The futures market for Bitcoin is currently experiencing a period of decline, prompting concerns about whether retail investors can maintain price momentum in the absence of significant involvement from institutional investors.

Recent insights from the blockchain analytics firm CryptoQuant indicate that smaller traders are increasingly influencing market dynamics, while selling pressure in futures contracts could potentially drive Bitcoin’s value downward.

Whales Withdraw as Retail Traders Take Charge

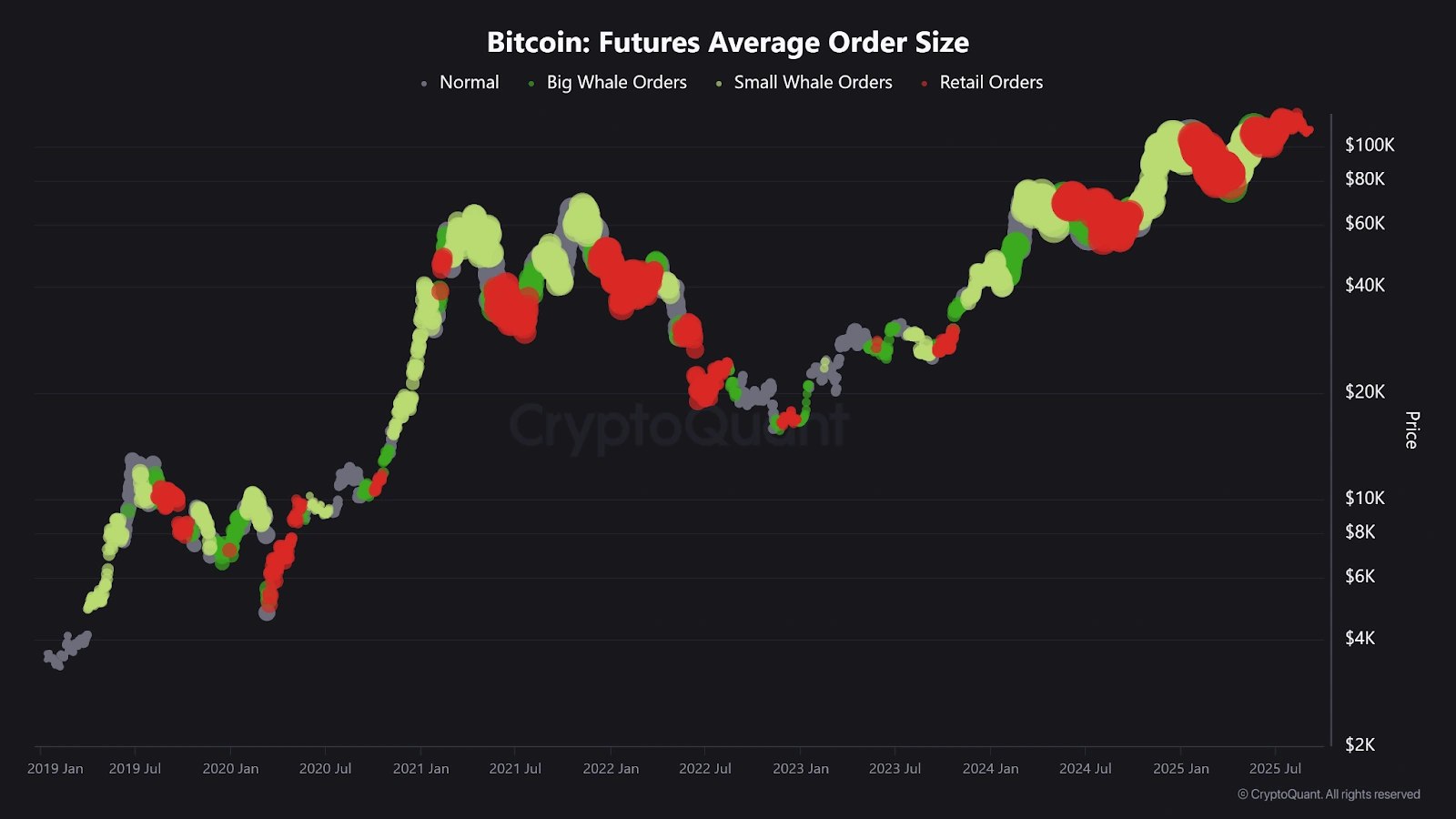

CryptoQuant’s analysis reveals a noticeable decrease in whale activity within the futures sector. The average order size, derived by dividing total trading volume by the number of trades, continues to diminish.

Bitcoin Futures Average Order Size. Source: Cryptoquant

Bitcoin Futures Average Order Size. Source: Cryptoquant

A larger average order size typically indicates greater participation from whale investors; however, current figures suggest that smaller transactions—indicative of retail traders—are now steering market trends.

