The Smarter Web Company, recognized as the largest corporate holder of Bitcoin in the UK, is contemplating the acquisition of struggling rivals to bolster its cryptocurrency reserves, according to CEO Andrew Webley.

In an interview with the Financial Times, Webley expressed that he would “definitely consider” purchasing competitors’ assets to obtain their Bitcoin (BTC) at a reduced price.

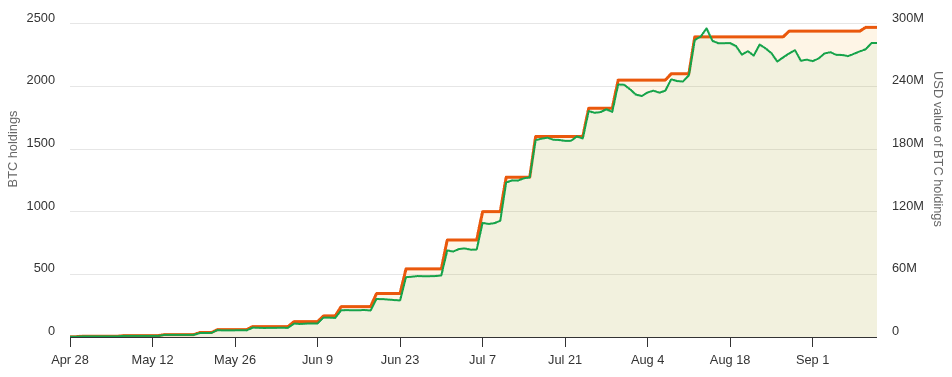

As per data from BitcoinTreasuries.NET, The Smarter Web Company ranks as the 25th largest holder globally and leads in corporate Bitcoin holdings within the UK. Currently, it possesses 2,470 BTC valued at approximately $275 million.

The BTC holdings of The Smarter Web Company (in orange) alongside their USD value (in green). Source: BitcoinTreasuries.NET

Webley’s aspirations extend beyond mere acquisitions; he aims for his company to join the FTSE 100 index — which features Britain’s top hundred publicly traded firms. He also mentioned that a rebranding is “inevitable,” but emphasized that it must be executed thoughtfully.

Alex Obchakevich from Obchakevich Research shared insights with Cointelegraph regarding potential acquisitions of bankrupt crypto firms. He noted that while such purchases can offer significant discounts initially, they often come with unforeseen complexities and challenges.

Related:Metaplanet and Smarter Web add nearly $100M in Bitcoin to their treasuries

Citing instances like FTX’s collapse and Celsius’ bankruptcy proceedings, Obchakevich explained how initial discounts ranging from 60% to 70% can diminish significantly after accounting for liabilities settled during bankruptcy processes and other legal encumbrances—often leaving only a net discount between 20-50%.

“This situation attracts seasoned investors since these assets are undervalued due to urgent circumstances.”

The remarks by Webley came on the heels of a nearly 22% drop in The Smarter Web Company’s stock on Friday; shares fell from $2.01 at market opening down to $1.85 during reporting time despite BTC experiencing over a 1% increase within a day.

A chart depicting share prices for The Smarter Web Company. Source:Google Finance

This past month has seen Bitcoin lose more than 4% of its value while shares in The Smarter Web have plummeted around 35.5%. This decline coincides with new regulations allowing retail investors access to crypto exchange-traded notes (ETNs), effective October 8th—a shift providing alternative investment avenues compared to previously available regulated options focused on crypto treasury companies within the UK market.

Related:The UK’s Smarter Web Company raises $21M through bonds denominated in Bitcoin

Taking Advantage of Rivals’ Downfall

The CEO’s comments about pursuing competitor acquisitions align with recent observations indicating that smaller or newer entities holding Bitcoins may face significant challenges ahead. Coinbase’s head researcher David Duong along with colleague Colin Basco recently indicated that public companies acquiring cryptocurrencies are entering an increasingly competitive phase where securing investor funds will become fiercer than ever before.

<p“They stated strategically positioned players will thrive,” highlighting how capital flow could invigorate growth across this sector while cautioning against oversaturation—many cryptocurrency treasuries may not endure long-term viability under current conditions.”

Josip Rupena—the CEO behind lending platform Milo—also weighed in last month suggesting parallels between risks associated with crypto treasury companies today versus collateralized debt obligations prior which contributed heavily towards triggering financial turmoil back in ’08.”

“There exists this tendency where individuals take what was once considered stable products such as mortgages or now digital currencies like bitcoin then manipulate them leading into uncertainties regarding actual exposure being undertaken by investors,” he remarked.”

<Em Magazine: <Em "Bitcoin might dip below '$50K' amid bearish trends – Hodler Digest covering events from Aug.'31-Sept.'6"</P