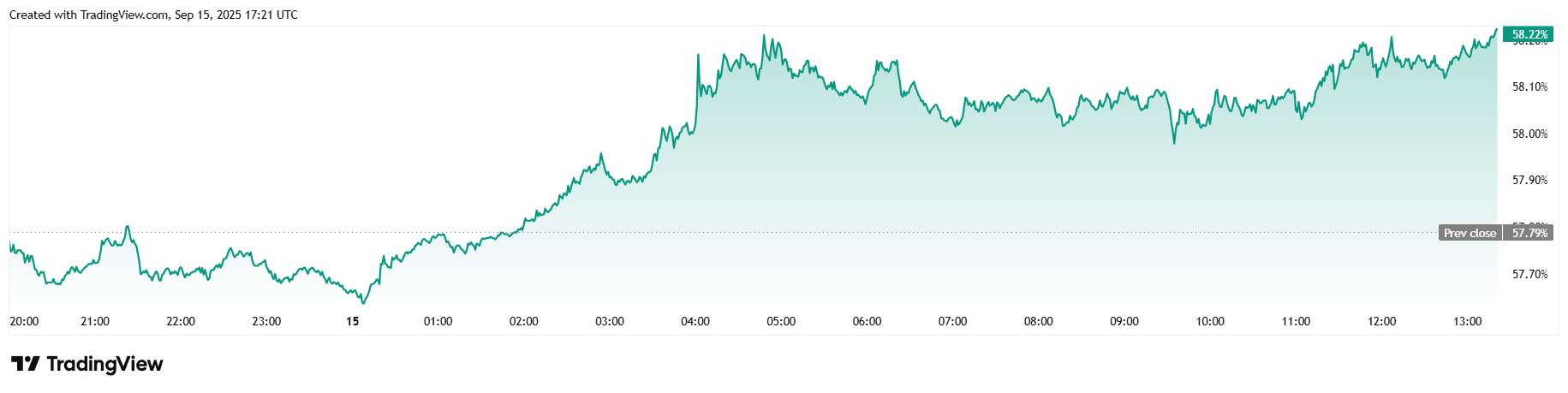

Bitcoin dominance saw an uptick of about 0.

73% since yesterday,

rising to reach around

58.

22%.

Total open interest in Bitcoin futures also showed minimal change within twenty-four hours,

experiencing only a minor decline of

0.

22%

to stand at

$83.

12 billion according

to Coinglass.

Liquidations related specifically

to Bitcoin totaled

$45.

92 million,

with long positions accounting for

$35.

22 million while short positions contributed approximately

$10.

70 million.