The recent movements in Bitcoin’s value have once again drawn attention, as it has made a notable recovery from the $112K support level and is currently trading above $116K. Let’s explore what might unfold next.

Key Support and Resistance Levels

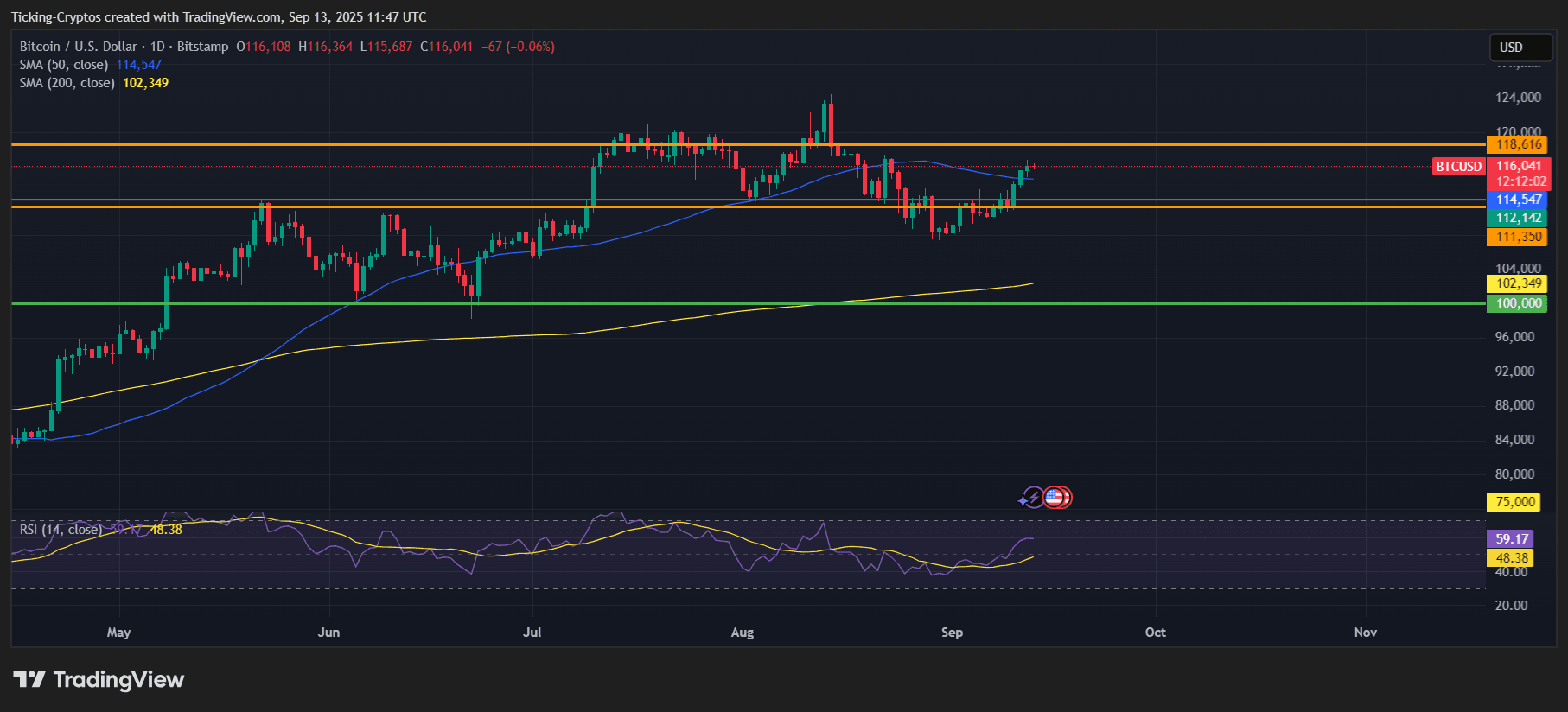

The chart indicates a significant support area between $111,350 and $112,142. This zone has proven to be a robust barrier for BTC, with buyers actively entering the market. Below this range lies the 200-day SMA at $102,349 along with the psychological threshold of $100,000, which serves as an essential safety net for medium-term traders.

BTC/USD daily chart – TradingView

On the upside, immediate resistance can be found at around $118,616. This price point has previously acted as a barrier against Bitcoin’s ascent multiple times and is considered a critical battleground. A confirmed breakout above this level could ignite bullish momentum towards higher targets.

Short-Term Forecast for Bitcoin

In terms of short-term predictions, the RSI is on an upward trajectory at approximately 59—just shy of overbought territory. This suggests that there is healthy buying activity without reaching extreme levels yet. If BTC manages to stay above its 50-day SMA while breaking through the $118K mark, we could see targets set around $120K to $122K.

If there’s rejection at the resistance level of $118K though, it may lead to a slight pullback that could retest around the value of $114K before making another attempt upwards.

Midsize Outlook for Bitcoin

An analysis of broader trends shows that the 200-day SMA sitting at about $102,349 is trending upwards—indicating solid medium-term support exists here. Should BTC successfully breach and consolidate above$11861816$, it opens up possibilities for a rally towards approximately$125000$. Beyond this point,$130000$ would become an enticing psychological target for bulls in pursuit.

If momentum starts to wane however,Bitcoin might retreat back into its previous range between$111k–$112k$. A more substantial correction down toward$100k$is only likely if global market sentiment takes a significant downturn.

Your Guide: What Steps To Take Regarding Bitcoin Prices?

The resilience shown by Bitcoin after bouncing back from recent lows while reclaiming its position above its 50-day SMA signals potential strength ahead.Traders should keep their eyes peeled on resistance near$118k—a successful breakout here may pave way toward achieving target prices near.$125k.in coming months; conversely,a rejection may trigger another consolidation phase closer toward.$114k..