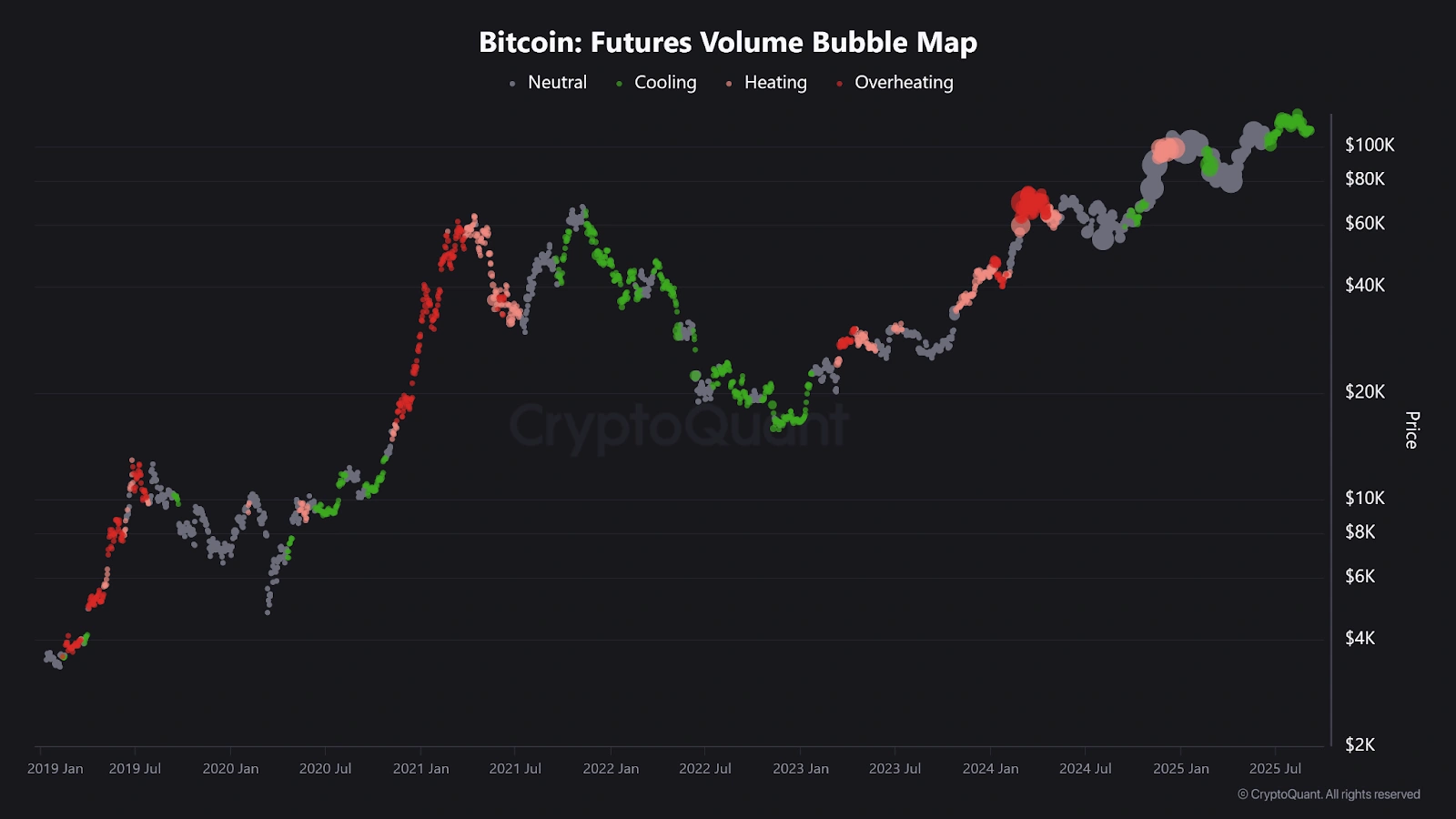

The Futures Volume Bubble Map supports this observation by illustrating diminished trading activity led by whales and highlighting a cooling phase characterized by reduced overall volumes.

Bitcoin Futures Volume Bubble Map. Source: Cryptoquant

Bitcoin Futures Volume Bubble Map. Source: Cryptoquant

At present, retail traders have taken over the futures market while institutional players seem to be sitting on the sidelines.

This shift has implications for market stability; institutional participants generally contribute more liquidity and long-term positioning compared to retail-driven flows which can lead to increased short-term volatility.

If whale participation remains low in the futures arena, Bitcoin’s price movements may become more unpredictable. Previous reports indicate that even purchases made through strategies have decreased significantly in scale recently.

