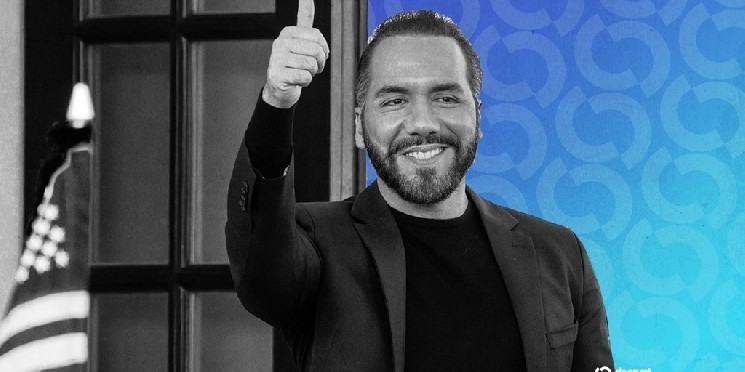

Supporters of Bitcoin globally are captivated by the economic strategies employed by El Salvador’s president, Nayib Bukele, particularly his acceptance of cryptocurrency. However, a closer examination of his administration’s cryptocurrency acquisitions reveals some inconsistencies.

In 2022, this millennial leader declared his intention to purchase one Bitcoin daily. At current market values, that translates to an expenditure exceeding $114,000 every single day for what is often referred to as digital gold.

On occasion, Bukele has claimed he purchases even larger amounts: just recently he revealed that he acquired 21 BTC in celebration of the fourth anniversary of El Salvador’s Bitcoin Law. This represents an additional investment worth approximately $2.3 million into the government’s newly established transparent blockchain reserves, which reportedly now contain over $700 million in BTC.

However, the International Monetary Fund (IMF) presents a different narrative. As part of a deal for development assistance from the IMF, El Salvador was compelled to curtail its Bitcoin initiatives by December 2024. The IMF has since asserted that announcements regarding new Bitcoin purchases are misleading.

“We can confirm that there has been no increase in government-owned Bitcoin and that any growth in the Bitcoin Reserve Fund is linked to movements within governmental wallets,” stated Meera Louis from IMF Communications in an email correspondence with Decrypt.

The organization did not provide further comments on this matter.

If President Bukele isn’t actually acquiring more Bitcoins as per IMF claims, why does he consistently announce new purchases? Additionally, how does blockchain data indicate that El Salvador continues adding one BTC daily?

The communications department for the Salvadoran government informed Decrypt that President Bukele is indeed still making these acquisitions but did not respond to further inquiries.

An analysis firm named Arkham indicates through blockchain data tracking that El Salvador’s collective Bitcoin wallets are indeed increasing at a rate of one BTC per day due primarily to deposits from exchanges like Binance and Bitfinex along with various other addresses involved.

This raises questions about whether these transactions represent genuine new buys or if they stem from earlier activities—potentially obscured before transparency measures were implemented under Bukele’s administration when there was minimal visibility regarding such transactions. Previously traceable only through tweets made by Bukele himself—who even humorously claimed he’d purchased BTC while “in the toilet.”

A possibility exists where prior acquisitions or other forms of tax payments made before recent agreements with the IMF could be financing transfers into their designated reserve fund today.

Bubblemaps noted when speaking with Decrypt, it remains uncertain based on public blockchain records exactly when today’s transferred Bitcoins were initially acquired; it’s conceivable they were obtained well ahead of late-2024 negotiations with the IMF and simply remained inactive within exchange accounts until being moved into publicly acknowledged wallets now.

Bubblemaps also pointed out recent governmental transactions might have been funneled through exchanges creating an illusion they represent fresh buys—a sentiment echoed by analysts who highlighted challenges accessing transaction ledgers without cooperation from those exchanges themselves providing necessary data disclosure.

- James Bosworth—the founder and CEO at Hxagon—a risk analysis consultancy based out Washington D.C.—expressed concerns during discussions held via Decrypt, emphasizing regardless if these bitcoin procurements qualify as novel investments or not greater transparency should have accompanied them right from inception.

“There exist valid reasons suggesting he’s not sourcing all bitcoins directly off open markets instead maneuvering funds around akin towards state-backed wash trading,” remarked Bosworth

He continued stating: “Bukele’s unprofessional oversight surrounding cryptocurrencies keeps clouding budgetary clarity; resources belong collectively unto citizens rather than being utilized whimsically within personal trading games.” .... . . . >The crypto platforms used by El Salvadors’ regime—Binance Bitfinex Coinbase—all opted against addressing inquiries posed towards them via Decrypt concerning such matters .