On Thursday afternoon, all three primary stock indices reached unprecedented heights, and by Friday, bitcoin began to mirror this upward trend.

Bitcoin Rises as Stock Markets Flourish

An interesting development unfolded on Thursday. Despite the Bureau of Labor Statistics reporting a higher-than-anticipated Consumer Price Index (CPI), the focal point shifted away from inflation. Instead, it was the notable increase in jobless claims that economists believe solidifies expectations for an interest rate cut by the Federal Reserve next week. This sentiment sparked a rally in stocks, leading all three major indices to close at record levels while bitcoin joined in on the excitement.

(Gemini co-founder Tyler Winklevoss predicted during a Friday interview that bitcoin could reach $1 million per coin within ten years.)

The S&P 500 finished at 6,587.47 points; the Nasdaq surpassed 22,000 for its first time ever; and the Dow Jones jumped past 46,000—marking its highest closing value yet. Oracle Corporation (NYSE: ORCL) led market gains with an impressive surge of 36% on Wednesday after securing several multi-billion-dollar contracts with various AI firms as noted by CEO Safra Catz. This remarkable rise has catapulted co-founder Larry Ellison into becoming one of the wealthiest individuals globally with a net worth nearing $400 billion—surpassing Tesla’s Elon Musk.

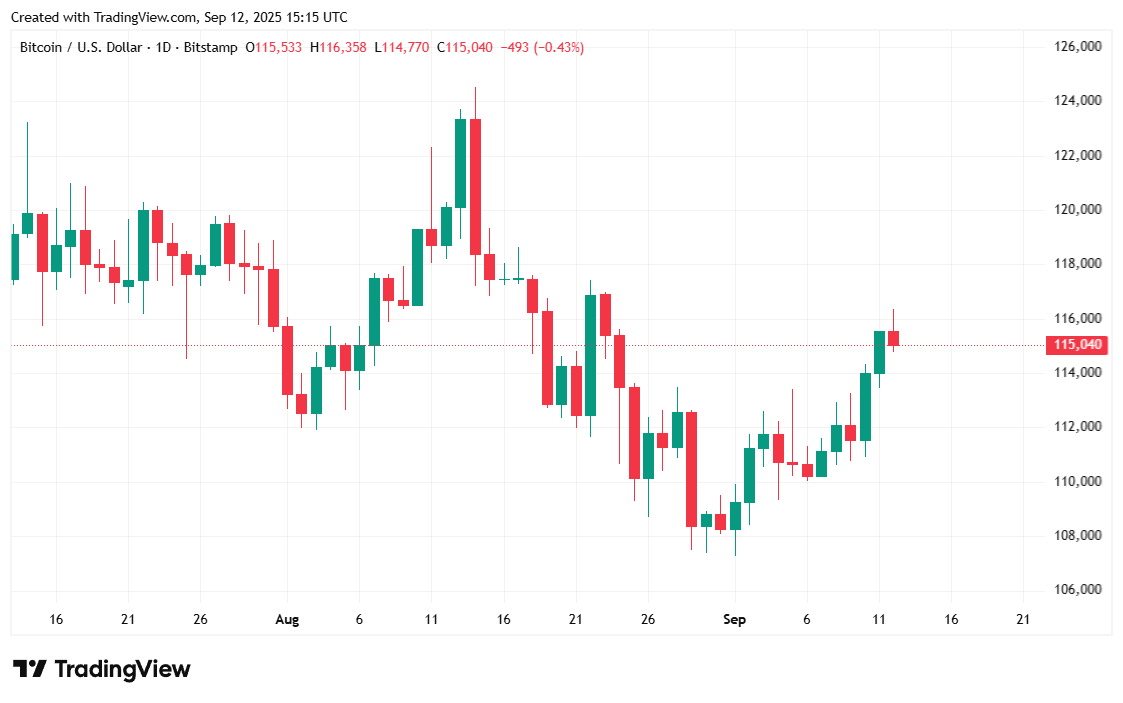

Meanwhile, in cryptocurrency markets, bitcoin emerged as a standout performer by extending its gains from equities and reaching over $116K during overnight trading before stabilizing around $115K early Friday morning.

“We are still very much at just the beginning,” stated Tyler Winklevoss during his interview on Friday regarding bitcoin’s potential to reach $1 million if it disrupts gold markets. “We believe there is easily room for growth tenfold from here—it’s still quite early days—and I think we’ll look back ten years from now and say ‘Wow! Today was really just scratching the surface.’”

Market Overview

As of this writing, Bitcoin is trading at approximately $115026.52—a slight increase of 0.38% over the last day according to Coinmarketcap data—with fluctuations between $114030.39 and $116317.21 observed since yesterday.

( Bitcoin price / Trading View)

The trading volume over twenty-four hours remained relatively stable but saw a minor decline of 0.93%, totaling around $46.65 billion while market capitalization rose by 0.53%, reaching approximately $2.

29 trillion; however,bitcoin dominance fell slightly by about

0.

52% to stand at

57.

98%.

( Bitcoin dominance / Trading View)

The total open interest for Bitcoin futures remained unchanged throughout today , inching up marginally

by

around

0 .

07 % , bringing it up to roughly

$85 .

10 billion according Coinglass data . However , liquidations involving Bitcoin surged significantly hitting about

$68 .

58 million since yesterday due largely short sellers facing losses amounting approximately

$61 .

90 million following overnight rallies within cryptocurrency space ; meanwhile long positions suffered comparatively smaller losses totaling only about

$6 .

68 million across same period .