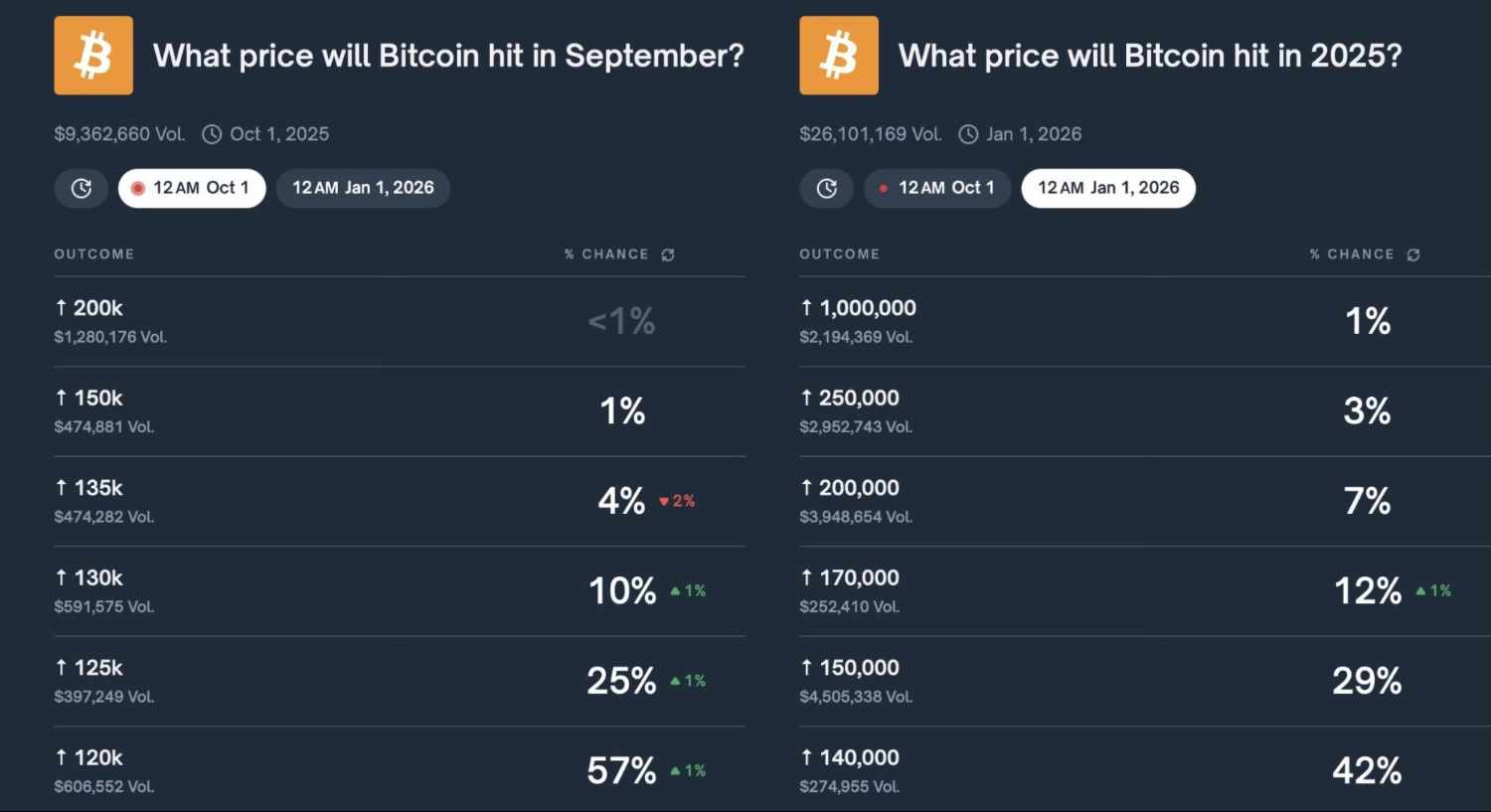

On the prediction platform Polymarket, nearly $600,000 has been wagered by traders on contracts suggesting a 10% likelihood that Bitcoin (BTC) will reach $130,000 by October 1, 2025.

Additionally, current odds indicate a 29% chance of BTC hitting $150,000 by the end of this year. This particular bet represents the largest single wager with over $4.5 million in total betting volume at stake.

A smaller group of traders is even more optimistic; about 3% have placed nearly $3 million on a price target of $250,000 and another 1% has staked almost $2.2 million on Bitcoin potentially soaring to $1 million by January 1, 2026.

Is Bitcoin Heading Towards $130k?

As of now, Bitcoin is trading at approximately $115,700 and has seen a weekly increase of 3.5%. This rise can be attributed to strong institutional interest through spot exchange-traded funds (ETFs), which recorded inflows totaling around $2.3 billion just last week.

The broader economic environment continues to be influenced by monetary policy decisions. For example, Polymarket estimates there’s a remarkable 98% probability that the Federal Reserve will announce a rate cut during its upcoming meeting set for September 16–17.

The recent softer inflation data has led traders to anticipate greater liquidity in the market—a scenario reminiscent of the rally from late-2020 into early-2021 when BTC surged from around $10,000 to an all-time high near $69,000.

The Potential Influence of Gold on Another Bitcoin Surge

Additonally,Bitcoin’s performance is closely linked with gold prices; as gold rose above \$3,650 per ounce on September 12—coinciding with silver reaching its highest closing price in fourteen years—there are implications for BTC’s trajectory as well.

If gold maintains its upward trend,BTC’s current phase could reflect earlier consolidation periods before significant breakouts since historical patterns suggest that Bitcoin often reverses direction and breaks out following peaks in precious metal prices.

From a technical analysis standpoint,BTC successfully reclaimed its key moving average—the fifty-day simple moving average (SMA)—just above \$114500 after breaking free from an ongoing downtrend channel observed throughout September.Currently,resistance levels are forming between \$117500 and \$118000; if these levels are surpassed,a potential target price could be set at \$125000.

This image was sourced via Shutterstock.