Bearish Sentiment Grows

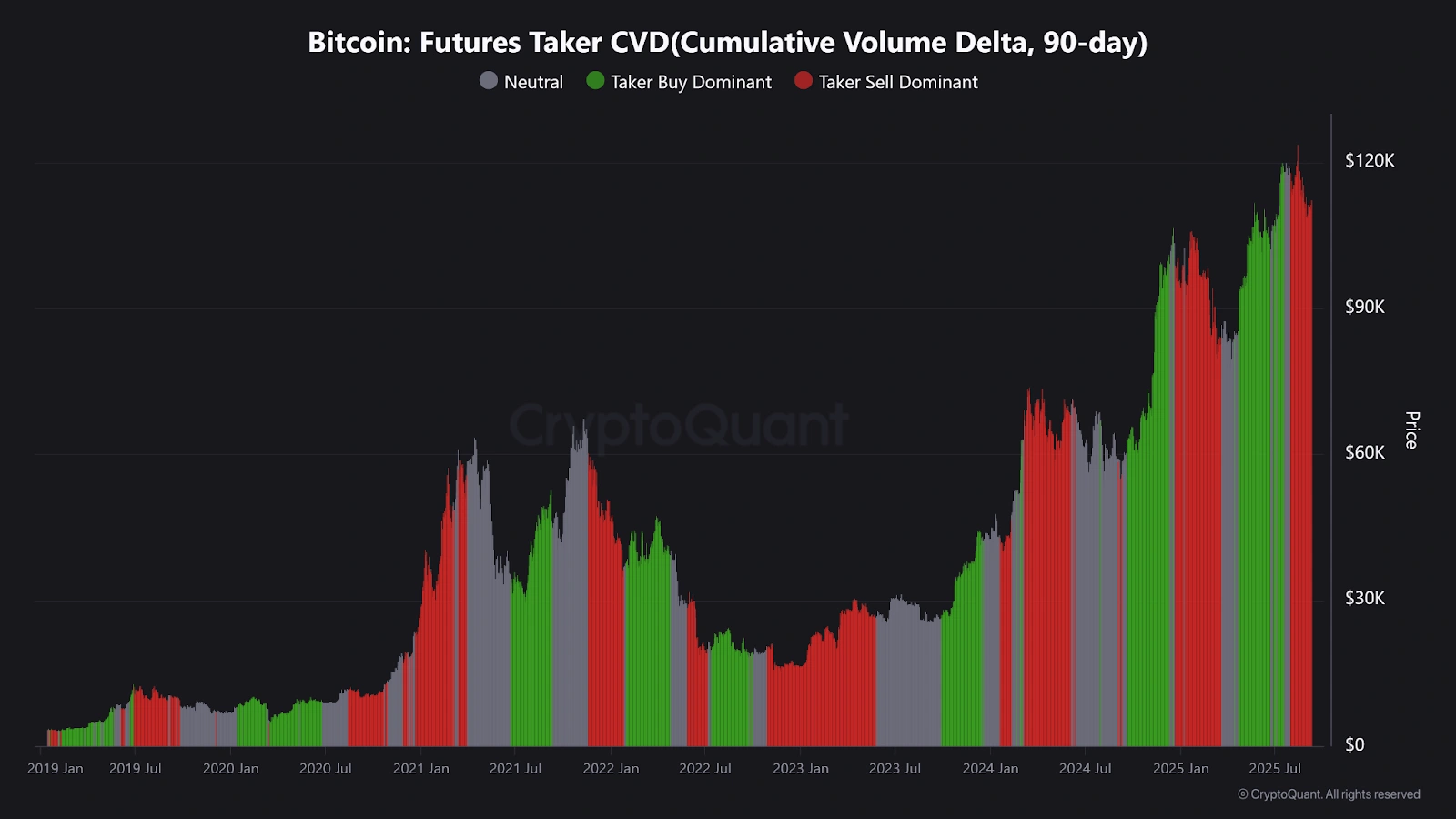

The 90-day Taker Cumulative Volume Delta from CryptoQuant shows that selling activities have outpaced buying efforts as sellers exert downward pressure on market direction. This trend suggests that traders might be bracing themselves for a potential drop in Bitcoin’s value within the futures landscape.

Bitcoin Futures Taker Cumulative Volume Delta. Source: Cryptoquant

Bitcoin Futures Taker Cumulative Volume Delta. Source: Cryptoquant

Additional analyses support this perspective; since August, Bitcoin has struggled to maintain levels above $115,000–$120,000 with critical liquidity zones identified at $110,000 and $113,000. Renewed selling pressures at these thresholds may pave the way for additional declines ahead.

A week ago analysts at VT Markets observed that attempts to breach resistance levels around $111,000–$111400 had repeatedly failed; however at present writing time frame sees Bitcoin priced slightly above $112K mark.

This is an example image caption.... . . .

This is an example image caption.... . . .

Institutional Demand’s Role In Market Dynamics

Institutional interest has been pivotal this year driving rallies as ETFs attracted billions leading prices towards record highs.

Reports indicated much momentum during summer surge stemmed largely due interest surrounding regulated future products reaching unprecedented levels.

However recent data suggests such stabilizing influence seems diminished lately.

Plausible Scenarios Ahead For BTC Movement?

The immediate outlook regarding BTC heavily relies upon whether or not there will be renewed engagement from larger players entering back into future trades again soon enough . Without fresh inflows coming forth , top cryptocurrency risks getting stuck without major gains , or worse yet , drifting lower due solely driven forces stemming primarily via small-scale investor actions .

Nonetheless surprises remain possible ; analysts pointed out resilience shown amidst ongoing sell-offs suggesting strong absorption occurring particularly seen across derivative exchanges like Binance indicating potential quiet accumulation happening behind scenes possibly awaiting clearer macro indicators or significant industry catalysts emerging soon thereafter!