Investors are leveraging their positions in a bid to push Bitcoin BTC$115,283.91 back towards its all-time highs. This strategy introduces significant risks, as any downturn could trigger a sell-off in derivatives.

Market analyst Skew cautioned that one trader looking to establish a nine-figure long position should consider waiting for the spot market to support the buying activity, which would help avoid creating adverse flows.

$BTC

To the random 9 figure whale apeing into longsmaybe wait for spot to carry the buying so it doesn’t create toxic flows pic.twitter.com/GOi1GZazl0

— Skew Δ (@52kskew) September 12, 2025

Bears are also employing leverage; one trader is currently facing an unrealized loss of $7.5 million after shorting BTC with a total of $234 million at an entry price of $111,386. To sustain their position, this trader has added $10 million in stablecoins while facing liquidation at around $121,510.

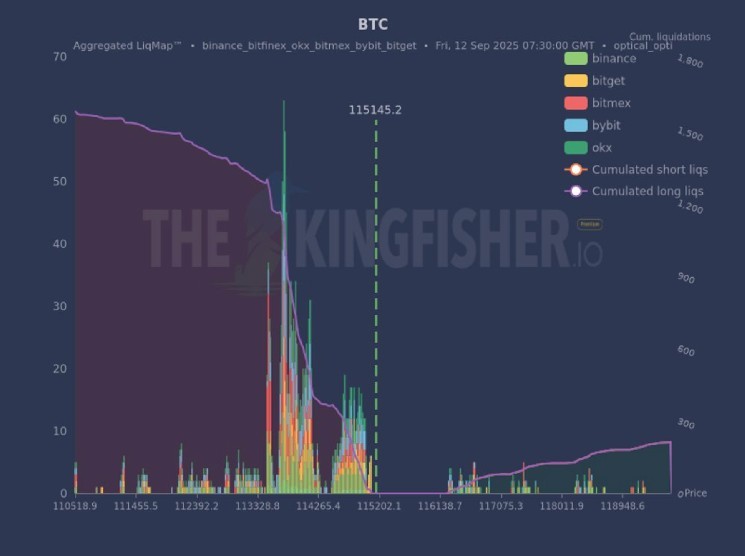

The most pressing liquidation risk appears on the downside. Data from The Kingfisher indicates that a significant amount of derivatives may be liquidated between prices of $113,300 and $114,500. This scenario could potentially lead to a cascade effect down towards the support level around $110,000.

“This chart illustrates where traders have taken on excessive leverage,” noted The Kingfisher. “It’s essentially a pain map; prices often gravitate toward these areas to clear out positions. Utilize this information wisely so you don’t find yourself caught off guard during major price movements.”

Currently trading quietly near $115,000, Bitcoin has entered a phase characterized by low volatility and has struggled to break free from its existing range for over two months now.